Introduction

Bitcoin exchange reserves have started climbing again, and netflows have turned positive for the first time in weeks. These changes could mean big shifts in Bitcoin’s price.

Bitcoin’s Reserves and Netflows: What’s Happening?

Since hitting an all-time high of $108k, Bitcoin has struggled to hold its momentum. Over the past two weeks, it has traded sideways and is now valued at $94,507, down 2.14% in the last 24 hours.

A key shift is happening with Bitcoin’s exchange reserves. According to Cryptoquant, reserves recently rose with 20k BTC flowing into exchanges. This is a major change from the previous weeks when reserves were dropping as investors moved Bitcoin off exchanges for safety. This rise in reserves is significant. When Bitcoin moves to exchanges, it often means investors are planning to sell or trade, which can add selling pressure. At the same time, netflows have turned positive, with +15.8k BTC inflows. This signals more Bitcoin entering exchanges than leaving, pointing to potential price changes ahead.

What Does This Mean for Bitcoin?

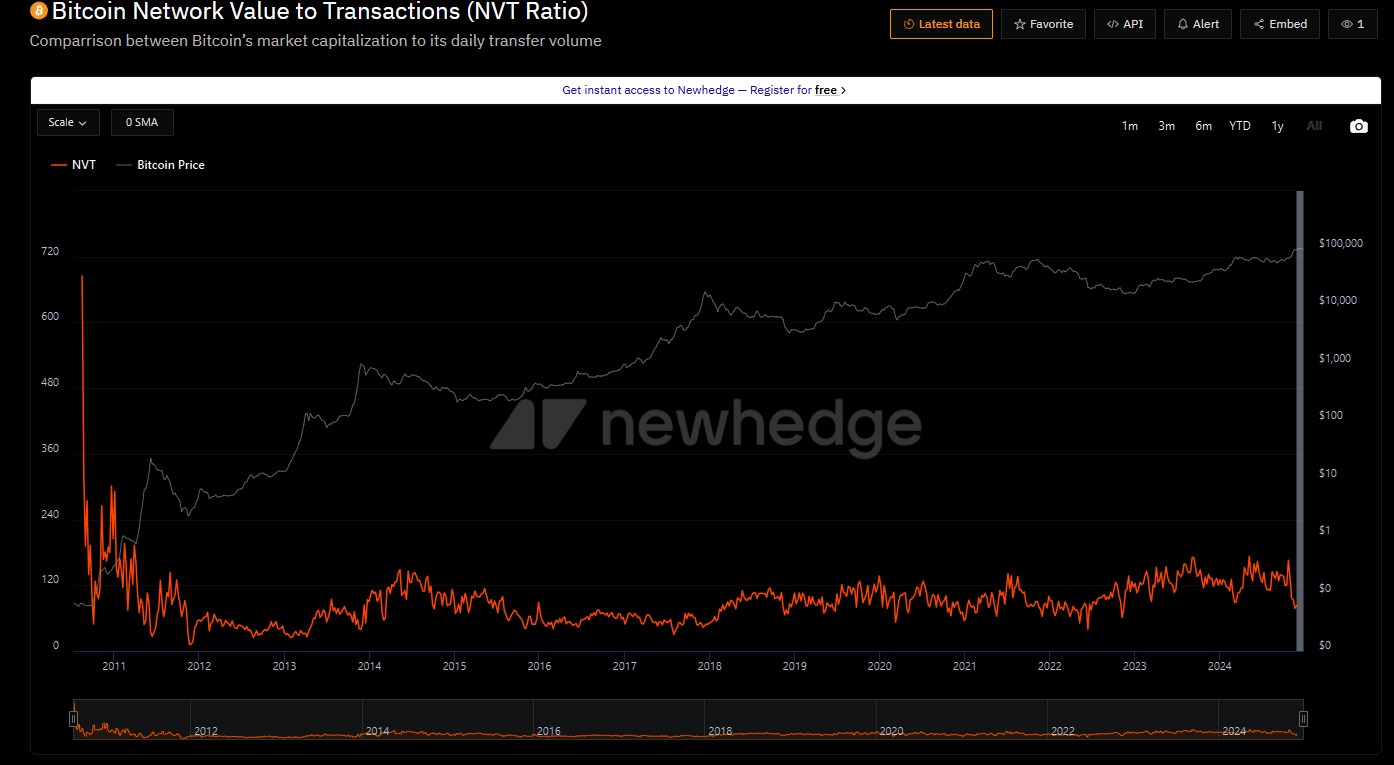

The rise in reserves and positive netflows suggest that more investors are preparing to sell or trade. This could lead to short-term price drops. Data shows that big investors are also sending more BTC to exchanges. The netflow ratio for large holders jumped from -0.04% to 0.26%, showing increased activity that often comes before selling. BTC’s NVT ratio has also surged to 201.88, a level that suggests the market cap is very high compared to transaction volume. Historically, this kind of spike happens before price corrections.

Possible Scenarios for Bitcoin

If selling pressure continues, BTC could fall to $92,700. If it doesn’t hold that level, the price might drop further to $86,000. On the other hand, if market sentiment improves, BTC could recover and maintain stability.

VR Soldiers’ Thoughts

As the VR Soldiers, we believe the current rise in exchange reserves and netflows signals potential selling pressure for BTC. Investors should watch these metrics closely and proceed with caution. While BTC remains a strong long-term asset, the short-term outlook could see more volatility. Stay informed, and remember—this is not financial advice.

Conclusion

BTC’s rising exchange reserves and positive netflows point to significant market activity ahead. While these trends often signal selling pressure and potential price corrections, BTC’s resilience and long-term strength remain key factors to watch. As the market navigates this critical phase, staying informed and cautious is crucial for traders and investors alike. The coming days will reveal whether BTC can maintain its support levels or face further downward pressure.