MicroStrategy’s strategic accumulation of Bitcoin is bearing fruit as the cryptocurrency skyrockets in price. The company holds a staggering 158,245 BTC, currently valued at $5.4 billion, and it’s reaping substantial rewards.

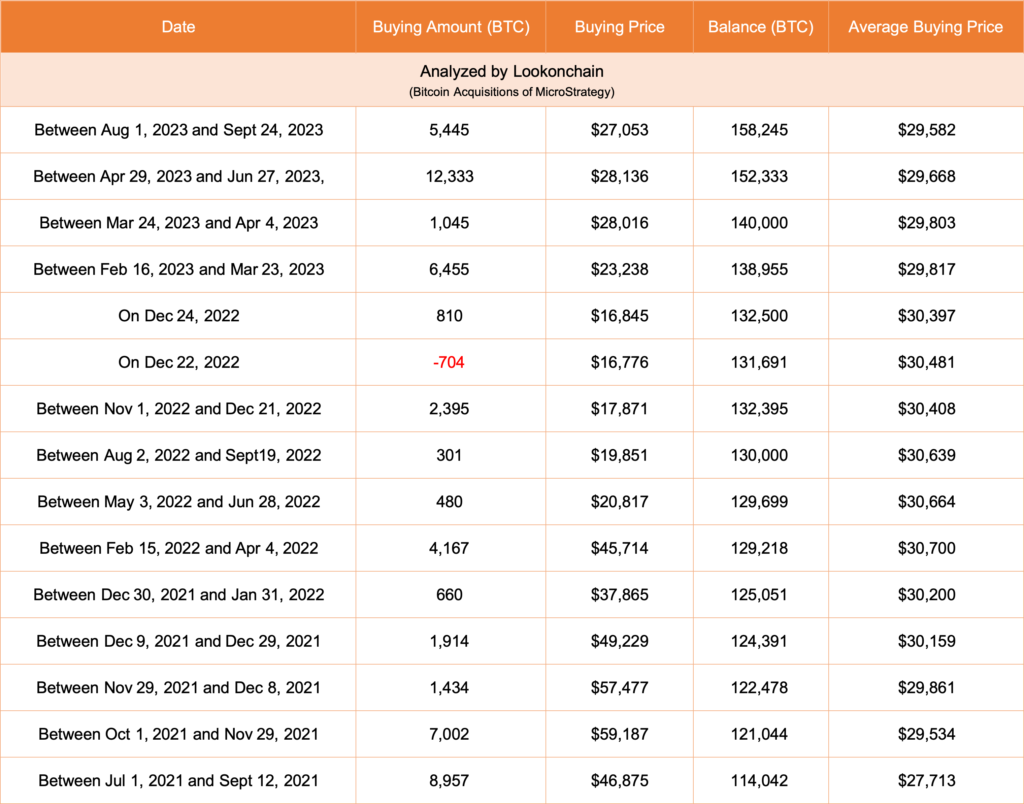

MicroStrategy’s Bitcoin holdings have appreciated significantly, with an unrealized profit of approximately $746 million. Their buying strategy is noteworthy, having acquired an additional 28,560 BTC at an investment of $734 million since May 2022. This strategic accumulation effectively lowered their average purchase price from $25,707 to $29,582 per BTC.

The cryptocurrency market’s meteoric rise is making these investments exceptionally lucrative. Over the past eight months, Bitcoin has surged to $35,000, marking an impressive 107% increase this year alone. The surge in price is driven by a myriad of factors, including increasing institutional adoption, retail interest, and growing recognition of Bitcoin as a hedge against inflation.

MicroStrategy’s ongoing accumulation and steadfast belief in Bitcoin’s potential as a store of value and asset class have paid off. The unrealized gains serve as a testament to the long-term bullish sentiment surrounding Bitcoin. This move by a significant corporation like MicroStrategy highlights the increasing trend of companies diversifying their treasury assets by investing in cryptocurrencies, particularly Bitcoin.

Conclusion

The rising prices underscore the significance of proper timing and strategic accumulation in the cryptocurrency market, where value can appreciate at a breathtaking pace. As Bitcoin continues to attract more institutional and retail investors, the crypto market’s growth prospects appear robust, making it an attractive investment for various entities looking to secure their financial future.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: buhta//123RF // Image Effects by Colorcinch