The total amount of liquidations on the crypto market over the past 24 hours exceeded $550 million. Most of the forced closed positions were in Bitcoin (BTC), LINK, and ETH. Selling pressure amid low trading volumes over the weekend saw BTC traders collectively lose about $138 million. Market participants who opened positions in Chainlink (LINK) and Ethereum (ETH) also suffered significant losses – the sharp decline in the value of these cryptocurrencies cost them at $68.77 and $67.12 million.

What’s happening to the price of Bitcoin (BTC)?

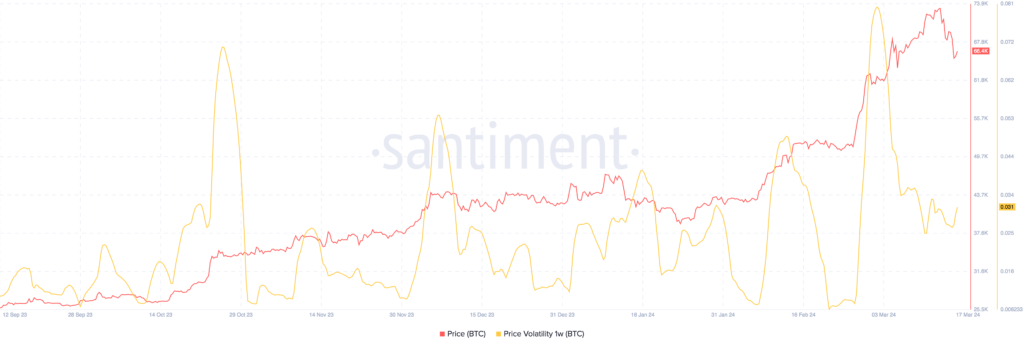

This week, the price of BTC once again updated its all-time high, rising above $73,000. However, after this, the asset went into a correction, during which it briefly dropped below $65,000. However, the data shows that long positions outnumbered short positions in the last hour, signaling traders’ hope for a recovery in the price of the top cryptocurrency.

Bitcoin whales take profits

The Realized Price and Short-Term Holders Profit/Loss Margin indicator tracks the average price at which the coins of investors holding BTC for less than 155 days last moved. According to this indicator, this cohort currently has 70% unrealized profits – the highest in the last three years.

While short-term holders don’t appear to be planning to exit their positions just yet, some whales have begun reducing their Bitcoin holdings ahead of the halving. Data from the analytics platform Santiment shows that addresses with balances between 1,000 and 10,000 BTC sold more than 80,000 coins worth about $4.96 billion over the past month. If whales continue to dump the asset, they could trigger an even deeper correction and encourage short-term holders to take profits.

BTC price forecast: Another fall ahead?

Judging by the MVRV Pricing Bands indicator, a price correction could push Bitcoin to test the 2.4 MVRV level. The MVRV Pricing Bands indicator is a graphical representation that displays the MVRV ratio over time, outlining different levels of market sentiment. It allows you to assess how the current price compares to historical selling prices and signals potential market reversals. However, one important bullish factor could negate the warning signs. Increased investor interest in the recently launched spot Bitcoin ETFs has resulted in these financial instruments accumulating the asset at an unprecedented rate. In just 2 months, fund issuers bought 433,843.58 BTC worth about $31.67 billion.