Venezuela is believed to hold a large amount of Bitcoin, possibly as much as 600,000 BTC. If these coins were seized by the United States following the capture of President Nicolás Maduro, they would likely be tied up in legal processes for years.

That outcome would remove around 3 percent of Bitcoin’s total supply from active circulation without any coins being sold. For an asset with a fixed supply, this kind of disruption could have meaningful effects on the market.

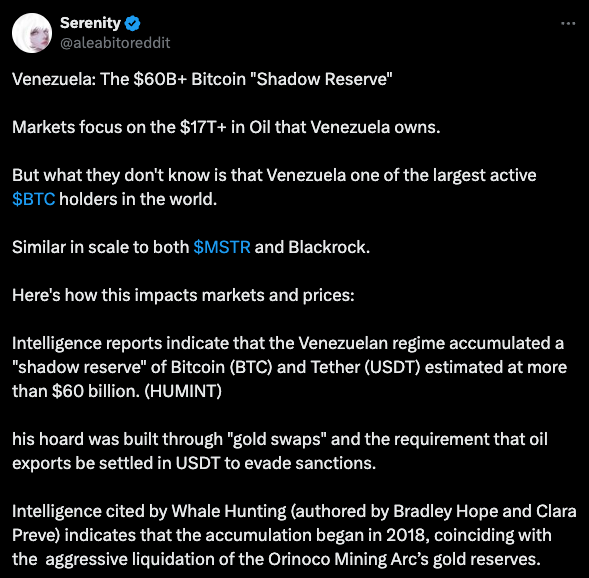

How Venezuela Built a Large Bitcoin Reserve

While Venezuela is often associated with oil exports, reports suggest the country quietly accumulated Bitcoin over several years. After international sanctions began in 2018, the government reportedly turned to alternative methods to move and store value.

These efforts included gold swaps, oil transactions settled in stablecoins, and the seizure of domestic Bitcoin mining operations. Gold extracted from the Orinoco Mining Arc was allegedly sold, with estimates suggesting that close to $2 billion was converted into Bitcoin when prices were near $5,000.

As the state-backed Petro currency failed, USDT became a temporary solution for oil payments. Over time, some of those funds were reportedly converted into Bitcoin to reduce the risk of account freezes.

Taking later inflows into account, analysts estimate Venezuela’s Bitcoin holdings range between 600,000 and 660,000 BTC, currently valued at more than $60 billion.

Why This Matters for Bitcoin’s Market

To understand the potential impact, consider Germany’s Bitcoin sale in 2024. When Germany sold roughly 50,000 BTC, the market saw a correction of about 15 to 20 percent, followed by weeks of weakness.

Venezuela’s estimated holdings are more than ten times larger. At this scale, they rival the Bitcoin holdings of MicroStrategy and sit just below the size of BlackRock’s IBIT exchange traded fund. They are also nearly double the amount of Bitcoin held by the U.S. government.

If these coins were frozen instead of sold, a significant portion of Bitcoin’s circulating supply would effectively disappear from the market.

Why a Large Sell-Off Is Unlikely

The most likely outcome is a prolonged freeze. Legal disputes, forfeiture claims, and creditor challenges could keep the coins locked in escrow for years.

Another possibility is that the Bitcoin could be held as a long-term reserve. Donald Trump has previously expressed openness to holding seized Bitcoin rather than selling it immediately.

A rapid sale appears unlikely. Selling such a large amount of Bitcoin would risk major market disruption and could undermine broader narratives around Bitcoin as a strategic asset.

Short-Term and Long-Term Effects

In the short term, uncertainty around these holdings could increase volatility. However, there are no strong signs of panic selling so far, similar to patterns seen during recent geopolitical events.

Over the longer term, a forced lock-up of hundreds of thousands of Bitcoin could support prices. Reduced liquid supply strengthens the scarcity argument and favors long-term holders as the market moves into the next cycle.