Solana (SOL) is losing support from one of the most important investor groups: institutions. The loss of institutional investor support will likely lead to a major correction for Solana if SOL price fails to address the issue.

Institutions have decided to take a break from Solana

The project’s token, like any other cryptocurrency, will inevitably depend on the actions of institutional investors. They can play the role of a driver for both growth and price correction. Perhaps the latter is what awaits SOL, as the altcoin has lost a significant amount of investment from institutional investors.

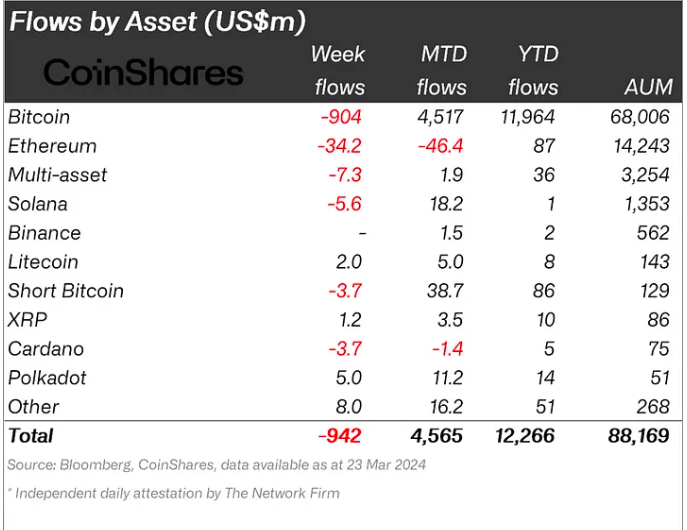

According to the weekly CoinShares report, Solana, along with Bitcoin and Ethereum, has registered significant outflows. Over the past week, institutions withdrew almost $5.6 million from the asset, resulting in the volume of investments at the beginning of the month amounting to $18.2 million. The net inflow of capital into SOL since the beginning of the year amounted to only $1 million.

These dynamics could cause the price to fall, and retail investors may not be able to save SOL from this bearish influence.

This forecast is supported by the lack of optimism among them, as evidenced by the SOL financing rate. This mechanism in derivatives markets ensures a balance between long and short positions. At the moment, the rate is positive, but over the past ten days, it has not shown any growth. This suggests that traders are not betting on the altcoin to rise, and this could minimize the bullish impact.

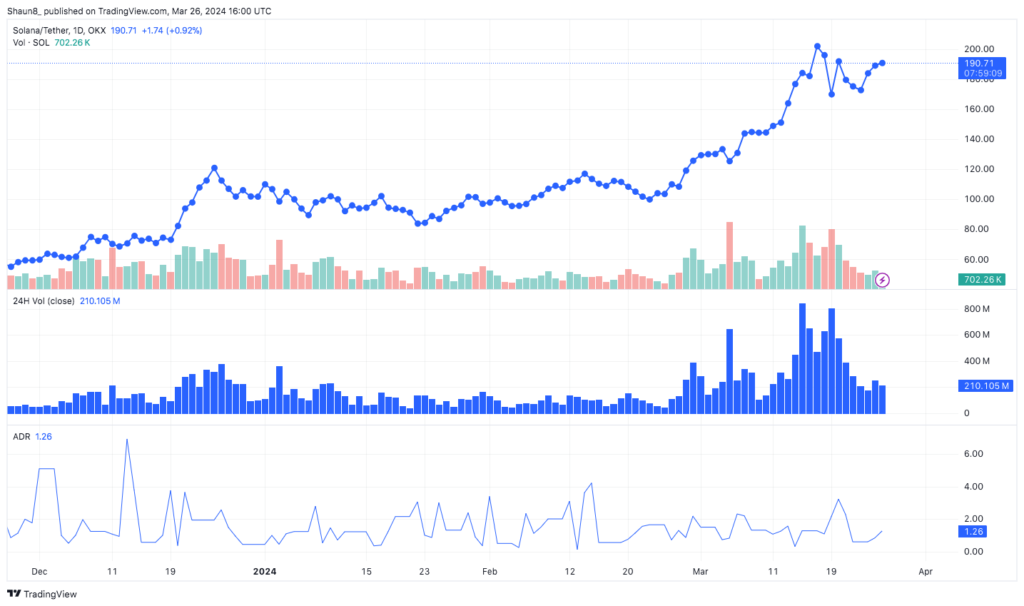

SOL Price forecast: should we expect a fall of 15%?

The token is currently trading at $190, breaking the $200 resistance level. However, it is likely to pull back soon if it fails to break through the $201 barrier, as it did earlier this month. This would potentially lead to a drawdown to $160, which would represent a 15% drop and also a break of support at $168. On the other hand, if Solana breaks the $200 resistance level, it will invalidate the bearish scenario and target SOL at $220.