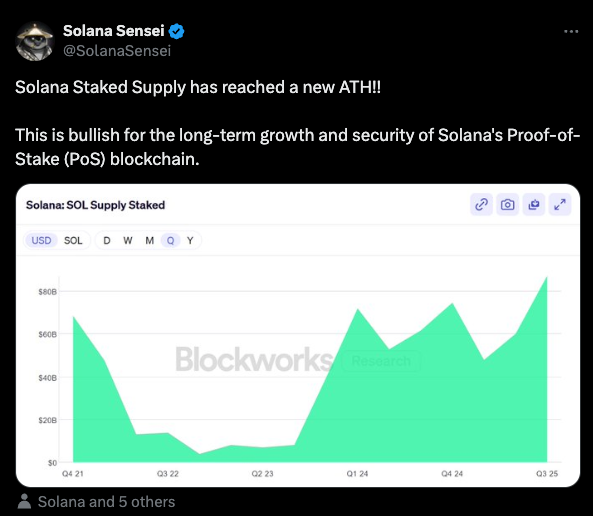

Solana’s network activity continues to grow, even as SOL’s price struggles. Recently, the amount of SOL locked in staking reached a new all-time high of 409 million tokens. This increase strengthens network security, but it also raises questions about whether Solana is becoming more decentralized or less.

While staking growth is usually seen as a positive signal, changes behind the scenes show a more complicated picture.

Solana Validator Numbers Drop After Subsidy Changes

To improve long-term sustainability, the Solana Foundation reduced staking subsidies that were previously given to some validators. Validators are the operators responsible for producing blocks and securing the network.

As part of this shift, the Foundation cut its delegated SOL to smaller validators from 85 million SOL down to 23 million. While this move was meant to encourage healthier economics, it also had a major side effect.

Many smaller validators could no longer operate profitably and exited the network. As a result, the total number of Solana validators fell sharply, dropping by about 68 percent from roughly 2,500 to around 800.

This decline has raised concerns about decentralization. For context, Ethereum has close to one million validators securing its network, far more than Solana. If Solana’s validator count continues to shrink, critics worry that control could become more concentrated among fewer operators.

Real World Asset Activity Continues to Grow

Despite validator concerns, Solana’s on-chain activity is picking up in another area. The network is seeing increased interest in real-world asset tokenization.

The number of RWA holders on it has reached a new high of more than 115,000 addresses. This represents an 11 percent increase over the past 30 days, even while the broader crypto market remains quiet.

These assets include tokenized versions of traditional financial products such as stocks, credit instruments, and money market funds. The rise in users suggests growing demand for on-chain financial tools beyond speculative trading.

Solana Lags in RWA Capital Flows

While user participation is rising, Solana is not leading in capital inflows. During the fourth quarter of 2025, Solana attracted about $216 million in net RWA flows.

By comparison, Ethereum and BNB Chain each recorded more than $1 billion in net inflows over the same period. This means competing networks captured roughly six times more capital.

Interestingly, its number of RWA users is close to Ethereum’s total of around 138,000 and far higher than BNB Chain’s roughly 8,000 users. However, BNB Chain appears to attract larger individual participants, allowing fewer users to move significantly more capital.

Solana Price Action Fails to Reflect Network Growth

Despite strong staking levels and growing RWA participation, SOL’s price has not followed these improvements. The token has fallen by about 58 percent from previous highs and was trading near $121 at the time of writing.

This gap between price performance and network fundamentals suggests that market sentiment remains cautious. Whether staking growth and real-world asset adoption can eventually support a recovery remains an open question.