Dogecoin (DOGE) appears poised to witness a decline in value as bullish pressure begins to wane. However, the increased volatility observed in the coin’s market puts it at risk of significant price swings. Especially downward, as demand for the meme coin declines. Meanwhile, Bitbot represents a paradigm shift in trading, democratizing access to advanced trading tools and strategies through the familiar interface of Telegram. With its user-centric approach and commitment to innovation, Bitbot is poised to redefine the landscape of cryptocurrency trading, empowering users to trade smarter and achieve their financial goals with confidence.

A wave of negativity is washing over Dogecoin investors

While DOGE’s price has risen by 7% in the past 24 hours, it continues to be trailed by negative weighted sentiment. As of this writing, the coin’s Weighted Sentiment returned a value of -0.404. This metric has returned a negative value since May 5.

An asset’s Weighted Sentiment measures the overall market sentiment surrounding it. The metric improves upon the simple positive and negative sentiments by considering the importance of each sentiment mentioned.

When it returns a negative value, the asset’s market is overwhelmed by negative sentiment. Its price is therefore expected to fall. Conversely, when the value is positive, the bulls are in control. Meanwhile, the bearish trend in the DOGE market is confirmed by the fact that its futures market open interest across exchanges has trended downward since May 8. At $9.83 billion at press time, it has since fallen by 7%.

DOGE’s futures open interest refers to the total number of its futures contracts that have yet to be settled or closed. When it declines in this manner, it indicates an increase in the number of market participants exiting their trade positions without opening new ones.

Dogecoin (DOGE) Price Prediction: A Decline Ahead?

At the time of writing, DOGE is trading at the support level of $0.15. Its Parabolic SAR indicator, as observed on a weekly chart, rests above its price, hinting at the possibility of a breach below this level.

This indicator is used to identify potential trend direction and reversals. When its dotted lines are placed above an asset’s price, the market is said to be in decline. It indicates that the asset’s price has been falling and may continue. However, If these bearish projections hold, the meme coin’s value might dip under $0.1 to find support at $0.08.

The widening gap between the upper and lower bands of its Bollinger Bands indicator heightens the risk of this significant price swing, as it signals the growth in market volatility. However, if the bulls regain control and DOGE’s price swings in an uptrend, it may initiate a rally toward resistance at $0.17.

Bitbot: A Suite of Powerful Trading Tools

Bitbot caters to investments of all sizes, making it a versatile platform suitable for both small-scale and large-scale investors. Its self-custodial approach ensures the secure handling of larger investments, while its robust features are equally effective for managing smaller investment amounts with precision and ease.

Bitbot brings institutional-level trading tools to the fingertips of every user. From automated sniping and limit orders to copy trading and yield optimization, Bitbot provides a comprehensive suite of tools to enhance trading strategies and maximize returns. Whether a novice or experienced trader, Bitbot offers the tools necessary to thrive in the dynamic world of cryptocurrency trading.

Bitbot brings institutional-level trading tools to the fingertips of every user. From automated sniping and limit orders to copy trading and yield optimization, Bitbot provides a comprehensive suite of tools to enhance trading strategies and maximize returns. Whether a novice or experienced trader, Bitbot offers the tools necessary to thrive in the dynamic world of cryptocurrency trading.

Support for Leading Networks & Telegram Integration

Currently, Bitbot supports trading on the Ethereum and Solana networks, with strategic plans to expand its support to other Layer 2 solutions in the future. This broad network support ensures accessibility and flexibility for users, enabling them to trade across various blockchain ecosystems seamlessly.

Bitbot seamlessly integrates with Telegram, operating directly within the messaging platform. Through Telegram’s mini apps interface, users can execute trades effortlessly, leveraging the convenience and accessibility of Telegram’s extensive user base. This integration streamlines the trading process, making it accessible to users without the need for additional platforms or complex interfaces.

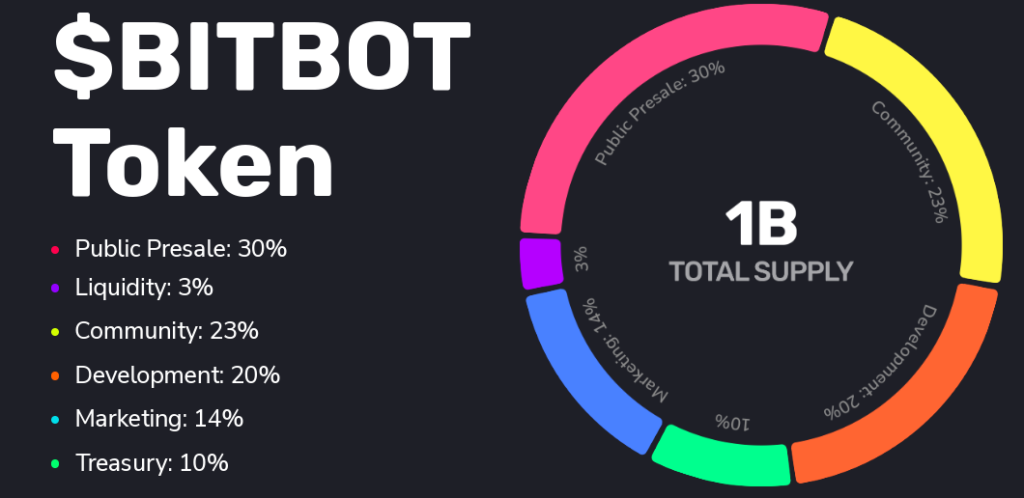

At the heart of Bitbot’s ecosystem lies the $BITBOT token, a utility coin that offers a range of exclusive benefits to holders. These benefits include revenue sharing, access to presales, unique perks and airdrops, and participation in governance decisions shaping Bitbot’s strategic direction. The $BITBOT token not only enhances the trading experience but also empowers users to actively contribute to the growth and development of the Bitbot platform.