Introduction

Bitcoin is struggling as big sell-offs from traders push prices lower. Important indicators like MACD and RSI show that Bitcoin is losing momentum, making people wonder if it will stay strong or drop even more.

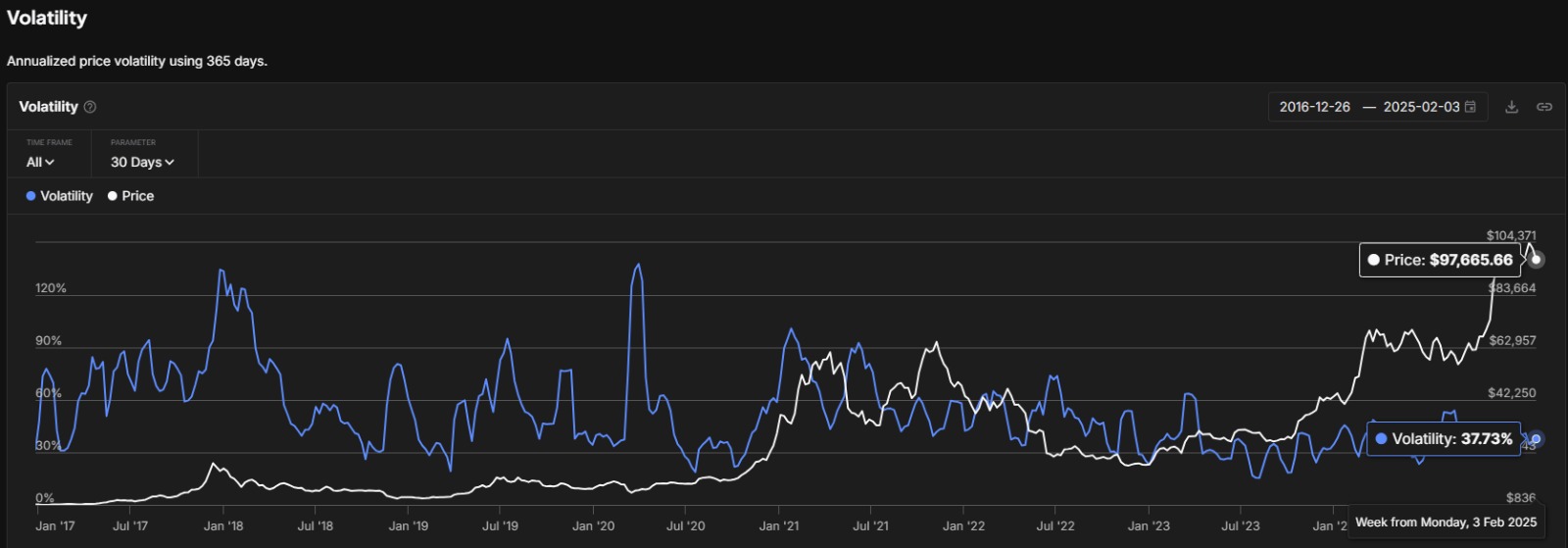

Why Does Low Volatility Matter for Bitcoin?

Bitcoin’s volatility has been going down, now at 37.73%. This means that price swings are not as wild as before. Usually, when volatility goes down, it could mean that selling pressure is slowing down and the market is stabilizing.

If volatility stays low, Bitcoin might stop dropping and start moving up again. But if more people start selling, the price could fall even further.

Will More Sell-Offs Cause a Bigger Drop?

Bitcoin’s heat map shows that there are many long positions below the current price. If Bitcoin’s price keeps going down, it could cause even more people to sell, making the drop happen even faster. However, if buyers step in before Bitcoin reaches lower levels, the price could stop falling and start recovering.

Are Too Many Long Positions Hurting Bitcoin?

The CME Futures market shows that too many traders are betting on Bitcoin going up. This can be risky because if the price drops too much, they might have to sell quickly, making the situation worse. For Bitcoin to stay stable, the market needs to have a good balance between buyers and sellers. If this happens, there will be less risk of a sudden crash, and Bitcoin could start recovering.

Are Big Sell-Offs Pulling Bitcoin Down?

Bitcoin’s price is falling because many traders are selling at the same time. When too many people sell, the price drops even more, making it hard for Bitcoin to recover.

The MACD indicator is now showing a negative trend, which means selling pressure is getting stronger. At the same time, the RSI level is at 44.98, which is getting close to the oversold zone. If it drops even lower, it could mean that Bitcoin is losing support from buyers.

Why Is $94K So Important for Bitcoin?

Many traders are watching the $94,000 price level closely. If Bitcoin drops below this, it could trigger even more sell-offs, pushing the price lower. But if Bitcoin stays above $94K, it could bounce back as more buyers step in. Whether Bitcoin stabilizes or keeps dropping will depend on how strong the demand is at this level.

Will Bitcoin Recover or Keep Dropping?

Bitcoin’s next big move depends on how many people keep selling, how volatile the market is, and how traders react. If too many people keep selling, Bitcoin could drop even more. But if fewer people sell and more buyers step in, Bitcoin could start recovering, especially if it stays above $94,000. For now, traders should watch key price levels, how much Bitcoin is being traded, and if selling slows down, because these things will decide Bitcoin’s next move.