Trump China Warning Sparks $700M Crypto Market Liquidation

A sharp warning from U.S. President Donald Trump over potential new tariffs on China sent shockwaves through global markets, triggering nearly $700 million in crypto liquidations and reigniting fears of a renewed trade conflict.

Tariff Threats Shake Markets

In a post on Truth Social, Trump accused China of sending “hostile letters” to several countries and threatening new export controls on rare earth materials. He warned that the U.S. would respond with “massive tariff increases” and “financial countermeasures.” The remarks immediately rattled investors and revived concerns about a repeat of earlier tariff escalations that disrupted global supply chains.

During the previous “Liberation Day” tariff episode earlier this year, U.S.–China tensions led to tariffs as high as 34% and tighter export restrictions on key materials. Friday’s statement suggested that a similar conflict may be brewing again.

Crypto Markets Slide on Renewed Uncertainty

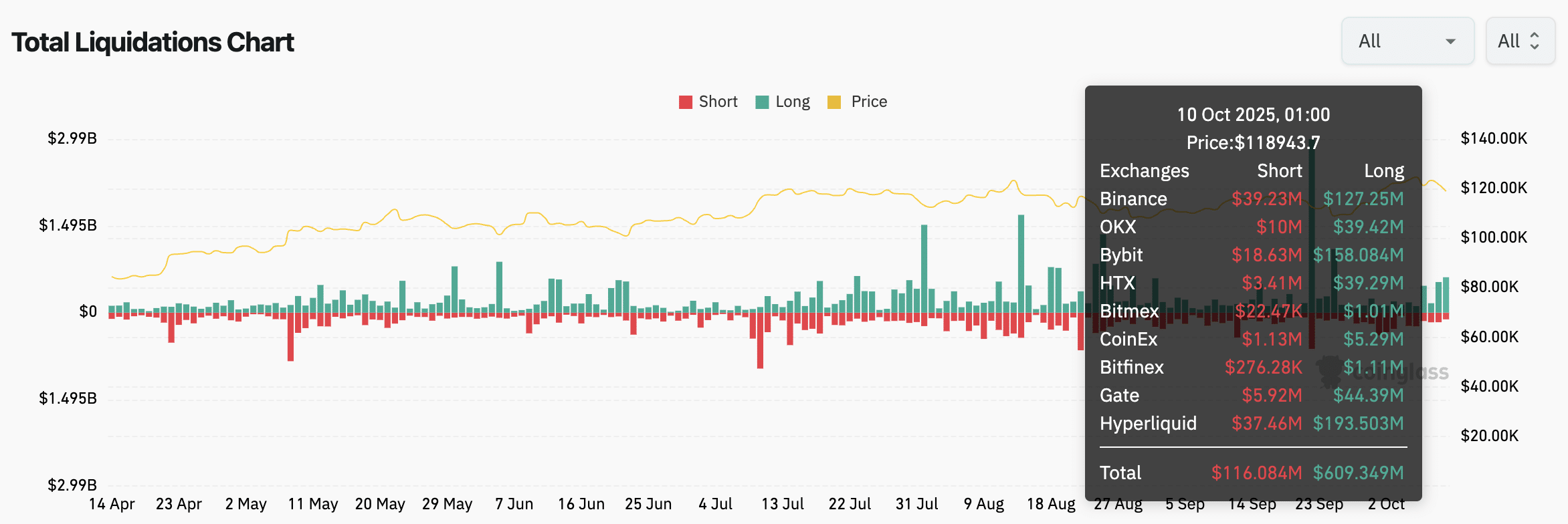

Data from Coinglass showed $700 million in liquidations within 24 hours, with long positions accounting for $609 million of the losses. Bitcoin briefly fell below $119,000, while Ethereum dropped to around $4,100. The downturn reflected a broad pullback in risk assets as traders reduced exposure.

Bitcoin’s relative strength index (RSI) eased to 52, hinting at slowing momentum after failing to break resistance near $123,000. Ethereum’s RSI slipped to 41 amid stronger selling volume and weaker sentiment.

Trade War Fears Weigh on Risk Assets

Trump’s comments reignited market anxiety over a potential trade war, a scenario that typically drives investors away from speculative assets like crypto. References to “monopoly positions” and “financial countermeasures” added to concerns about disruptions in key industries linked to inflation and global trade.

The abrupt reaction showed how sensitive the crypto market remains to macroeconomic headlines, especially those tied to geopolitical and policy risks.

Outlook: Volatility Ahead

With Beijing yet to issue a response, traders are preparing for heightened volatility through the weekend. Analysts note that any official counterstatement from China or formal action from the U.S. could intensify market pressure.

Bitcoin currently finds key support near $115,000, while resistance stands at $123,000. Ethereum’s support zone sits around $4,000, with resistance near $4,400.