NEAR Protocol price is displaying promising indications of recovery, with transaction numbers ascending again from a recent dip on March 20. This bullish sing in activity is complemented by an RSI value of 73, suggesting a robust potential for further rises in price. Moreover, the emergence of a golden cross on the price chart strengthens this positive outlook, often perceived as a precursor of an imminent bullish trend. Together, these indicators propose that NEAR might be gearing up for a significant upward movement in the market.

NEAR Protocol Transactions are Surging

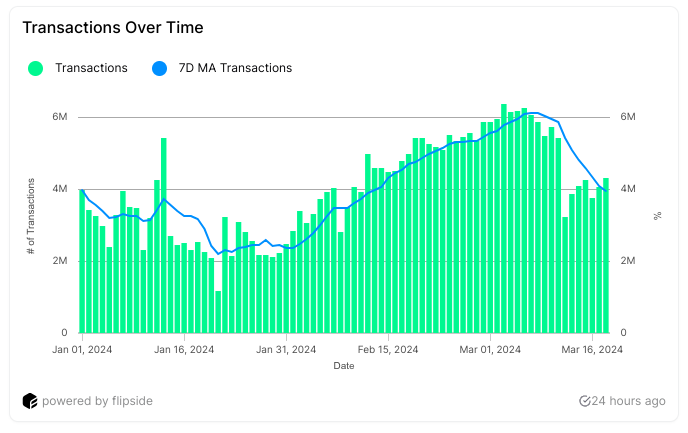

Following a significant drop to 3.1 million daily transactions on March 20, the NEAR protocol’s transaction count has shown signs of recuperation, steadily increasing after a notable slump observed between March 12 and 20. Throughout this period, the NEAR price experienced minimal movement, essentially moving sideways as the daily transaction volume gradually declined.

This phase witnessed the NEAR price shift from $5.96 to $6.44, indicating a mild upward trend amidst fluctuating transaction volumes. Notably, post-March 20, the transaction count witnessed a substantial surge, reaching 6.8 million on March 26, marking its highest point since December 2023.

This recent trend where the NEAR price appears to echo the trajectory of its transaction volume suggests that the upswing in daily transactions could signify the onset of a new bullish phase. Given the close correlation between transaction activity and price dynamics, the increasing transaction volume could indeed indicate a potential rally in the NEAR market.

NEAR RSI Is Currently At 73

During the surge from February 29 to March 13, when NEAR’s price significantly increased, its Relative Strength Index (RSI) remained above 80. Following this period, a correction ensued, with NEAR’s price adjusting from $8.84 to $6.6 within just four days.

The RSI, a key momentum indicator in technical analysis, evaluates the velocity of price movements to determine if an asset is in overbought or oversold territory. With a scale ranging from 0 to 100, an RSI above 70 typically suggests an overbought condition, offering a precursor to potential price stabilization or retracement, whereas values below 30 indicate an oversold state.

Currently, the NEAR RSI stands at 73, having moderated from a peak of 78. This shift from 78 to 73 in RSI signifies a modest relaxation in the rate of price appreciation, yet it remains in a healthy range, indicating potential for further growth. Despite the recent drop, an RSI of 73 for NEAR still denotes a strong market with room for price expansion, underscoring a sustained positive momentum.

NEAR Protocol Price Prediction

Analyzing the NEAR 4H price chart, the short-term EMA lines just crossed above the more long-term lines. That constitutes a pattern called “golden cross,” which is a bullish signal.

EMA lines, or Exponential Moving Averages, are pivotal trend indicators that prioritize recent price data more heavily. They are employed to streamline price movements and ascertain the trend’s direction over a given timeframe. This suggests that the current trend could be shifting from bearish to bullish, mirroring the prospective price movements discussed.

For the NEAR price, the $8.57 level is identified as a critical resistance area. Should NEAR successfully uphold this resistance, it might pave the way for an ascent toward the $9 threshold. This would mark a potential increase of about 25% from its current price.