A recent RedStone report underscores Solana growing importance in blockchain infrastructure for capital markets, particularly in real-world asset (RWA) tokenization.

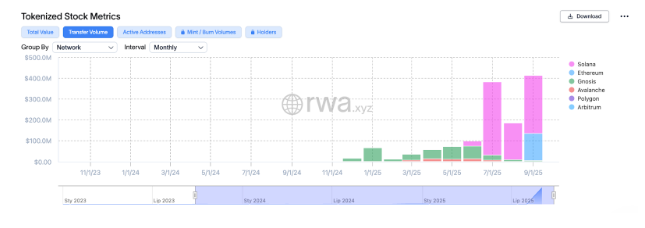

Rapid Growth in Tokenized Assets

According to RedStone, Solana now hosts about $700 million in RWA assets, a figure that expands to more than $13.5 billion when stablecoins are included. This represents a staggering 500% year-over-year increase, positioning Solana among the leading networks for tokenized financial products.

Expanding Market Integration

One example of this growth is the xStocks integration, which pushed Solana’s tokenized equity volumes ahead of Ethereum. Partnerships with exchanges such as Kraken have further fueled adoption by enabling fast and low-cost transactions.

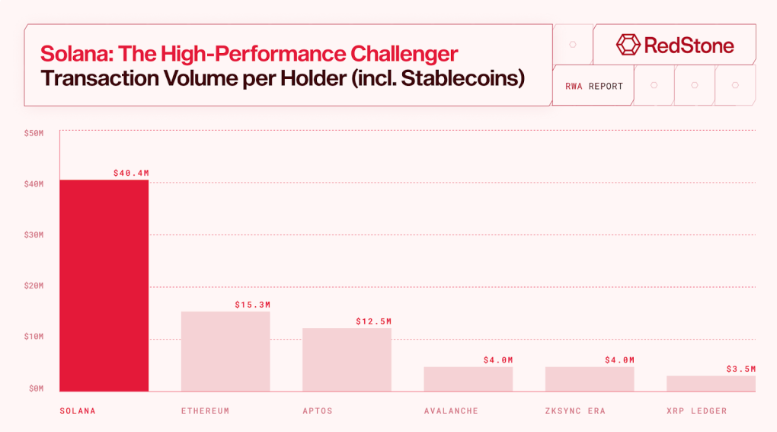

Performance as a Key Advantage

The report emphasizes Solana’s technical strength as a major factor in its dominance. Capable of processing up to 100,000 transactions per second, Solana has become the preferred option for institutional investors seeking scalability and efficiency in RWA applications.

Growing Institutional Presence

Major institutions including BlackRock, Apollo Global, Janus Henderson, and VanEck are already active on Solana. At the same time, the network continues to appeal to retail users through applications like Phantom, Raydium, Jupiter, and Pump.fun, highlighting its broad ecosystem reach.