Tether Expands Gold Operations with HSBC Talent

Tether, the world’s largest stablecoin issuer, is expanding its gold strategy by bringing on two senior executives from HSBC, one of the global leaders in metals trading. The move underscores Tether’s growing commitment to physical assets as part of its reserve diversification strategy.

On November 11, Tether confirmed that Vincent Domien, HSBC’s Global Head of Metals Trading, and Mathew O’Neill, Head of Precious Metals for Europe, the Middle East, and Africa, will join its team in the coming months. Their primary responsibility will be overseeing and scaling Tether’s gold reserves, which have reached approximately $12 billion.

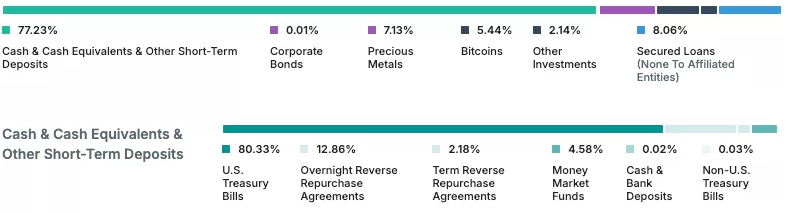

These holdings include assets backing Tether Gold (XAUT), a gold-backed stablecoin with a market capitalization of $1.56 billion, alongside physical bullion supporting USDT, Tether’s flagship stablecoin.

A Strategic Pivot Toward Precious Metals

The hires reflect Tether’s intent to increase its exposure to tangible assets amid global financial uncertainty. Over the past several months, the company has added roughly one metric ton of gold per week to its reserves, positioning itself among the largest private buyers of gold worldwide.

According to Bloomberg, this steady accumulation makes Tether one of the few major non-sovereign entities actively stockpiling bullion at scale. The addition of HSBC’s senior metals specialists is expected to enhance Tether’s trading capacity and operational efficiency within the global gold market.

HSBC’s reputation in the sector strengthens this strategic shift. The bank operates one of the world’s largest private gold vaults in London and remains a central clearing member of the London Bullion Market Association (LBMA). HSBC’s influence extends across gold spot trading, futures, swaps, and derivatives markets areas where Domien and O’Neill have extensive experience.

Institutional Expertise Meets Digital Finance

The appointments come as Tether continues to merge traditional finance with blockchain-based products. The firm’s Tether Gold (XAUT) token allows investors to gain exposure to physical gold holdings without leaving the digital asset ecosystem. Each token represents ownership of one troy ounce of gold stored in secure vaults.

The company has also hinted at broader plans to integrate its gold reserves more deeply into its ecosystem, possibly expanding tokenization efforts or launching additional asset-backed products tied to real-world commodities.

Industry analysts suggest that by recruiting HSBC’s metals specialists, Tether is signaling an ambition to operate more like a global commodities player than a typical stablecoin issuer. The move also highlights the growing overlap between traditional asset management and blockchain finance, as stablecoin firms increasingly turn to tangible reserves to reinforce trust and regulatory resilience.

Gold as a Safe Haven in Uncertain Markets

Tether’s expansion into gold comes at a time of heightened macroeconomic volatility. Central bank rate decisions, currency fluctuations, and geopolitical instability have fueled a surge in gold demand as investors seek refuge from riskier assets.

This environment has prompted companies across both traditional and digital finance to strengthen their positions in precious metals. By bolstering its bullion reserves, Tether appears to be hedging against market turbulence while reinforcing the credibility of its asset-backed tokens.

As global markets adjust to tighter monetary conditions, analysts predict that Tether’s continued gold accumulation could further cement its role as a hybrid financial entity bridging blockchain liquidity with traditional asset security.