At one time, DeFi protocols such as Uniswap, SushiSwap or PancakeSwap experienced significant growth in volume and liquidity. These liquidity protocols allow virtually anyone to become a market maker and earn commissions for trading. This democratization of the market has provided freedom to carry out economic activities in the crypto space. What is important to know before providing liquidity to these platforms? In this article we will look at one of the most important concepts – impermanent loss.

What is Impermanent Loss in Yield Farming?

An impermanent loss occurs when you provide cryptocurrency to a liquidity pool and the price of the deposited tokens changes since the moment of deposit. The larger the change, the greater the impermanent loss: in other words, when you withdraw your funds, you will receive fewer dollars than you deposited.

Losses are called “impermanent”, since the position of the liquidity provider on the AMM, due to the volatility of the crypto market, can sink in value today, and tomorrow it can come out of the drawdown, and so on. Losses become irreversible or permanent only if the LP closes the loss-prone position, i.e. records the drawdown.

| Note: What is Automated Market Maker (AMM): An automatic market maker works as a mechanism that forms the price between two assets. Some of them use a simple formula like Uniswap, while Curve, Balancer and others use more complex algorithms. |

For example: Uniswap charges a 0.3% fee on each trade and passes these funds on to liquidity providers. A pool with a large trading volume will be quite profitable for liquidity providers even with a high risk of variable losses. However, this will also depend on the protocol, the specific pool, escrowed assets and market conditions.

How To Estimate Impermanent losses?

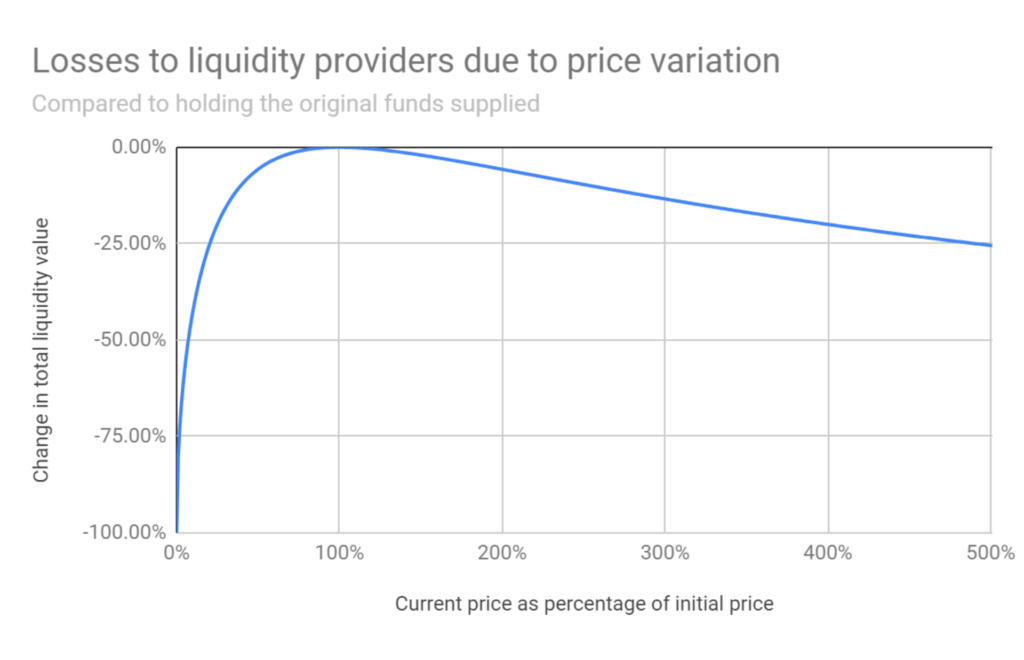

Impermanent losses occur when prices change. But how big can they be? Let’s look at the chart below. Please note that it does not take into account liquidity fees.

The ratio of asset price changes and impermanent losses shows the ratio of the asset’s value to potential impermanent losses, and the results are:

1.25x price change = 0.6% loss

1.5x price change = 2% loss

1.75x price change = 3.8% loss

2x price change = 5.7% loss

3x price change = 13.4% loss

4x price change = 20% loss

5x price change = 25.5% loss

Strategies to Avoid Impermanent Losses

Well, now we know what impermanent losses are. The question arises: how to deal with them? With many liquidity pools, variable losses are a fact of life that cannot be avoided. However, there are a number of strategies to mitigate, and sometimes eliminate, volatile losses.

-

Avoid volatile liquidity pools to reduce the impermanent loss

It is important to remember that liquidity pools based on volatile assets are the main sources of volatile losses.

Unlike stablecoins, crypto assets like ETH are not tied to any external assets and their value depends on market demand. And although “blue chips” (for example, the same ETH and WBTC) exhibit noticeable volatility, small coins are even more susceptible to short-term price swings, which means that “small change” carries much greater risks in terms of unstable losses.

If minimizing volatile losses is your top priority, then a wise decision would be to avoid volatile pools in the first place.

-

Provide liquidity to pools with tokens pegged to a single asset

Stablecoins such as USDC and DAI are pegged to the value of the US dollar and therefore they always trade at ~$1. You can recall other pairs of stablecoins, for example, sETH and stETH, tied to the value of ETH, or WBTC and renBTC, tied, respectively, to the BTC rate.

Liquidity pools based on tokens pegged to the same asset ( eg USDC/DAI ) have very low volatility. And this, in turn, is reflected in possible non-permanent losses, which in this case are either extremely small or simply absent.

If you want to earn money from commissions without worrying about potential inconsistent losses, pools like these can be a good option.

-

Supply liquidity to one-way staking pools

Not all earning opportunities for liquidity providers revolve around dual-token pools. Another popular source of yield for LPs is staking pools, which are often used to ensure protocol solvency and support deposits of a single asset type.

An example is the Stability Pool of the Liquity landing platform. Users deposit the LUSD stablecoin into Liquity’s “stability pool” and ensure the platform’s solvency, and in exchange, the platform pays them a percentage of commissions earned on liquidations. In this pool, there is simply no such problem as inconsistent losses – after all, there is no need to maintain a balance between two assets!

-

Provide liquidity to pools with unequal asset mixes

Unequal liquidity pools are pools that employ ratios other than the classic 50/50 split. The pioneer in terms of flexible liquidity pools was the well-known Balancer protocol, which supports asset ratios such as 95/5, 80/20, 60/40, and so on.

-

Participate in liquidity mining programs

Nowadays, liquidity mining programs, in which protocols distribute governance tokens of their first LP, can be found on almost every corner in DeFi. Why is this happening? It’s simple. Such programs are an easy opportunity for protocols to decentralize governance, attract liquidity, and also win the hearts of early adopters.

But liquidity programs can offer another benefit. The fact is that the size of the rewards paid for participation in these programs, in most cases, covers any non-permanent losses that the liquidity provider may face. And really, what is an inconsistent loss of some 5% in two months, if during the same period you managed to earn rewards ranging from 25% to 100% of the amount of the initial deposit.

Final Conclusion

Impermanent loss is one of the fundamental concepts that anyone who wants to provide liquidity for AMM should be aware of. Its essence lies in the fact that the liquidity provider may incur losses when the price of deposited assets changes.

Actions you have to do:

-Experiment with liquidity provision on AMM platforms and monitor for inconsistent losses

-Apply some of the above strategies to mitigate possible losses