The issuer of the market’s most popular stablecoin, Tether (USDT), has significantly increased its investment in Bitcoin (BTC) reserves by acquiring an additional 8,889 coins. Tether has not disclosed its Bitcoin addresses to the public. However, transactions were tracked on the blockchain show 8,888 BTC were recently sent from Bitfinex cryptocurrency exchange to a wallet that belongs to Tether.

Tether Increases Bitcoin Reserves Significantly

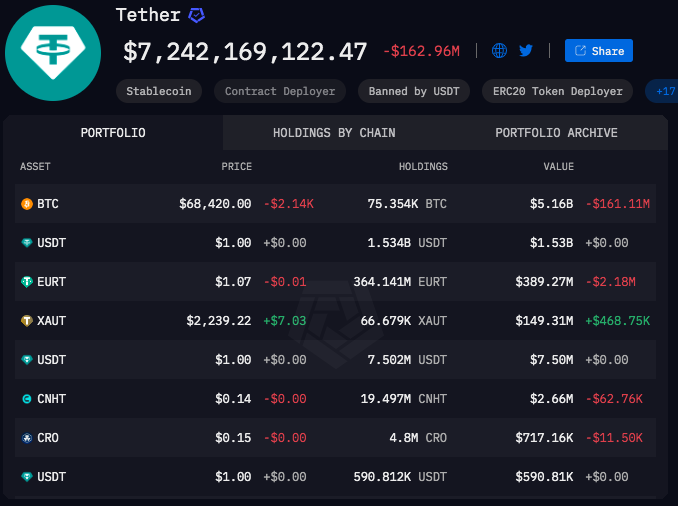

As a result of the latest transaction, Tether’s Bitcoin reserves increased to 75,000 BTC. The total value of the assets at current rates is estimated at more than $5.3 billion. Moreover, according to on-chain data, on March 31, 2024, a large transfer of $627 million was received by the Tether hot wallet on the Bitfinex cryptocurrency exchange. This purchase brought Tether’s total Bitcoin holdings to 8,889.

Over the past year, the company has significantly increased its holdings of the leading cryptocurrency. The company first announced investments in BTC in the first quarter of 2023. At that time, The stablecoin CEO Paolo Ardoino said that the stablecoin issuer would regularly allocate 15% of its “corporate profits” generated from excess USDT reserves to purchase Bitcoin.

“The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, was driven by its strength and potential as an investment asset,” the CEO said.

Tether Diversification

At the end of January, Tether published its report for the last quarter of 2023. Then, it was revealed that the company’s unrealized profit from investments in Bitcoin exceeded $2.8 billion.

According to coinmarketcap, at the time of writing, BTC is trading at $68,395.96. However, within the past 24 hours, the cryptocurrency rate has decreased by 1.1%. The issuer of the stablecoin is not only interested in digital assets. In November, Tether announced that it would invest $500 million in BTC mining. The company is already building farms in several South American countries, including El Salvador.

The company recently decided to develop artificial intelligence (AI). Tether will create a dedicated department and focus on developing open-source multimodal AI models. The company’s decision to enter this market was prompted by concerns about monopolization in the AI space.

Strategic Expansion

These strategic steps indicate the issuer’s desire to become both an investor in digital assets and a developer of their infrastructure. “Tether is mainly known for one product: USDT. But we are committed to becoming an investor and infrastructure builder in many strategic sectors: from artificial intelligence to P2P telecommunications, from Bitcoin mining to renewable energy generation,” Ardoino wrote on his X (formerly Twitter) page.

Tether Q4/2023 attestation is out.

My summary:

– profit for the quarter: $2.85B, of which ~$1B in net operational profit (mainly US t-bill interests), ~$1.85B from gold and #bitcoin holdings.

– total profit for 2023: $6.2B.

– cash & cash equivalents cover now 90% of all… https://t.co/AXjDw33QTc

— Paolo Ardoino 🍐 (@paoloardoino) January 31, 2024

About Tether

Tether (USDT) is a stablecoin, the cryptographic version of the US dollar. Each unit of the stalecoin issued for circulation is backed by a one-to-one ratio (i.e. 1 USDT = 1 USD ) of a corresponding currency unit held by Tether Limited (Hong Kong). Moreover, all USDT can be exchanged for the underlying monetary currency in accordance with Tether’s terms and conditions.

The fact that USDT is always worth one US dollar makes it extremely useful for storing or transferring value. Bitcoin, Ethereum and other popular cryptocurrencies constantly change their value based on supply and demand in the market. Not only that, Tether can be a good alternative to fiat US dollars for many purposes, including cross-border monetary transactions and trading cryptocurrencies without constantly converting it back to fiat.