Introduction

On April 18, the TRUMP memecoin faced a significant test as 40 million new tokens—worth nearly $300 million—entered circulation. This release represented 20% of the coin’s current circulating supply and 4% of its total future cap of 1 billion tokens. Typically, such large unlocks would trigger a price drop due to sudden supply expansion. Yet surprisingly, TRUMP defied expectations, posting an 8% intraday price increase and pushing back above the $8 psychological threshold.

This strong reaction suggests traders may have anticipated the unlock and priced it in early. With 24-hour trading volume spiking 68%, bullish sentiment appeared to temporarily overpower fears of dilution.

Behind the Numbers: Is the Bounce Sustainable?

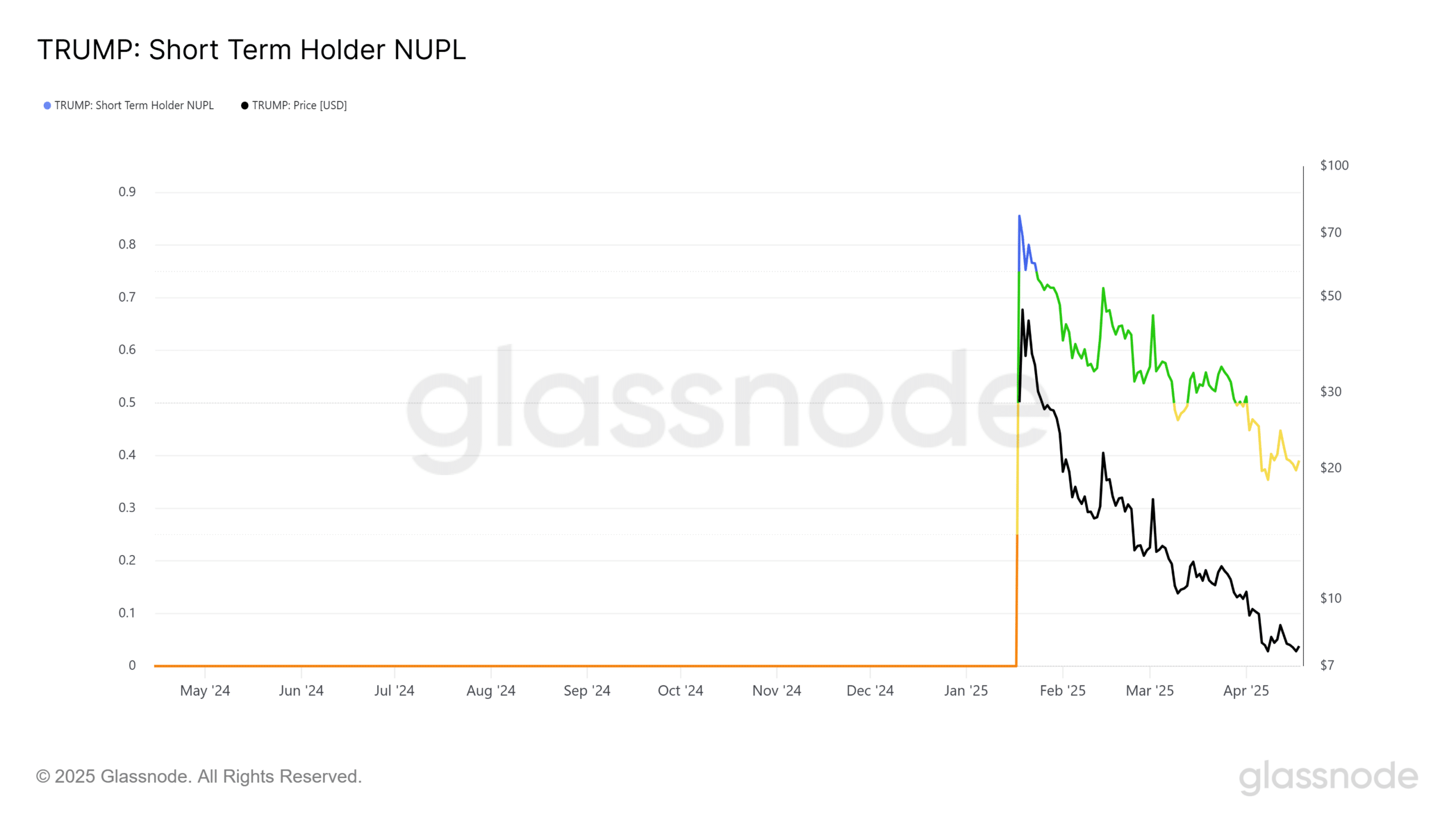

Although the short-term price action seemed encouraging, the bigger picture is more nuanced. TRUMP has fallen 88% from its all-time high of $74.59, reflecting a heavily weakened structure. The rally sparked by the unlock may simply be a reflex move within a longer downtrend, rather than the start of a lasting recovery.

Adding to the uncertainty is TRUMP’s fading network activity. Just 1,476 new wallet addresses were recorded recently—a steep drop from the nearly 700,000 wallets created during its bullish phase. Without fresh demand or growing adoption, the recent pump could struggle to maintain momentum.

Investor Behavior Shows Mixed Signals

On-chain data offers an interesting contrast. Despite the token’s sharp decline in price, Short-Term Holders (STHs) haven’t shown signs of panic. TRUMP’s Net Unrealized Profit/Loss (NUPL) for these holders remains above capitulation levels. In other words, many investors appear content to hold, even through deep drawdowns.

This kind of holding behavior reflects lingering optimism among retail participants and may explain why the market didn’t immediately crash after the unlock. Strong support remains around the $7 level, as buyers continue to absorb selling pressure.

TRUMP Token Tokenomics and Long-Term Outlook

TRUMP’s tokenomics are structured with a hard supply limit of 1 billion tokens to be released over a three-year period. With only 20% currently in circulation, more unlock events are expected. Historically, these could lead to increased volatility, especially if large holders dump tokens into the market.

Still, the token’s post-launch fundamentals have held up better than some expected. While the initial hype may have worn off, the absence of full capitulation among holders suggests that TRUMP’s long-term outlook isn’t entirely bleak—at least not yet.

Conclusion: Resilience or Temporary Relief For TRUMP?

TRUMP’s ability to rally during a major unlock event shows that there’s still life in the project. However, the question remains: was this a true reversal or just a bounce before another drop? Without clear signs of growing user interest and stronger capital inflows, the memecoin risks falling into extended sideways movement.

For now, the $7–$8 range will serve as a key battleground. If TRUMP wants to break out of its slump, it needs more than a technical bounce—it needs a revival in belief, adoption, and liquidity.