Introduction

Solana is making a huge change that could affect its price and future growth. A new proposal called SIMD-228 aims to cut SOL’s inflation by 80%, meaning fewer new SOL tokens will enter the market. So far, 71.85% of voters support the proposal, which means it is likely to happen. But will this be enough to push SOL’s price up, or does it need more than just an inflation cut to recover?

How Solana Inflation Works

Solana has a semi-deflationary system, which means some SOL tokens get burned during transactions, reducing the total supply. This helps control inflation and keep prices stable over time. However, recently, SOL’s network activity has dropped, and transaction fees are at their lowest level in six months. Since fewer transactions are happening, less SOL is getting burned, which makes it harder to control inflation. To fix this, SIMD-228 will reduce staking rewards, which is the main way new SOL tokens enter the market. Right now, SOL adds 6.8% more tokens per year, but with this new proposal, that number could drop by 80%.

How This Could Affect Solana’s Price

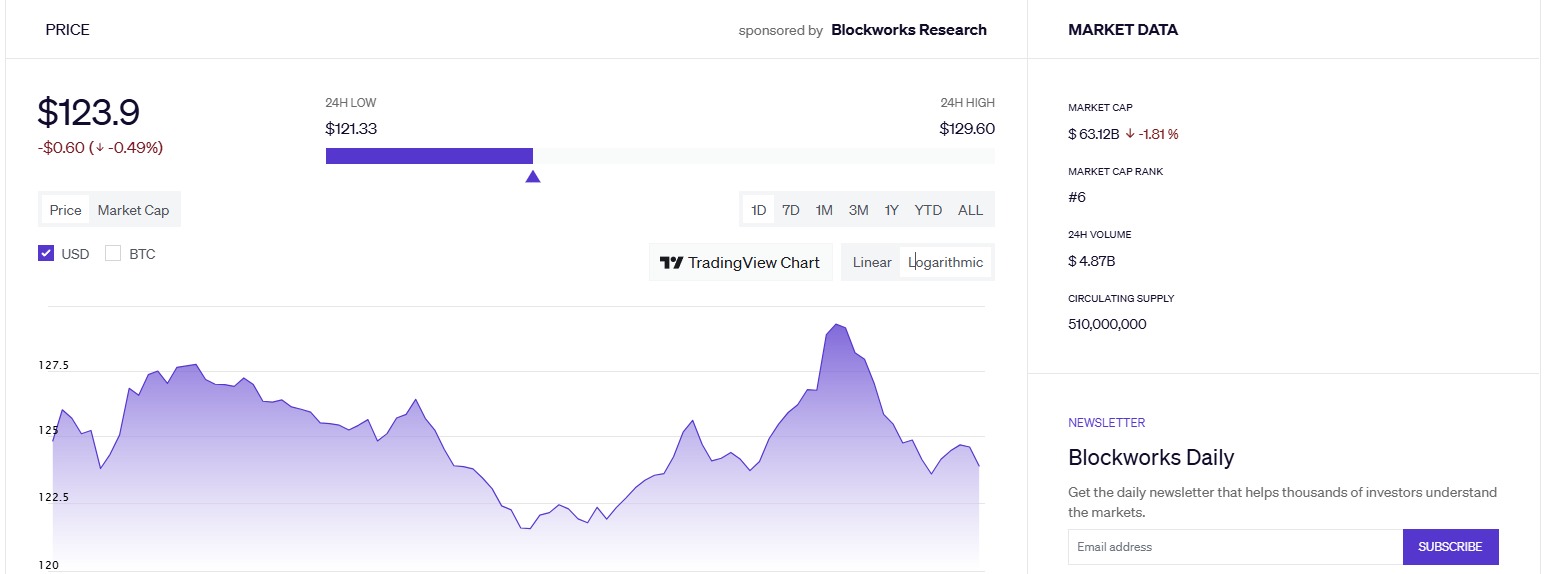

At the moment, Solana’s price is $123.9, and there are 509.38 million SOL in circulation. Solana’s total market value is $63.56 billion, which is a big drop from $123 billion back in January.

One of the biggest reasons for Solana’s price drop is lower network activity and cautious investors. The SOL/BTC price chart shows that SOL has fallen to its lowest value against Bitcoin in two years, making traders uncertain about its future. Since fewer transactions are happening, fewer SOL tokens are being burned. This means SOL’s deflation system isn’t working as well as before, and its price has come under pressure.

If SIMD-228 reduces inflation and keeps validators motivated, it could help boost investor confidence and improve SOL’s supply balance. However, for the price to go back up, Solana also needs more users and transactions on its network.

Will Solana Price Go Up?

While cutting inflation and staking rewards will help SOL in the long run, it may not be enough on its own. If more people start using Solana’s network, this plan could help drive a strong price recovery. But if network activity stays low, SOL might still struggle even with reduced inflation. The real test will be whether SIMD-228 brings more attention and investment back to Solana.

For now, traders will be watching closely to see if this change helps SOL grow or if it needs more adoption to truly bounce back.

Conclusion

Solana’s plan to cut inflation by 80% has strong support, but its success will depend on how many people continue using the network. If network activity picks up, SOL’s price could climb again. But if demand remains low, this change may not have a big impact. Investors will need to wait and see how the market reacts in the coming weeks.