Polygon investors are losing confidence in MATIC’s recovery , and this could be bad for the coin’s price. However, If Polygon holders continue to show pessimism, MATIC price may continue to fail in its attempts to make a bullish breakout.

Polygon Whales Unload Their Supplies

Investors are losing confidence in Polygon. This can be seen from the way the whales have been dumping coins in the last few days. In just a week, addresses holding between 1 million and 10 million MATIC sold more than 21 million tokens. As a result, their inventories fell to a three-month low.

Sales of $14.7 million show that the big players are trying to recoup their losses. The lack of recovery convinced the whales to retreat and lock in as much profit as possible. Traditionally, accumulation of an asset by whales promotes recovery and growth, while selling causes the price to fall.

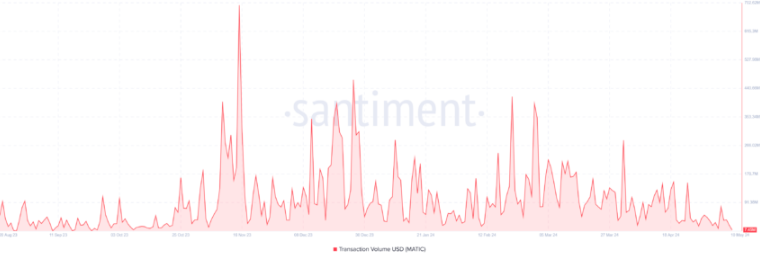

However, not only whales are retreating , but also retail investors. This can be seen from the sharp decline in transaction volume. MATIC holders refrain from activity until they see compelling incentives to participate in the network. In recent weeks, average transaction volume has fallen from $77 million to $21 million. Moreover, a decrease in network activity can serve as a bearish signal for the price, as a decrease in volatility leads to a decrease in liquidity.

MATIC Price Forecast

Polygon’s price has been consolidating in the range of $0.65 to $0.75 over the past month. These boundaries have been tested as support and resistance in the past and continue to be so.

Despite many attempts, the token was never able to break out of this consolidation. Due to the reasons mentioned above, the altcoin may fall to $0.65. If bearish trends intensify, this support level could be broken, putting MATIC at risk of falling to $0.60. On the other hand, if Polygon investors change their views and resume online activity, the altcoin could rebound. A break of the resistance at $0.75 will cancel the bearish scenario, pushing the price towards $0.80.