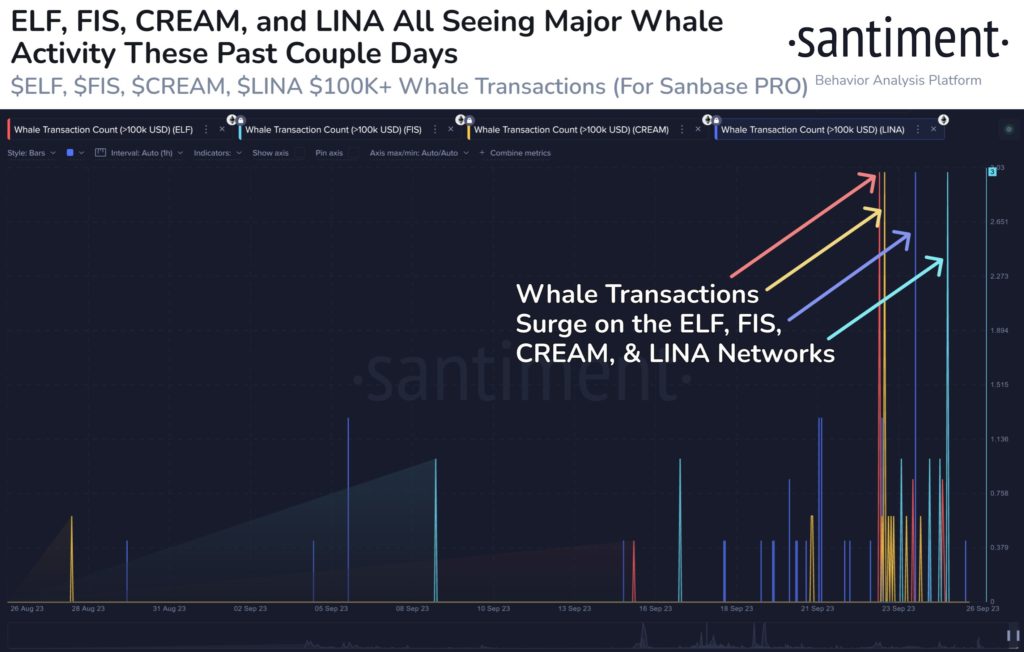

Recently, there has been a noticeable uptick in transactions involving $100,000 or more on the networks of $ELF (aelf), $FIS (StaFi), $CREAM (Cream Finance), and $LINA (Linear Finance). These developments suggest that these projects may be primed for substantial price fluctuations in the coming week.

Watch These Four Tokens

$ELF, the native token of the aelf blockchain, is witnessing increased whale activity. This could be attributed to growing interest in aelf’s unique approach to blockchain scalability, interoperability, and enterprise adoption. Whales are known to take substantial positions in projects they believe hold long-term potential, and this surge in large transactions may indicate bullish sentiment surrounding aelf.

Similarly, $FIS, the utility token of StaFi, is experiencing a surge in whale transactions. StaFi is a DeFi platform focused on staking and liquidity solutions, making it an attractive choice for investors seeking exposure to DeFi projects. Whale activity here may signify growing confidence in StaFi’s ability to deliver on its promises.

Cream Finance’s $CREAM token is another asset that has recently attracted significant whale interest. Cream Finance is a DeFi lending protocol, and increased whale activity may be linked to expectations of the platform’s growth in the evolving DeFi landscape.

Lastly, $LINA, the token of Linear Finance, has seen a rise in large transactions. Linear Finance is known for its synthetic assets and decentralized exchange, and the surge in whale activity could be a sign of confidence in the project’s ability to innovate within the DeFi sector.

Final Thoughts

While increased whale activity often foreshadows potential price swings, it’s important to remember that the cryptocurrency market is inherently volatile. Investors should conduct thorough research and exercise caution when making investment decisions. These surges in whale transactions on $ELF, $FIS, $CREAM, and $LINA networks may present opportunities, but they also come with risks. Traders and investors should stay vigilant and closely monitor these projects in the coming week for any developments that may impact their prices.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: wirestock/123RF // Image Effects by Colorcinch