Solana (SOL) sees a surge in institutional interest, with bullish forecasts suggesting a potential rally. However, the competition intensifies in the blockchain space while Solana’s network activity and TVL show promising growth. The main catalyst for growth is likely to be institutional investors, whose interest has seen a sudden surge.

Institutions are pushing Solana to grow

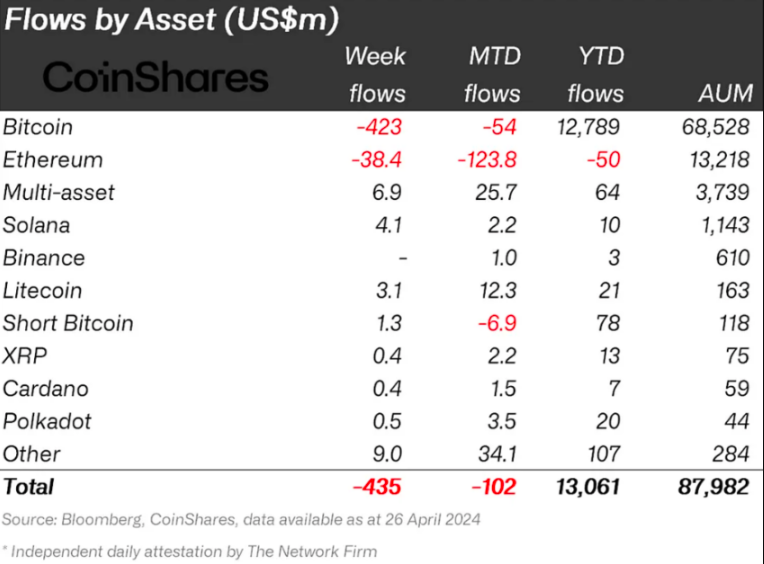

Over the past few days, Solana has regained the support of institutional investors that it lost at the beginning of the year. According to a recent CoinShares report, inflows into SOL- based investment products exceeded $4 million in a week. However, the total inflow since the beginning of 2024 was only $10 million.

The mood of retail investors also changed to optimistic. According to Coinglass, the funding rate is in the positive zone for the first time in a long time: this means that futures market participants are opening more and more long positions in SOL.

SOL Price Forecast: A Bullish Rally is Coming!

At the time of writing, the altcoin is trading at $148, which coincides with the neckline of the double bottom pattern. Typically, the formation of this pattern on a chart indicates a potential transition from a downtrend to an uptrend. Based on the figure, the likely target for SOL is at $187.

Intensifying Blockchain Competition: A Challenge for Solana

The competition among blockchains that emphasize decentralized applications (DApps) has intensified in recent months. This surge is partly due to Toncoin’s (TON) integration with Telegram and the rise of Ethereum layer-2 solutions like Base and Blast. Despite Solana’s marketing around its capacity and decentralization, persistent issues with failed transactions continue to impede the network.

Alternative networks that provide cost-effective transactions and incentives for deposits are challenging Solana, especially as the cryptocurrency market contends with various bearish factors. These include outflows from U.S. spot Bitcoin exchange-traded funds (ETFs), regulatory actions against cryptocurrency mixing services, and a generally more stringent stance from lawmakers.

Solana Network Activity

Solana network’s activity picks up, paving the way for SOL price growth. In addition to ongoing development within the ecosystem, the Solana network has seen an uptick in activity and deposits. The network’s total value locked (TVL), a metric indicating the amount held in decentralized applications’ (DApps) smart contracts, reached its highest point since October 2022.

Solana’s TVL in SOL terms peaked at 49.7 million on May 3, marking a 26% increase over two months. This growth was propelled by a $500 million inflow into Sanctum’s liquid staking solution. By comparison, Ethereum saw a 9.5% increase in ETH terms during the same timeframe, whereas the TVL of the BNB Chain experienced a 24% reduction.

In terms of active addresses interacting with DApps, Solana reported a 29% weekly rise, primarily fueled by the liquid staking application Jito, which saw $312 million in transactions. This was followed by growth in Marinade Finance, which recorded $220 million in transaction volume. Ethereum DApps reported a 20% increase in volumes, while BNB Chain saw a 22% decrease in the same seven-day period, according to DappRadar. While it is challenging to predict the sustainability of SOL’s price above $150, the bullish reports from major investment banks, heightened activity on the Solana network, and ongoing developments focusing on interoperability and reliability suggest a growing investor interest.