The meme corner of the crypto market just flexed its muscles, reclaiming the $80 billion mark in total value. Dogecoin strutted in with a $35 billion cap, Shiba Inu wagged its tail at $7.9 billion, and PEPE hopped up to $5.1 billion.

Ethereum-based memecoins stole the spotlight as ETH smashed past $4,000, giving PEPE the perfect tailwind. Over the last 24 hours, the token leapt 10.8% to $0.00001237, according to CoinMarketCap. Its month-to-date climb is already at 18.3%, though year-to-date, it’s still down about 36%.

Déjà vu? Analyst sees echoes of the 2024 breakout

Crypto analyst Galaxy thinks PEPE might be setting up for a rerun of its 2024 rally. Back then, the token tripled from $0.000010 to $0.000032.

This time, the consolidation phase looks even bigger; which, in theory, could mean an even stronger blast-off. Targets near $0.000030 aren’t off the table if history decides to repeat itself. But Galaxy warns that if PEPE can’t hold its current retest, it might get stuck in a long sideways grind. And with August historically being a sluggish month for crypto, the risk is real.

PEPE Liquidations and the “max pain” battleground

Liquidation data shows PEPE’s max pain zone sitting around $0.0000126, where $1.29 million in shorts are parked, and $0.0000114, which holds $1.48 million in longs. The overnight jump already wiped out $2.56 million worth of short positions.

Below current prices, the heaviest liquidation levels are at $0.0000121, $0.0000119, and $0.0000110; together worth roughly $4 million. Another danger zone is forming at $0.0000115.

Above, the resistance points to watch are $0.0000124 and $0.0000126, each carrying just over $1.1 million. Breaking through could spark a chain reaction of short squeezes and extend the rally.

Retail traders load PEPE up while whales chill

On-chain data from IntoTheBlock shows a steady rise in retail accumulation. Wallets holding between $10 and $1 million worth of PEPE are hitting record numbers. The big whales, however, seem content to watch from the sidelines for now.

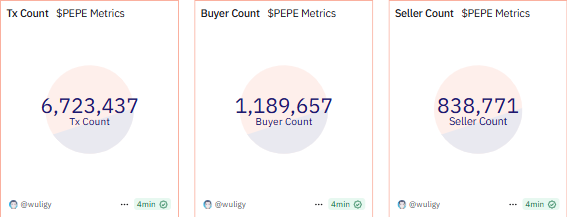

Dune’s stats show PEPE has now clocked 6.72 million total transactions, with 1.19 million buyers versus 838,771 sellers. The rally has boosted the percentage of holders in profit to 68%, leaving only about 32% “out of the money.”

The largest token clusters sit around $0.000012, holding 38.87 trillion PEPE, and $0.000013, with 31.38 trillion tokens. How traders behave around these price bands could determine whether PEPE’s 2025 will be another 2024-style bull run… or just another ribbit in the pond.