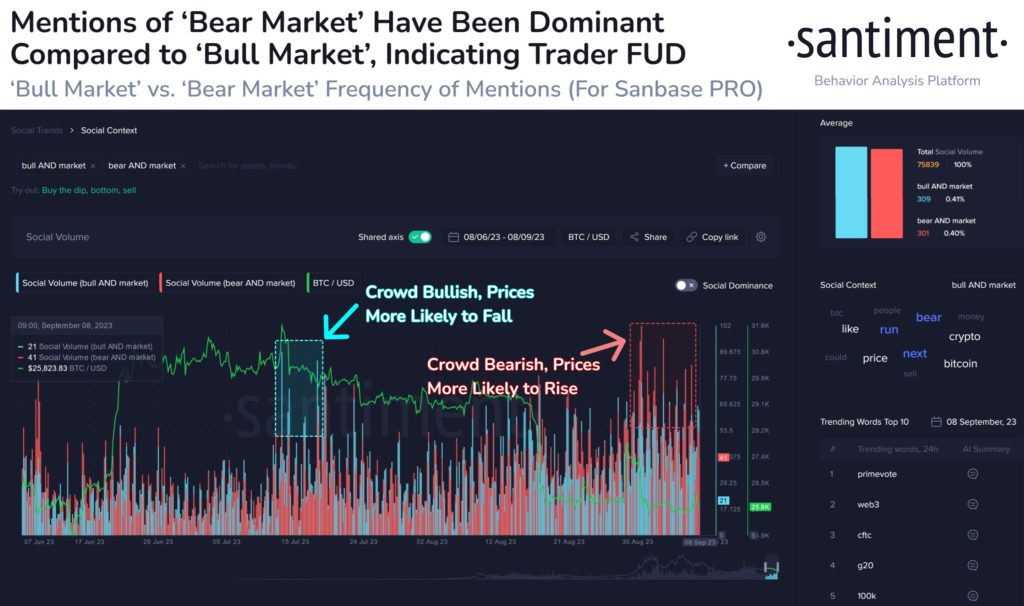

In the volatile world of cryptocurrency markets, September has brought with it a surge in bearish sentiment, amplified by the ever-present fear, uncertainty, and doubt (FUD). While this might sound concerning to some, history has shown that such periods of pessimism often pave the way for significant opportunities, particularly for patient traders.

Volatility: Panic Selling

Cryptocurrencies have always been subject to wild price swings, largely driven by sentiment and speculative trading. When the majority of the market turns bearish, it tends to create an environment where asset prices become undervalued relative to their long-term potential. This discrepancy between short-term sentiment and long-term fundamentals can be a goldmine for those who can see beyond the noise.

When fear and doubt dominate the discourse, it can lead to panic selling, pushing prices to levels that do not reflect the underlying technology or the project’s potential for adoption. For patient traders, this presents an opportunity to accumulate assets at a discount.

Price Rebounds Close?

Moreover, the probability of a price bounce or recovery tends to rise as FUD becomes the majority sentiment. This is because markets often experience sharp reversals when sentiment reaches extremes. Savvy investors recognize this pattern and position themselves accordingly, taking advantage of oversold conditions.

However, it’s essential to exercise caution and conduct thorough research during such periods. Not all projects will recover, and not all bearish sentiments are unwarranted. Distinguishing between legitimate concerns and baseless FUD is crucial for making informed investment decisions.

Conclusion

Finally, while the unpredictability of cryptocurrency markets can be unnerving, it’s important to remember that opportunities often arise when fear and doubt are prevalent. Patient traders who can weather the storm, identify undervalued assets, and separate genuine concerns from FUD may find themselves well-positioned to capitalize on market rebounds. As always, risk management and due diligence remain key to navigating the volatile crypto landscape successfully.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Image Source: loft39studio//23RF// Image Effects by Colorcinch