Introduction

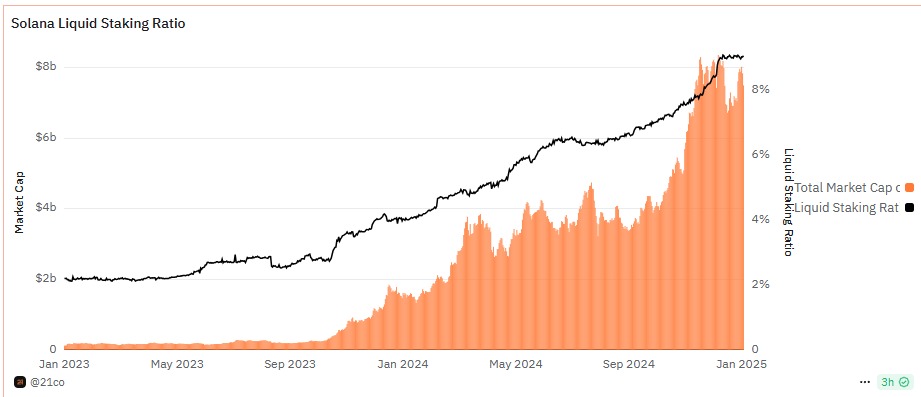

Solana, a popular blockchain platform, is growing fast. Its liquid staking tokens (LSTs) have become very popular, with their combined market value reaching $7.5 billion as of January 10. This shows how important LSTs are becoming in Solana’s DeFi (decentralized finance) ecosystem.

What Are Solana’s Liquid Staking Tokens?

Liquid staking tokens let users stake their Solana tokens (SOL) while still being able to use them. For example, when you stake SOL, you get an LST like jitoSOL or bnSOL in return. These tokens can be traded, borrowed, or used on other DeFi platforms to earn more rewards.

Who Are the Big Players With Solana?

Among Solana’s LSTs:

-

JitoSOL is the biggest, with a market share of 37.6% and a total value of $2.8 billion.

-

Binance Staked SOL (bnSOL) holds 20.2%, worth $1.5 billion.

-

Marinade Staked SOL (mSOL) accounts for 14.1%, valued at $1.05 billion.

Other tokens like jupSOL, sSOL, and bbSOL also contribute to the $7.5 billion market cap.

What’s Happening in the Solana Market?

Even though LSTs are growing, not all protocols are seeing success.

-

The total value locked (TVL) for Jito and Marinade has dropped by 19% and 15%, showing some decline.

Meanwhile, Binance Staked SOL (bnSOL) saw its TVL increase by 29%, likely due to Binance’s strong support.

Why Are Liquid Solana Staking Tokens Important?

Liquid staking tokens help users in two big ways:

-

Earn Rewards: When you stake your SOL, you earn rewards.

-

Keep Liquidity: Even though your SOL is staked, you can still use its value through LSTs for trading or other DeFi activities.

For example, if you stake SOL, you get jitoSOL in return. You can then use jitoSOL to earn more rewards or trade on DeFi platforms. This way, you earn rewards while keeping access to your assets.

VR Soldier Thoughts

As the VR Soldier’s, we see the growth of Solana’s liquid staking tokens as a game-changer in the blockchain ecosystem. The $7.5 billion market cap highlights the increasing demand for flexible staking options that allow users to earn rewards while staying active in DeFi. While challenges like declining TVL in some protocols exist, the overall momentum of LSTs, especially with leaders like jitoSOL and bnSOL, reflects a positive shift. However, it’s crucial to monitor market trends closely as the competition within the DeFi space intensifies. Always do thorough research before diving into any staking protocols!

What’s Next for Solana LSTs?

The rise of liquid staking tokens shows that more people want flexibility with their staked assets. While some protocols are facing challenges, the growing market cap of $7.5 billion proves that LSTs are becoming a key part of Solana’s ecosystem. As the DeFi market grows, LSTs like jitoSOL, bnSOL, and mSOL will likely play a bigger role in helping users earn rewards and stay active in the market.