Introduction

The Santa Claus rally faces doubt as Bitcoin trades at $94,955. Trading volumes stay strong, but signals are mixed. This week could decide if the rally will continue. Recent market drops raise concerns, but time remains for a final push. This rally happens in late December when prices often rise. Many traders focus on it for year-end gains. As 2024 ends, investors wonder if the rally is over or if it will bring more growth.

Current Market Overview

Bitcoin (BTC) trades at $94,955, showing less than 1% gain in 24 hours. Ethereum (ETH) is at $3,291 with a similar gain. Solana (SOL) and Binance Coin (BNB) also show small increases. The crypto market cap is close to $3.5 trillion. Despite the drops seen recently, trading volumes remain high. Bitcoin’s 55.08% dominance shows its strong role in the market.

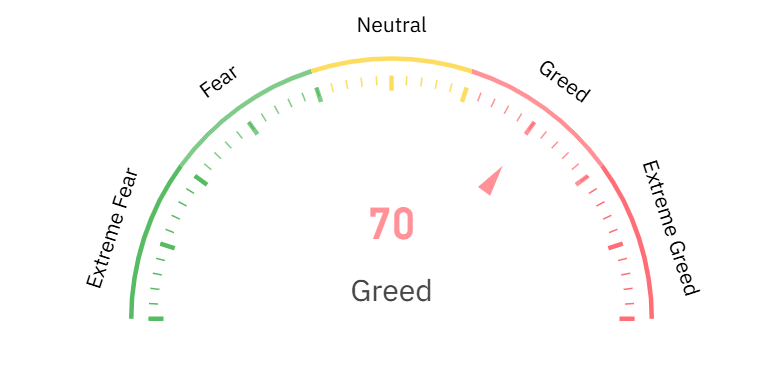

In addition, market sentiment leans positive. The Fear & Greed Index is at 70 (Greed), which shows cautious optimism among traders.

Has the Santa Claus Rally Lost Its Momentum?

The rally is tied to bullish trends, tax buying, and increased retail activity. However, recent events bring volatility. A $2.6 billion Bitcoin and Ethereum options expiry caused price swings. Moreover, on-chain data offers mixed signals. Whale activity has slowed, with fewer large transactions seen. At the same time, retail investors are buying more. The RSI for Bitcoin and Ethereum is near neutral. As a result, no clear direction is evident. The market is waiting for a stronger signal.

Key Levels and Barriers

For the rally to continue, Bitcoin must break $100,000. This psychological barrier is important for traders. Ethereum also needs to rise above $3,500 to show bullish momentum. Meanwhile, Bollinger Bands indicate low volatility. Even so, a breakout could result in large price moves. Traders are watching for changes.

What the Santa Claus Rally Means for Crypto Investors?

The rally’s fate is still unclear. Instead, the next few days will show if it can continue. Investors need to manage risks carefully during this time. Watching momentum indicators like MACD and RSI is key. Additionally, macroeconomic events and regulation news may affect sentiment. The market remains cautiously optimistic. Still, staying alert is essential. Adapting to new trends will help investors make smart decisions.

Could 2025 Begin on a Bullish Note?

As the year ends, the market looks ahead to 2025. For now, the Santa Claus rally has not delivered major gains. Yet, it could still bring surprises. The next week is crucial. Crypto investors should stay focused, as small shifts can create big chances. Monitoring key levels will help traders react to changes in time. Ultimately, preparing for year-end trends is important. Investors must stay informed and ready to act. Watching resistance levels and sentiment shifts will help navigate the market.