Introduction

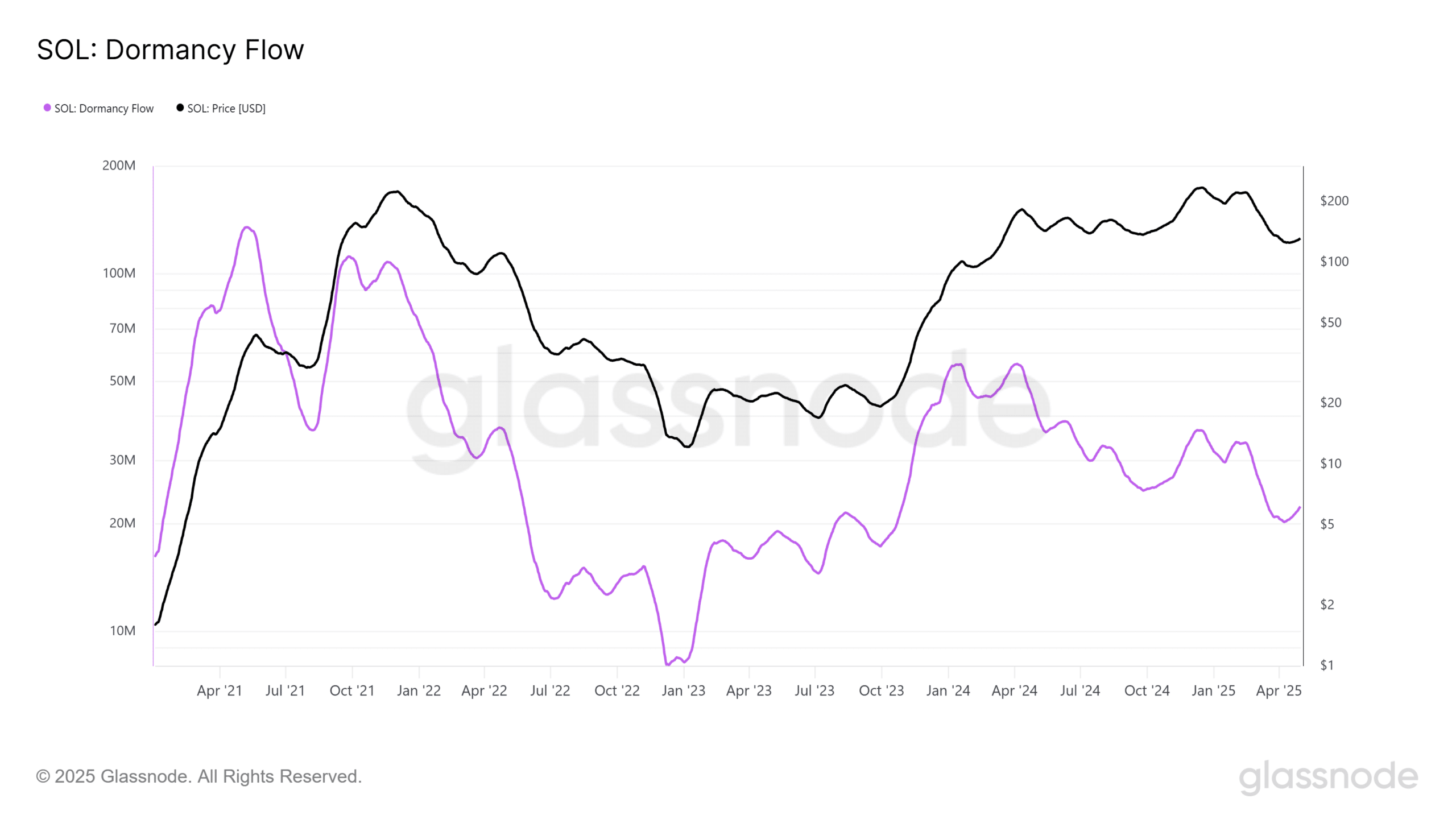

Solana appears to be entering a crucial accumulation phase, as its dormancy flow metric suggests that the network might be nearing a long-term bottom. Originally developed to assess Bitcoin’s market cycles, dormancy flow has become an increasingly valuable indicator for altcoins like Solana too.

Right now, Solana’s dormancy flow is hovering at levels last seen in August 2023, when SOL was priced at $24. This same metric also hit a low in December 2020 — right before SOL’s explosive rally from $2. The resemblance in these signals points to a potentially undervalued zone, and some traders are starting to see this as a fresh opportunity.

Short-Term Pain, Long-Term Setup

While the broader market still shows signs of caution, as reflected by Solana’s Spent Output Profit Ratio (SOPR), some analysts argue that these metrics often bottom out just before a turnaround. The SOPR, which gauges whether holders are selling at a loss or a profit, has remained below 1 for more than two months. Its 30-day average now sits at 0.987 — a strong indication that current sellers are doing so at a loss.

Yet history shows that persistent SOPR readings below 1 typically mark accumulation phases, where long-term investors take advantage of discounted prices. When paired with the dormancy flow and resurgent activity levels, this sets up the case for Solana entering a bullish recovery phase.

Solana Transaction Momentum Is Picking Up Again

Despite a challenging Q1 in 2025, where Solana briefly dipped to $100 in early April, on-chain activity is rebounding. The dip marked the lowest price for SOL since February 2024, a moment many believe could represent the low end of this cycle.

What’s encouraging is the broader transaction trend. Although activity dipped between February and April, the number of transactions — calculated using a 30-day moving average — is now climbing once again. This kind of recovery in on-chain usage often precedes a return in price strength and long-term investor confidence.

Why Solana At $100 to $120 Could Be the Perfect Buy Zone

Over the past 14 months, Solana has repeatedly bounced from the $115 range — establishing it as a major support area. And after the sharp decline to $100 in April, it’s now clear that this range could become a sweet spot for strategic entry.

With transaction levels rebounding and historical indicators flashing accumulation signals, the $100–$120 corridor may be where smart money continues to build positions. While a confirmed bottom hasn’t yet formed, the combination of rising engagement, healthy dormancy data, and undervalued pricing make this level increasingly attractive for long-term buyers.