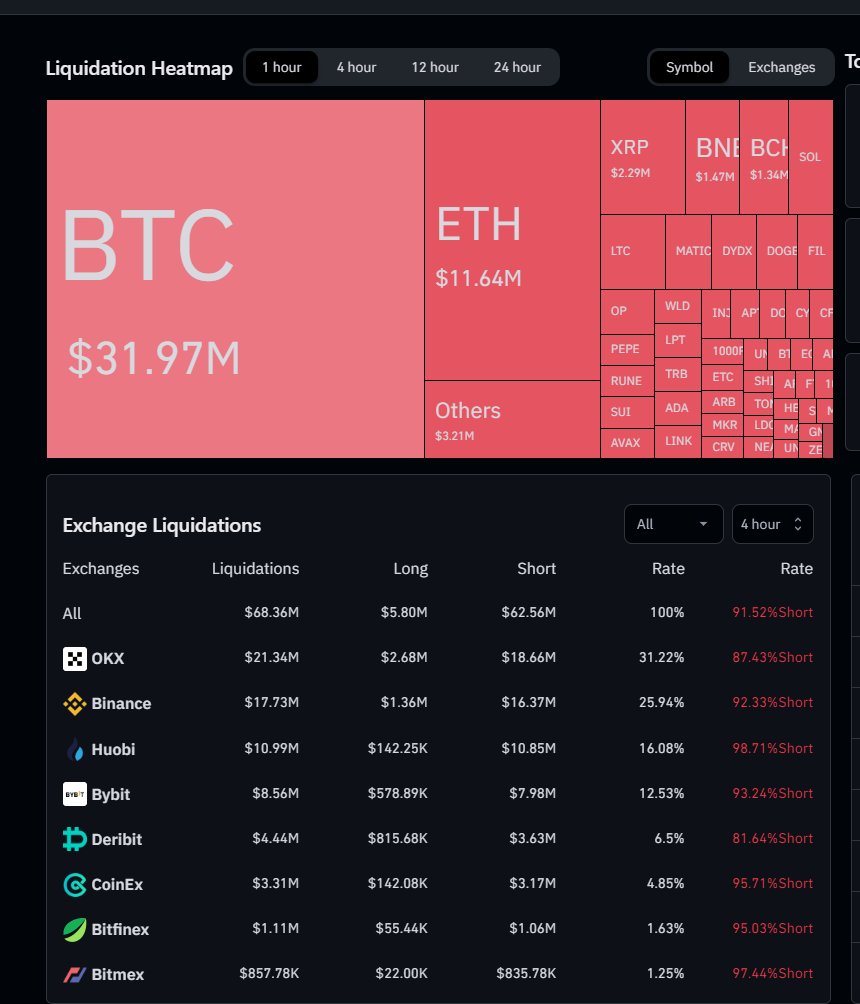

The news of Grayscale winning their lawsuit against the SEC was a major victory for the cryptocurrency community and sent shockwaves through the market. In the 30 minutes following the announcement, over $30 million in Bitcoin short liquidations were recorded. This means that traders who had bet that the price of Bitcoin would go down were forced to close their positions at a loss.

Positive Sentiment Around The Lawsuit Victory

The liquidations were likely caused by a combination of factors, including the positive sentiment surrounding the lawsuit victory, the technical strength of the Bitcoin market, and the fear of missing out (FOMO) among traders. The lawsuit victory was seen as a major step forward for the legitimization of Bitcoin and the cryptocurrency industry as a whole. It also raised hopes that the SEC would eventually approve a Bitcoin ETF, which would make it easier for investors to access the cryptocurrency.

Bitcoin’s Technical Strength

The technical strength of the Bitcoin market was also a factor in the liquidations. Bitcoin had been in a strong uptrend in the weeks leading up to the lawsuit victory, and the price was up to $28,000. This made it difficult for short traders to maintain their positions, as they were essentially betting against the trend. Finally, the fear of missing out (FOMO) likely played a role in the liquidations. As the price of Bitcoin continued to rise, more and more traders may have been eager to get involved, even if it meant closing their short positions at a loss.

Final Thoughts

The liquidations of over $30 million in Bitcoin shorts is a significant event and shows the power of positive news and sentiment in the cryptocurrency market. It remains to be seen whether the SEC will approve a Bitcoin ETF in the near future, but the lawsuit victory is a major step in that direction.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Image Source: nexusplexus/123RF// Image Effects by Colorcinch