Capital Rotation Lag Ties Solana and XRP to Bitcoin’s Trend

Both Solana and XRP have achieved major developments this year, from ETF launches to growing institutional adoption, yet their prices continue to decline. The shared challenge between the two assets lies in one missing element, renewed altcoin inflows strong enough to spark a sustained breakout.

Institutional Growth, But Price Lags Behind

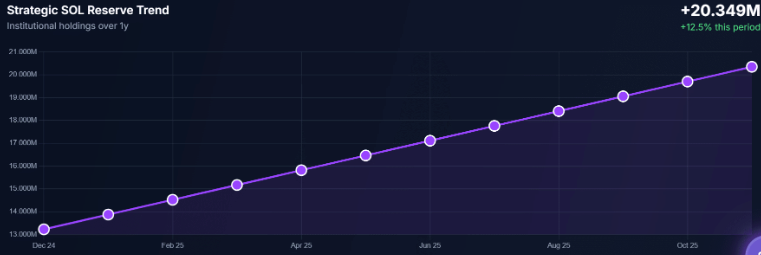

Despite broader market uncertainty, 2025 has been a positive year for blockchain growth. Solana and Ripple have expanded their networks through new partnerships and use cases, Solana in the stablecoin sector and XRP in cross-border payments. Institutional engagement has also increased: Solana’s institutional holdings rose nearly 15% to 20.35 million SOL, while the new XRP Bitwise ETF recorded over $21 million in trading volume.

However, both tokens remain down more than 30% this quarter. Their performance highlights the broader “risk-off” environment that has limited momentum across high-cap altcoins, even as top Layer-1 projects continue to build and attract capital.

Weak Altcoin Flows Limit Breakouts

Market data shows that despite Bitcoin dominance (BTC.D) falling below 60%, the Altcoin Season Index has not confirmed a full rotation into alternative assets. This indicates that liquidity is not yet shifting away from Bitcoin at a scale that would support sustained rallies in other networks.

On the charts, Solana’s SOL/BTC ratio has dropped to new lows since September, threatening support near 0.0015. Similarly, XRP/BTC faces resistance near 0.000025 and remains more than 20% below its key $2.50 price ceiling. These patterns reflect ongoing weakness despite fundamentally strong positions.

The Shared Factor: Limited Capital Rotation

While both Solana and XRP continue to demonstrate long-term strength through real-world use cases and institutional traction, the lack of altcoin-specific inflows remains the limiting factor. Until capital rotation picks up, the broader market’s cautious sentiment will likely keep both assets moving in sync with Bitcoin rather than leading their own independent rallies.