Shiba Inu (SHIB) price is attempting a bullish breakout from the descending wedge the coin has been in since March. Popular memecoin Shiba Inu (SHIB) has lost around 24% over the past month, but now it appears to be targeting a bullish breakout from its long-term pattern towards $0.000018.

The wedge narrows as Shiba Inu tries to start the rally

SHIB price reached a yearly high of $0.000035 on March 5 and has been steadily declining since then, forming a descending wedge. This technical pattern occurs when an asset forms a series of lower highs and lower lows that converge to form a wedge shape.

As the wedge narrows, buying pressure gradually increases. This is evident from the current price, which is approaching the point where the pattern lines converge. A bullish breakout from the wedge traditionally indicates a weakening of selling pressure and a possible shift from a downtrend to an uptrend.

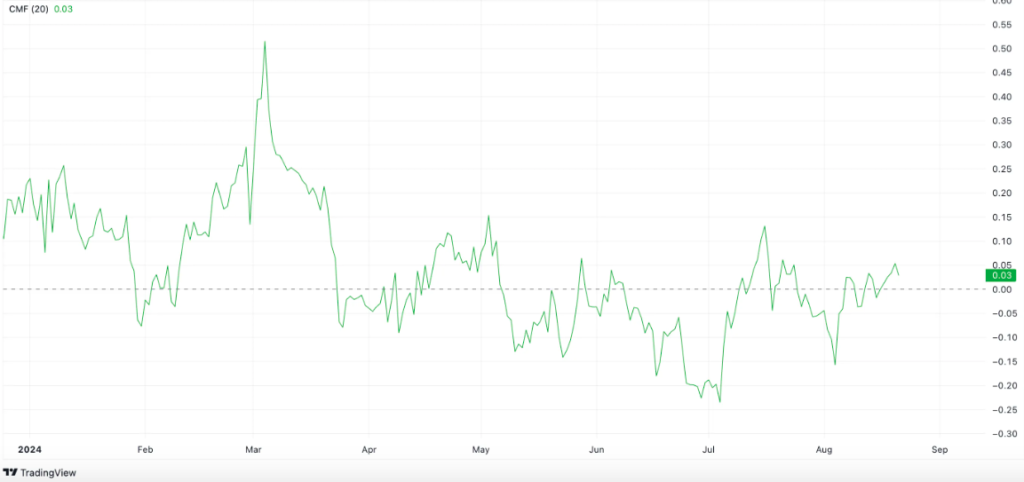

Similarly, the Chaikin Money Flow (CM F) indicator is also rising. This on-chain metric measures the movements of money flows into and out of an asset. Negative values indicate that the initiative is on the sellers’ side, and liquidity is leaving the asset. Meanwhile, positive values indicate that buyers are putting more pressure on the price. An influx of money into an asset is often associated with increased demand and a potential price increase.

In the case of Shiba Inu, the indicator is above the center line, at 0.03, confirming the bullish momentum. This increases the probability of a price breakout from the falling wedge.

SHIB Outlook: Bulls Are Staying Active

The dots of the Parabolic Stop and Reverse ( SAR ) indicator are below the token price at the time of writing. This is a signal that the upward trend is continuing. This location of the dots relative to the price is considered bullish and can encourage traders to buy or hold the asset. Accordingly, growth may continue in the short term.

If the buying pressure continues, SHIB will make a successful bullish breakout from the descending wedge. After retesting the breakout line, the price will start to rise to $0.000018 and above. However, if selling intensifies, the SHIB price may drop to $0.000010.