The Uniswap mobile app has officially launched for the public, featuring the integration of Blast, a Layer-2 scaling solution for Ethereum. This incorporation allows swaps to be executed directly within the app, enhancing convenience and enhancing the user experience on the decentralized exchange (DEX).

Uniswap Mobile App: Enhanced User Experience with Blast

The Blast protocol embedded into Uniswap brings substantial improvements in transaction speed and reduced gas fees. Blast addresses Ethereum mainnet’s scalability issues, enabling Uniswap users to enjoy faster and more economical transactions. This collaboration becomes particularly vital when the network experiences congestion, causing transaction speeds to decrease and fees to rise.

Live in 3…2…1

Users can now swap on Blast in the Uniswap mobile app 💥 pic.twitter.com/bdWbBBCxw0

— Uniswap Labs 🦄 (@Uniswap) April 27, 2024

The mobile app now accepts native yield for cryptocurrencies such as Ethereum (ETH) and USDB stablecoin. Concurrently, instead of active engagement in other DeFi protocols, users can earn interest from these holdings directly via the application. This feature simplifies investing and boosts the overall usefulness of the app.

Swap Functionality and Liquidity Provision

Liquidity pools for Uniswap v2 and v3 are accessible within the Uniswap mobile app. Liquidity providers in v2 pools can earn native yields if one of the two tokens in the pool is either USDB or wrapped ETH (wETH). This is akin to holding these tokens in a Blast wallet. However, since concentrated liquidity is relatively intricate, v3 pools on Blast do not yet have native yield.

Furthermore, the application offers additional features beyond token swapping. It includes the utilization of limit orders that are automatically triggered upon reaching specific price conditions. This tool is essential for traders looking to optimize their trading strategies without continuously monitoring market movements.

Global Accessibility and Multilingual Support

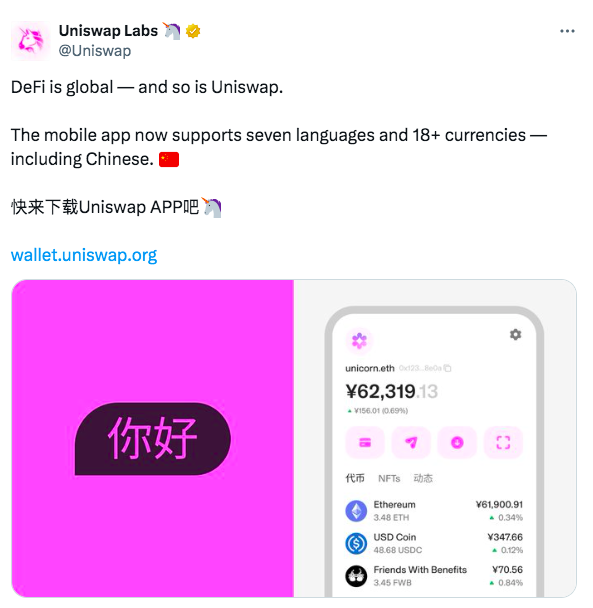

The mobile app’s multilingual and multicurrency support showcases Uniswap’s global accessibility. Users can navigate and transact in over seven languages, such as English, Spanish, Japanese, Portuguese, French, traditional Chinese, and simplified Chinese. Multilingual support is provided to accommodate a vast number of users from diverse cultural backgrounds, expanding the website’s reach to a broader audience, i.e., global.

Additionally, the app supports transactions in more than 18 currencies. Consequently, users can view their virtual currency holdings in their local currency. This feature eliminates the need for complex currency conversions and enhances the trading process’s convenience for users, which leads to an improved user experience.

Following the announcement, UNI price surged to an intra-day high of $8.05 before encountering strong resistance and retracing. At the time of writing, the bullish momentum remained active with UNI trading at $7.92, marking a 2.39% surge in the last 24 hours.