Solana just pulled off a curious feat: its market cap surged to a record-breaking $137 billion, even though its token price remains about 15% below all-time highs. At $250, SOL hasn’t yet caught up to its early-year peak of $295, but supply dynamics are doing a lot of the heavy lifting.

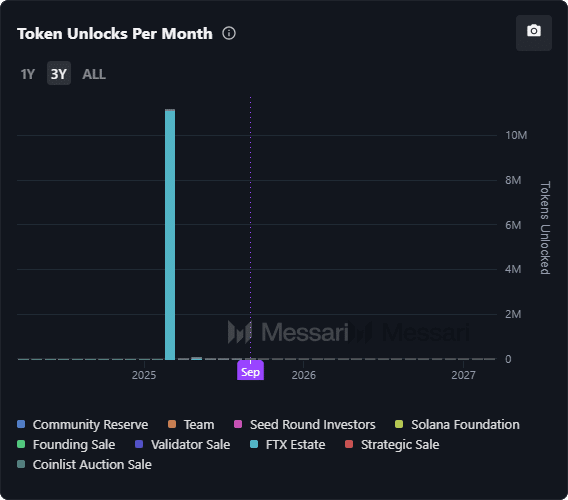

The secret? Circulating supply. Nearly 89% of Solana’s total supply—roughly 543 million tokens—is already liquid. Earlier this year, the FTX-related unlock of 11.16 million SOL was absorbed by the market without drama, clearing a huge overhang. With the heaviest unlocks behind it, the remaining scheduled releases average just 12.7K per month. In short, Solana has already digested its biggest supply shock, and the market is moving on.

Supply absorption fuels a new valuation game

This shift explains why Solana’s market cap feels stretched compared to January’s $295 peak. Back then, fewer tokens were in circulation. Today, with far more coins liquid, the network’s valuation nearly doubled even though the price per token is lower.

That doesn’t necessarily scream “overvalued.” Instead, it signals the market is factoring in the removal of supply-side risk. With most coins unlocked and absorbed, the fundamentals look stronger. The real question is whether demand can keep pace with this larger float.

Solana On-chain strength supports the rally

Under the hood, Solana’s adoption metrics back up the bullish case. Staked value just reached a record 410 million SOL, meaning nearly 67% of supply is locked away, reducing active circulation. That creates natural scarcity while reinforcing the network’s long-term commitment from holders.

Meanwhile, Solana’s inflation sits at about 4.279% annually and is programmed to decline over time. This tapering supply schedule further tightens available liquidity. In practical terms, Solana’s order books are staying bid-heavy, with demand consistently soaking up available tokens.

Q3 gains highlight momentum

Even with the “price lag” narrative, Solana delivered an impressive 55% return in Q3, clearing key resistance levels. The strong quarterly ROI shows buyers aren’t just speculating—they’re responding to robust on-chain signals. This performance points to a structural setup where fundamentals are driving confidence, not just hype.

Looking ahead: valuation or foundation for Solana?

Solana’s record $137 billion market cap isn’t just about token price—it’s a reflection of supply mechanics, staking growth, and easing inflation. While some may argue the valuation looks inflated compared to price levels, the underlying network strength tells a different story.

If adoption keeps accelerating and supply-side risks stay muted, Solana’s current structure could provide a solid foundation for the next leg higher. Instead of a bubble, the rally may just be the network showing it’s built for staying power.