Shiba Inu Supply Shrinks as Buyers Defend Key Demand Zone

Shiba Inu recent on-chain activity points to a tightening supply that could set the stage for a potential rebound. While volatility in burn rates persists, long-term contraction in circulating supply, combined with strong buyer behavior, is building the foundation for a possible trend reversal.

Burn Data Highlights Supply Contraction

Shiba Inu’s 7-day burn rate surged over 2,000%, reflecting an aggressive removal of tokens from circulation before a sharp pullback in the past 24 hours. Despite short-term fluctuations, the broader trend shows consistent supply reduction, a key factor behind the growing “supply-shock” narrative.

The price continues to hold within the 0.00000885–0.00000900 demand zone, with repeated buyer reactions signaling firm market support. Technically, SHIB is testing the upper boundary of its descending channel, positioning it close to a potential breakout structure.

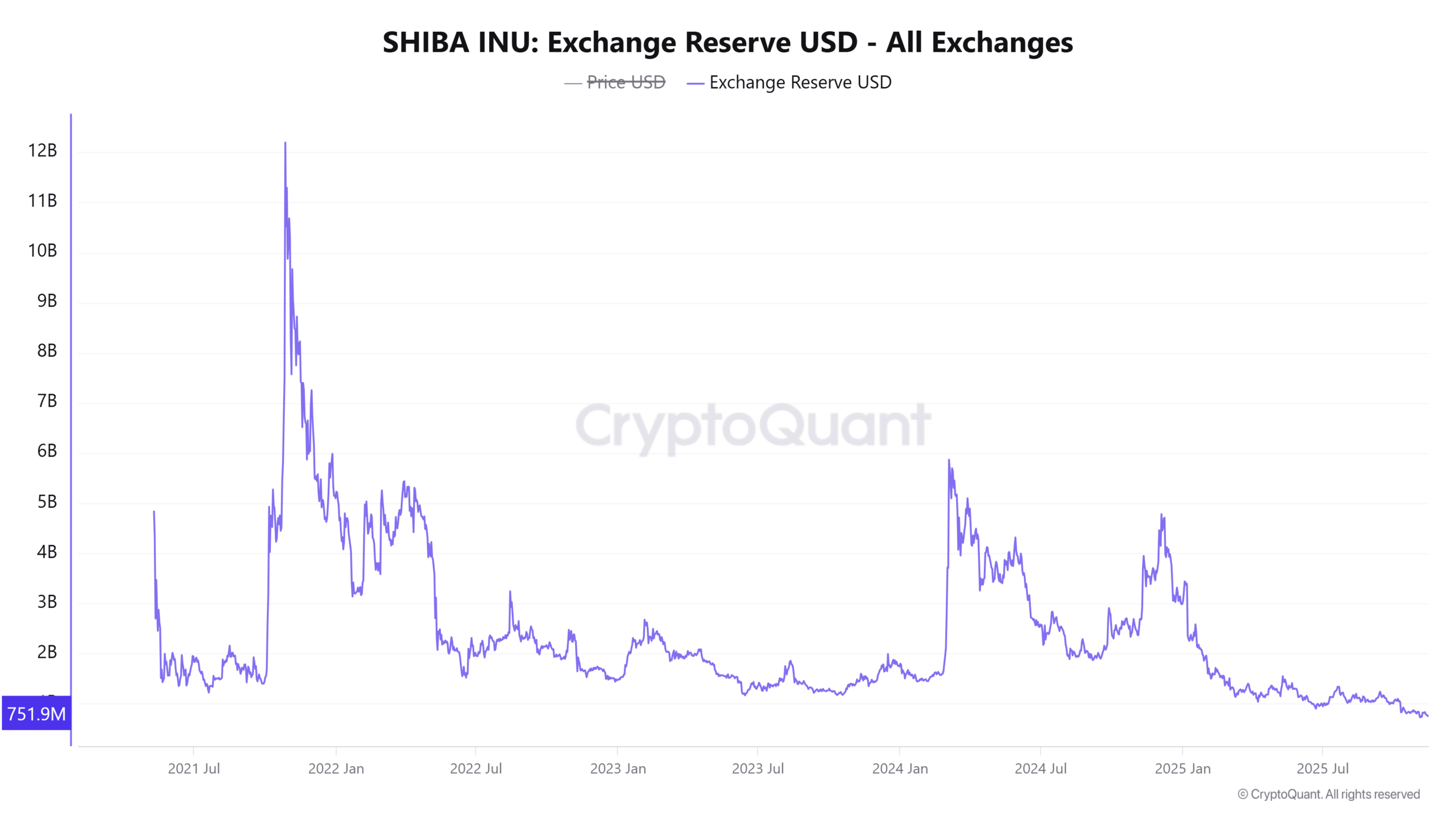

Buyer Activity and Exchange Flows

Exchange reserve data reveals a 6.79% decline, indicating that fewer SHIB tokens are held on centralized exchanges and therefore less immediately available for sale. This reduction in sell-side supply often aligns with healthier accumulation patterns and reduced downward pressure.

Additionally, the Spot Taker CVD metric, which measures buy and sell order flow, shows sustained buyer dominance. This suggests that buyers are absorbing sell orders during every retest of the demand zone, reinforcing stability and hinting at the possibility of a controlled upward shift.

Technical Indicators Suggest Waning Bearish Momentum

Shiba Inu’s RSI has gradually climbed toward 41, forming higher lows, a sign of easing bearish pressure. A move toward the 50 level would confirm improving momentum and strengthen the argument for a short-term reversal.

If buying volume increases near the channel resistance, SHIB could test upside targets at 0.00001029, 0.00001118, and 0.00001301.

Market Outlook

Shiba Inu sits in a tightening technical structure supported by falling exchange reserves, rising buyer pressure, and a resilient demand base. Although burn-rate volatility adds uncertainty, the broader contraction in supply and improving market metrics indicate early signs of strength that could precede a breakout from the current range.