In January, transaction volume on the Solana (SOL) blockchain hit a multi-year high. At the same time, the price of the ecosystem’s native token rose above $100, but by the time of writing it had rolled back a little.

Almost $1 Trillion in January

According to TheBlock, the volume of transactions with SOL and SPL tokens on the Solana network reached $951.9 billion. Compared to the previous month, the figure increased by 30%.

Transaction activity growth on the Solana blockchain is well above 2023 and most of 2022 levels. Back in August, the figure was about $36 billion, but since November it began to grow actively.

What about the price of Solana (SOL)?

The price of the ecosystem’s native token, SOL, is currently experiencing a recovery. So, on Monday, January 29, the value of the asset rose above $98. According to experts, the rate has corrected by about 6% since then. SOL is currently trading at $99.2.

On the other hand, the market capitalization of the native token of the Solana ecosystem is now more than $42 billion. Daily trading volume exceeded $3.7 billion.

What are the reasons for this dynamic?

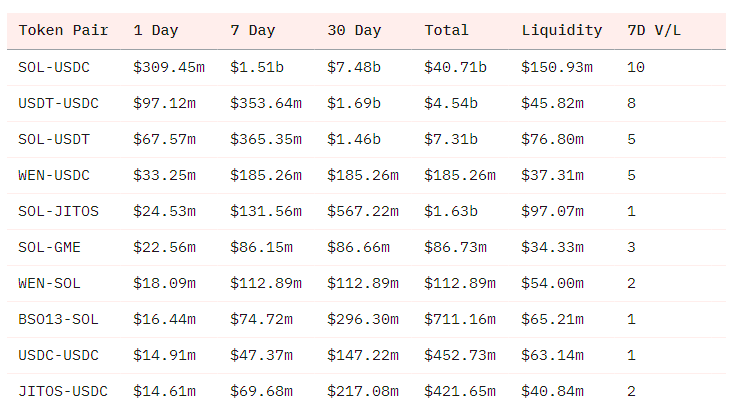

The increase in trading activity was largely caused by the rise in the value of SOL, as well as the popularity of the new “meme” coin based on Solana – WEN. According to Dune, the most popular pairs on decentralized exchanges (DEX) are:

This week, millions of Jupiter aggregator users and Saga phone owners were able to receive free WEN tokens. This also significantly influenced the popularity of the asset. Previously, the editors talked about how a trader managed to earn almost $2 million on WEN.

Today, on Wednesday evening, January 31, the first round of the JUP token airdrop will take place. This time, the project team will collectively distribute 1 billion coins. During all four planned distributions, the developers plan to transfer 40% of the total asset issue of 10 billion to the community.

About Solana

The Solana blockchain allows developers to create payment networks, marketplaces, prediction markets, and other types of applications that require maximum transaction speed. The main advantages, in addition to speed, include low commission fees (which do not become burdensome even if there are billions of users on the network), as well as comfortable compatibility between any second-level projects. SOL is the system’s native token, the main function of which is to protect the network using staking. The network uses the dPoS (Proof-of-Stake with delegation) mechanism; this means that any owner of SOL tokens can delegate a portion of their assets to one or more validators who process transactions and ensure the stability of the network.