Paul Atkins has said it is still unclear whether the United States will attempt to seize Bitcoin allegedly held by Venezuela. The comments came amid growing speculation that the U.S. could target the country’s reported crypto reserves following recent geopolitical developments.

In an interview with Fox Business, Atkins was asked directly whether the U.S. government would move to take control of Venezuela’s alleged Bitcoin holdings, estimated by some reports at around $60 billion. He responded

“That remains to be seen. But I’m not involved with that, and I’ll leave it for others in the Administration to deal with that.”

The comments followed reports that the U.S. asserted ownership claims over Venezuelan oil assets after the capture of President Nicolás Maduro. This fueled speculation that a similar approach could be taken toward Venezuela’s rumored Bitcoin reserves.

However, the existence of such a large Bitcoin stash has not been confirmed.

No On-Chain Proof of a Large Bitcoin Stash in Venezuela

At the time of writing, there was no verified evidence that Venezuela controls Bitcoin holdings anywhere near the figures being discussed publicly.

Blockchain intelligence firm Arkham said it has not identified wallets or on-chain data supporting claims of a $60 billion Bitcoin reserve. Matteo Colledan, Arkham’s vice president of business development, stated that the firm is still assessing whether any such holdings exist.

Without clear blockchain proof, reports of a massive Venezuelan Bitcoin reserve remain speculative.

Venezuela Crypto Usage in Context

While the size of any government-held Bitcoin reserve is uncertain, Venezuela has played a significant role in crypto adoption across Latin America.

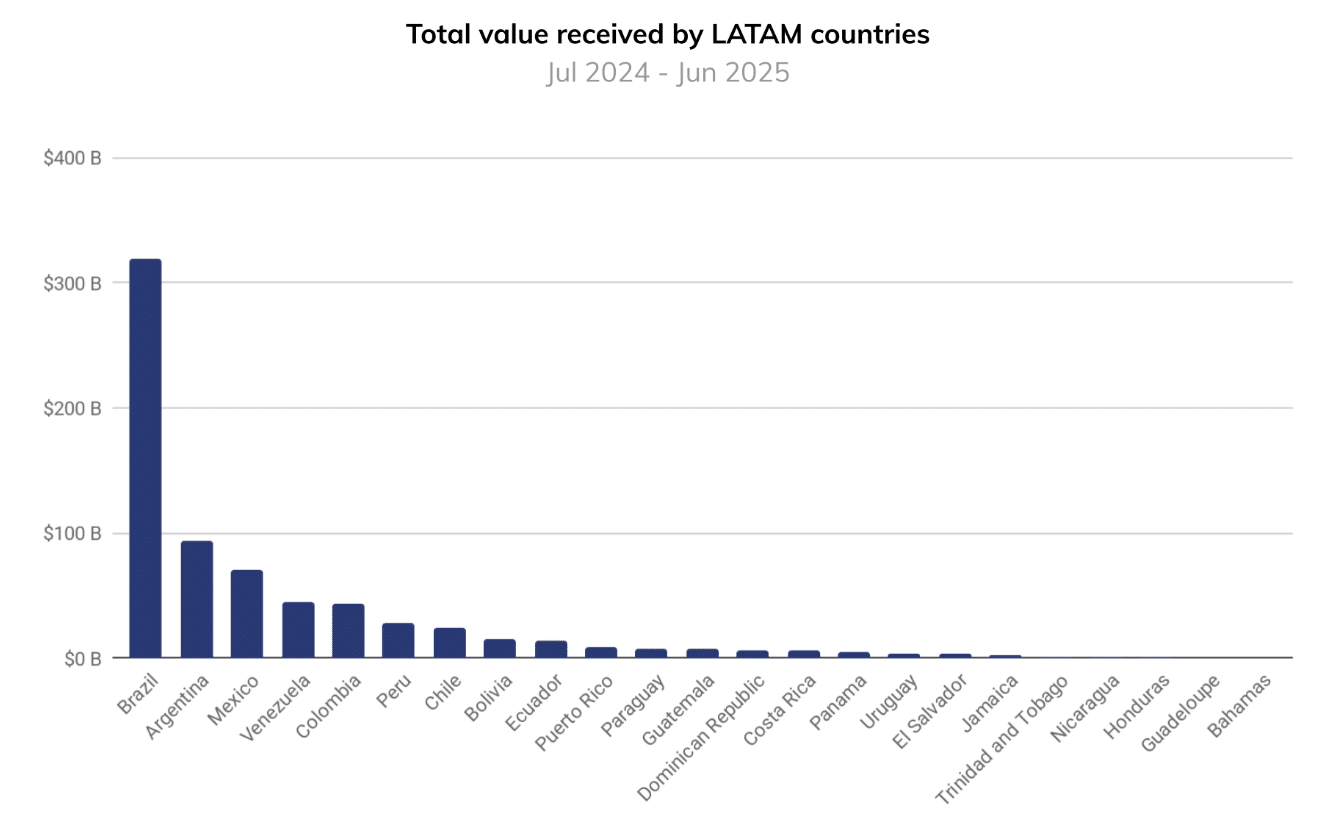

According to data from Chainalysis, Venezuela ranked as the fourth-largest country in the region by crypto value received between mid-2024 and mid-2025, with inflows totaling about $44.6 billion.

Chainalysis has linked the region’s growing crypto adoption to persistent inflation and international sanctions. For many Venezuelan citizens, cryptocurrencies became a practical alternative during periods of hyperinflation and currency instability.

At the state level, however, crypto reportedly served a different purpose. Analysts say Venezuelan authorities used assets such as stablecoins and Bitcoin to bypass U.S. sanctions on the oil sector.

Sanctioned Crypto Flows Increase

Chainalysis also reported a sharp rise in crypto activity tied to sanctioned jurisdictions in 2025. Inflows into sanctioned addresses surged by nearly %700, reflecting heightened geopolitical tensions.

Stablecoins and Bitcoin emerged as the most commonly used assets for moving value across borders while avoiding capital controls.

Some estimates place Venezuela’s alleged Bitcoin holdings at around 600,000 BTC, which would be worth roughly $56 billion at recent market prices. However, verified data paints a very different picture.

According to Bitcoin Treasuries, the Venezuelan government currently holds only about 240 BTC, valued at approximately $22.6 million.

Until further evidence emerges, the question of whether Venezuela controls a much larger Bitcoin reserve, and whether the U.S. could move to seize it, remains unresolved.