Introduction

Solana, also known as SOL, recently dropped to $197, losing 8.68% in just one day. Despite this fall, its trading volume went up by 94%, showing strong interest in the coin. Many wonder if Solana can recover and reach $200 again.

What Happened to Solana’s Price?

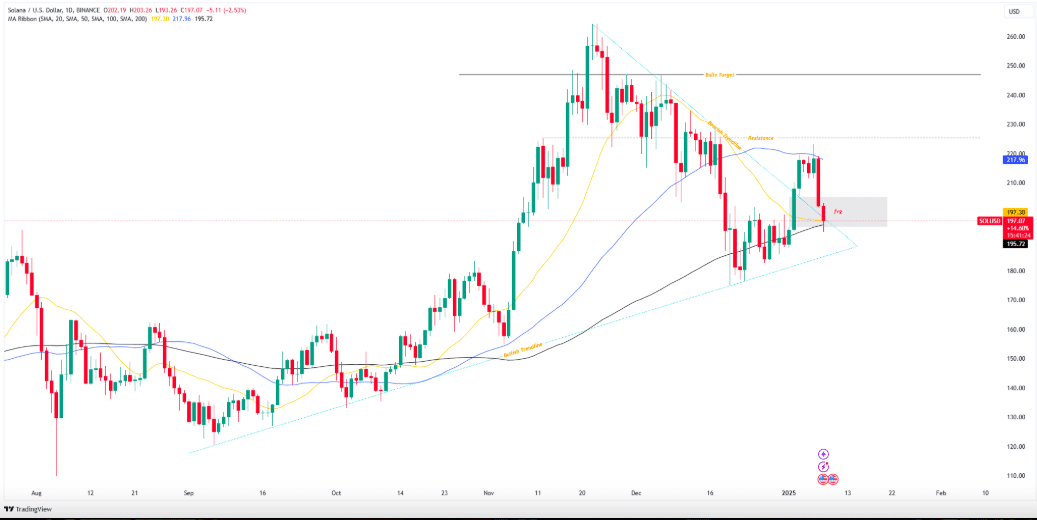

Solana’s price dropped to $197.05, but it still gained 4.31% over the past week. The coin traded between $193.90 and $215.98 on the last day. Over the week, the price ranged from $188.79 to $221.35. Right now, SOL’s market cap is $95.54 billion, with 480 million SOL in circulation. It’s still 24.9% below its all-time high of $263.21, which it reached in November 2024. The next major resistance is at $217, while support at $195 is critical to prevent further drops.

Solana Indicators Show Bearish Momentum

Solana’s recent price action shows weakness. It broke below a bullish trendline and a key zone called the Fair Value Gap (FVG). The 200-day Moving Average (MA) at $217.96 is acting as strong resistance.

The closest support is at $195.72. If the price falls below this, it could drop further to $180. Traders are keeping an eye on whether SOL can regain $200 and aim for $220. If the bearish trend continues, the price could test even lower levels.

What Are Traders Doing?

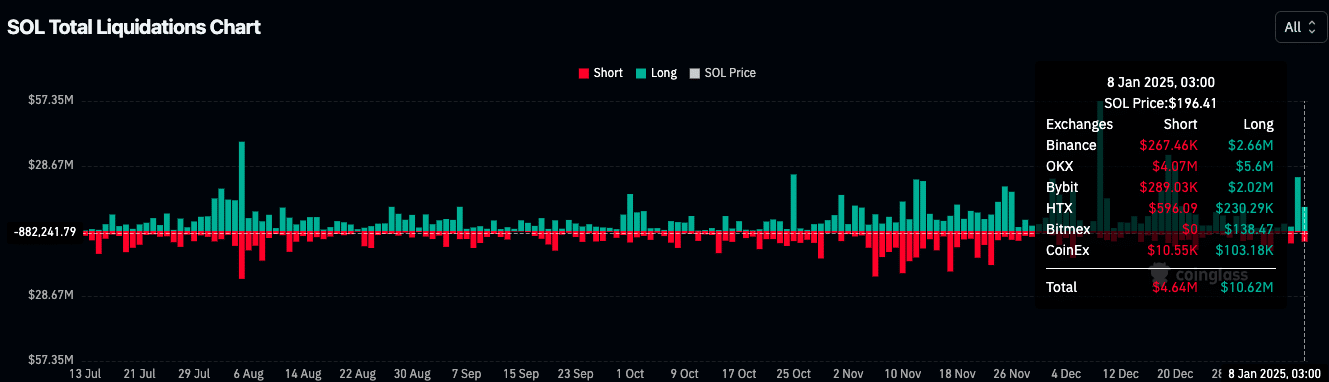

Data from Coinglass shows mixed feelings among traders. Trading volume jumped by 94.85%, reaching $12.62 billion. However, Open Interest (OI), which tracks active trades, dropped by 10.68% to $6.03 billion. This means fewer traders are using leverage to bet on price movements.

Options trading also saw a big jump, with activity increasing by 447.63%. Still, $10.62 million worth of long positions (bets on the price rising) were liquidated when the price fell. In comparison, $4.64 million in short positions (bets on the price dropping) were liquidated. Most of these losses happened on Binance and Bybit exchanges.

Strong Network Activity Supports Solana

Despite the price drop, SOL’s network activity remains strong. According to DefiLlama, its Total Value Locked (TVL) is $8.79 billion, though it has fallen by 7.59% in the last day. The stablecoin market on SOL is worth $5.56 billion. The network earned $4.35 million in fees and $2.18 million in revenue in just 24 hours. SOL also recorded 4.74 million active addresses and over 62 million transactions in the same period.

Will Solana Recover?

SOL’s network activity and high trading volume show that interest in the coin remains strong. However, bearish indicators like falling support levels and liquidations suggest caution. To recover, SOL must hold above $195 and break through $200. For now, the market remains uncertain. Traders are watching closely to see if Solana can stabilize and make its way back to $200 or higher.

VR Soldier Thought

Solana’s dip highlights the risks and rewards of the crypto market. While the network shows promise with strong activity, price trends depend on breaking key levels. Traders should watch closely and stay prepared for changes.