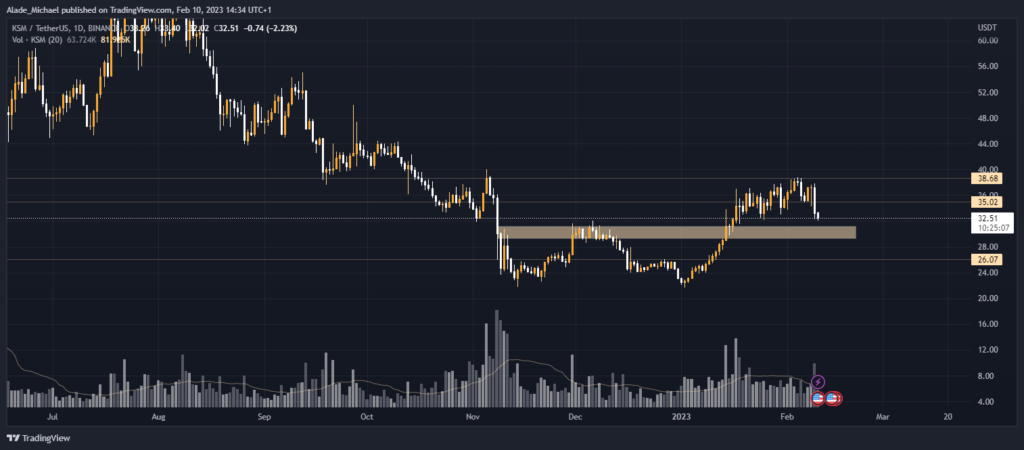

While most top altcoins count their losses over the past hours, Kusama has also suffered a heavy blow due to the current breakdown. It has marked a new low and now looking calm for the next leg down.

From $21, Kusama made a bounce and rallied steadily to mark a local top at $38.7 – totaling 25% returns in six weeks. It saw a sharp rejection at that top price level and started to fall days back.

The price is down by 12% in a week and is still posing for more drops in the higher time frame. The price looks calm on the lower time frame following a sudden rejection at the $32 level.

It currently trades at $32.5 with a potential retracement to $34 before making another impulsive move to the downside. The trend appears to have changed with the lower lows and lower highs formation on the 4 hours chart.

This bearish pattern could bring the price to as low as $26 before we can see a buyback. The orange demand zone could pose a threat to the bears. But if they can overcome that zone, an extension should be expected.

To lure the bulls back into the market, KSM would have to climb above the previous resistance levels to confirm a positive action. However, the chances for a bullish rally are very slim with the current market condition.

Kusama’s Key Level To Watch

Kusama looks indecisive at the moment. A retracement move from here could push the price briefly to the $34 resistance level before rolling down. An increase above that level could trigger more actions to $34 and potentially $38.7 before breaking higher.

The support level to watch in the next selling pressure is $30 as soon as it reclaims the current low level of $32. Further support is located at $28 and $26 in case of a decline.

Key Resistance Levels: $35, $37, $38.7

Key Support Levels: $30, $28, $26

- Spot Price: $32.5

- Trend: Bearish

- Volatility: High

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Image Source: karnoff/123RF // Image Effects by Colorcinch