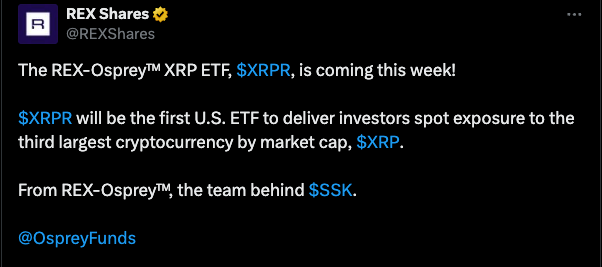

The countdown is on. On September 18, the first-ever U.S. spot XRP exchange-traded fund (ETF) is set to launch, opening a new chapter for Ripple’s token. The fund, called the REX-Osprey XRP ETF (XRPR), will operate under the Investment Company Act of 1940, with a Cayman-based subsidiary limited to 25% of assets.

For investors, this matters. Until now, regulated crypto ETFs have focused almost entirely on Bitcoin and Ethereum. XRPR breaks that mold, expanding institutional access into the altcoin space. It’s a milestone that signals growing demand for structured exposure beyond the two market leaders.

But here’s the catch: while ETFs can draw in new capital, they don’t guarantee price fireworks. The big question is whether XRP can actually hold the momentum and translate institutional demand into a lasting rally.

Price action hangs at a crossroads

At press time, XRP traded at $3.01, pressing against resistance at $3.12. What happens next could go one of two ways.

In the bullish case, a decisive breakout above $3.12 would open the door to $3.59, a key supply zone. Clear that, and $4 becomes the psychological target traders are salivating over. That move would also flip XRP out of its months-long descending channel, giving bulls fresh confidence.

In the bearish case, rejection at $3.12 could send the token back down to $2.60, a level many see as make-or-break support. Lose it, and ETF hype may not be enough to stop the bleed. In the meantime, volatility is alive and well, with short-term traders battling it out inside the mid-range channel.

Traders load up on longs — maybe too much

Sentiment on Binance shows where traders’ heads are at: overwhelmingly bullish. CoinGlass data reveals that 78.07% of traders hold long positions, leaving just 21.93% short. That produces a lopsided Long/Short ratio of 3.56.

While that sounds supportive, it also sets up risk. If price fails to break $3.12 and turns lower, those over-leveraged longs could face rapid liquidations, turning a dip into a plunge. On the flip side, if ETF excitement pulls in fresh inflows, longs could ride the momentum higher, accelerating the path toward $4. In short: longs are both XRP’s rocket fuel and its biggest liability.

ETF optimism vs. downside reality

So, can the ETF debut be the spark that carries XRP to new highs? Absolutely—if inflows align with already bullish positioning. A breakout past $3.59 could give XRP the momentum it needs to chase $4 and beyond.

But investors should keep one eye on $2.60. If XRP slides back there and fails to hold, the ETF launch might feel more like a head fake than a breakout. The next few weeks could determine whether XRP joins the ETF club with a bang—or with a whimper.