BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), has overtaken Grayscale’s (GBTC) fund in terms of assets under management. Meanwile, Bitbot couldn’t have timed its presale any more perfectly. With the BTC price nearing record levels and AI adoption continuously growing, Bitbot’s unique value proposition presents an enticing opportunity in the rapidly expanding Telegram trading bot sector.

Why GBTC lost to IBIT in Spot Bitcoin ETF Market

The US Securities and Exchange Commission (SEC) approved Bitcoin exchange-traded funds (ETFs) in January of this year. It took BlackRock exactly 96 days to overtake the sector’s former leader, Grayscale.

The GBTC fund charged a fee of 1.5%, which is significantly higher than its competitors. Therefore, the instrument gradually lost its attractiveness among investors, who were increasingly choosing alternatives. For example, IBIT from BlackRock.

“At the time of the conversion (January 10, 2024), Grayscale managed 620,000 BTC, representing more than 3% of the circulating Bitcoin supply, but refused to reduce its fees (1.5% vs. 0.2% for competitors), even after investors withdrew more than 330,000 BTC. This is too much for a “special” strategy,” wrote a well-known investor in the crypto community under the nickname HODL15Capital on X (formerly Twitter).

BlackRock’s latest achievement highlights the growing institutional interest in Bitcoin, as well as the competitive dynamics in the ETF market.

What’s happening in the Bitcoin ETF market

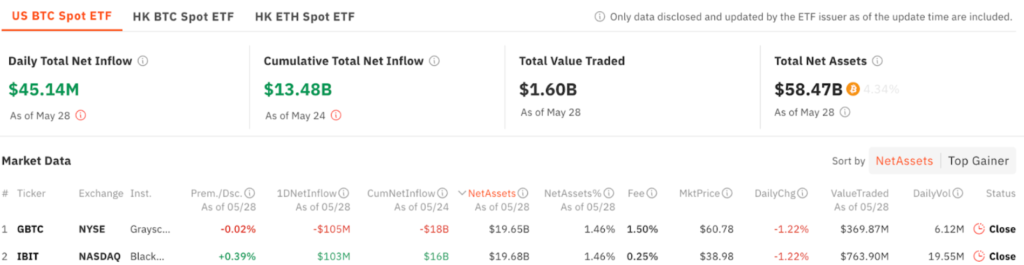

As of the end of trading on May 28, the inflow of funds into IBIT amounted to $102.5 million. GBTC recorded negative dynamics – about $105 million were withdrawn from the fund. The net inflow into spot Bitcoin ETFs, meanwhile, exceeded $45 million.

The total volume of BTC managed by the ETF reached 1 million coins , which is almost 5% of the issue of the first cryptocurrency by capitalization. American exchange-traded funds hold the most bitcoins.

Earlier it became known that BlackRock used its own income and bond organizations to invest in IBIT. BlackRock Strategic Income Opportunities Fund (BSIIX) and Global Bond Fund (MAWIX) purchased $3.56 million and $485 thousand worth of IBIT shares, respectively.

However, all attention is now focused on spot Ethereum ETFs, which the SEC unexpectedly approved last week. The regulator made a positive decision on eight applications. It is not yet clear when trading in the new instrument will begin.

Riding the AI & Crypto Waves with Bitbot

Bitbot is a fresh entrant in the swiftly evolving Telegram trading bot market niche, which has witnessed remarkable growth in the last 12 months. At the core of its array of trading tools is the AI-powered Gem Scanner, which combs through the web, exchanges, and social media for undervalued diamonds and presale gems.

Moreover, Bitbot is addressing the security vulnerabilities that plague many of its closest competitors, with the world’s first non-custodial security offering. This enables users to maintain custody of their digital assets until trades finalize. This arrangement shuts the door on the types of hacks that have impacted competitors like Unibot, Maestro, and, most recently, Solareum.

Bitbot Promising Future

A brief plunge into the Telegram trading bot market reveals the abundant potential available. Presently valued at over $1 billion, this market segment is expanding at an astonishing pace. 1.6 million users have exchanged over $22 billion with Telegram bots. An average of $115 million traded over the past week translates to over $1 billion being traded every nine days.

While the crypto market heats up, Bitbot is also positioned to capitalize on the current strength of the AI market, demonstrated by recent reports of Alphabet and Microsoft earnings displaying substantial AI-driven growth.

Already touting a superior security solution that’s likely to propel it to the pinnacle of the market alongside its exceptional AI-powered trading suite, Bitbot also offers users a share of 50% of Bitbot trading fees to any BITBOT holders. Compared to Banana Gun and Unibot, both of which have experienced significant price corrections since their previous highs were reached, Bitbot stands prepared to emerge as the Telegram trading bot of preference for crypto traders.