Introduction

Bitcoin’s price has been struggling as big investors, known as whales, are betting that BTC will drop. These large traders are taking short positions, which means they are expecting Bitcoin’s price to fall and are selling now to buy back later at a lower price. This has created selling pressure and added to Bitcoin’s recent price decline. Many traders are now paying close attention to these whale moves because they often influence the entire market. If whales continue to bet against Bitcoin, the price could fall further. But if something causes Bitcoin to rise unexpectedly, these whales could be forced to buy back their positions, leading to a sharp price reversal.

How Whales Control Bitcoin’s Price

Whales hold large amounts of Bitcoin and have the ability to move the market with their trades. Their actions affect liquidity, price direction, and overall sentiment. When whales short BTC, they increase selling pressure, which can lead to price drops as other traders follow their lead.

Short-selling occurs when traders borrow BTC to sell at a high price, hoping to buy it back at a lower price for a profit. When whales take short positions, it can trigger market-wide sell-offs, causing prices to drop further. This often creates a chain reaction, where smaller traders also start selling out of fear, making BTC’s decline even more extreme.

Whale Position Sentiment: What It Tells Us About Bitcoin

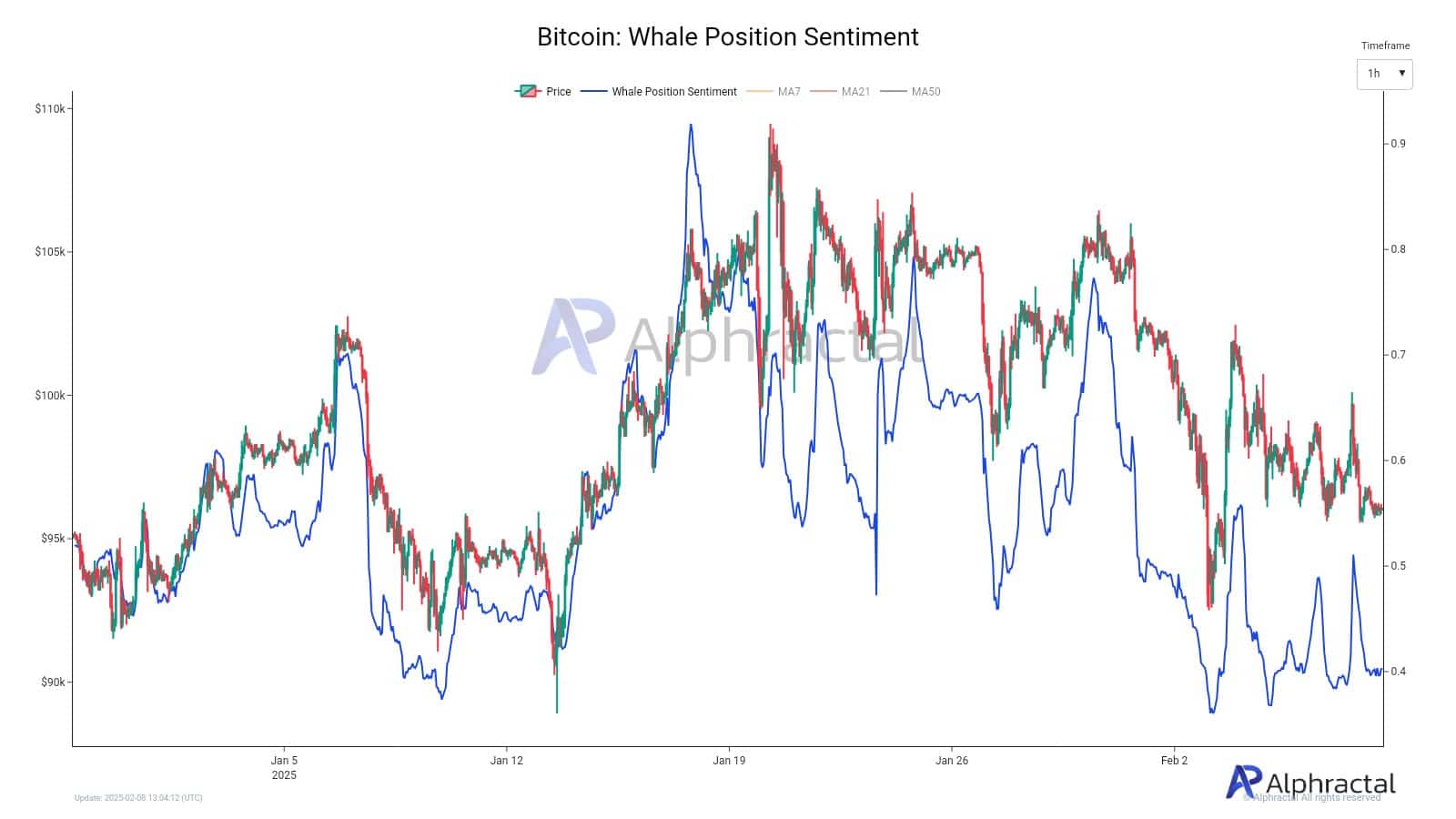

A special indicator called Whale Position Sentiment helps track what big investors are doing. This metric looks at big trades over $1 million, combined with open interest (OI) and how many long vs. short trades whales are taking.

Between January 12 and January 19, this indicator dropped from 0.9 to 0.5, showing that whales were placing more short trades. During the same time, BTC’s price fell from $105,000 to $95,000. This confirms that whales were betting against BTC, and the price responded by going down.

On January 5, whale sentiment briefly went above 0.8, leading to a small price bounce. However, this rally didn’t last, and BTC’s price continued to fall. Right now, the sentiment is at 0.4, showing that whales are still not confident in BTC, and the price is struggling to stay above $90,000.

Why Whale Activity Affects Smaller Traders

Whales don’t just move the market directly—they also influence how smaller traders react. Many retail traders watch what whales do and follow their trades. If they see whales selling BTC or shorting it, they panic and start selling too. This fear spreads, leading to even more price declines.

However, this also creates a risky situation for whales. When too many whales short BTC , there is a risk of a short squeeze. This happens when BTC’s price suddenly jumps up, forcing whales to buy back BTC quickly to close their short positions. When this happens, the price can rise very fast, catching many traders off guard and causing panic buying.

What’s Next for Bitcoin?

If whales continue shorting BTC, the price may keep falling in the short term. However, the market can change quickly. Big events like government policies, interest rate changes, or major companies adopting BTCcould reverse the trend.

For Bitcoin to recover, whales would need to start closing their short positions and buying back BTC. If this happens, the market could turn bullish again, and smaller traders would likely follow their lead. Until then, traders should watch whale activity closely, as their moves will determine whether BTC drops further or stages a comeback.