XRP traders might be feeling optimistic with the token inching closer to the $3.03 mark, but there are growing signals that suggest caution could be warranted. A significant whale transaction totaling $73 million worth of XRP has sparked fresh fears of a potential market sell-off, bringing investor focus back to historical patterns. Typically, when whales send large amounts of crypto to exchanges, it hints at profit-takingXRP Eyes $3.03 As Whale Sends $73M to Coinbase; Correction Coming? and that could mean price weakness ahead.

Massive Exchange Transfers Raise Eyebrows

On July 16th, a single transaction saw 25.5 million XRP tokens, valued at roughly $73.6 million, sent from a private wallet straight to Coinbase. This hefty move wasn’t isolated, spot markets also saw net outflows of $9.69 million on the same day. These actions only reinforce XRP’s current trend of tokens leaving investor wallets for exchanges.

Why does this matter? Historically, large whale transfers to exchanges have signaled short-term dips in price, typically tied to sell-offs. With XRP hovering near critical resistance levels, it’s understandable that traders are nervous about whether more downward pressure is lurking around the corner.

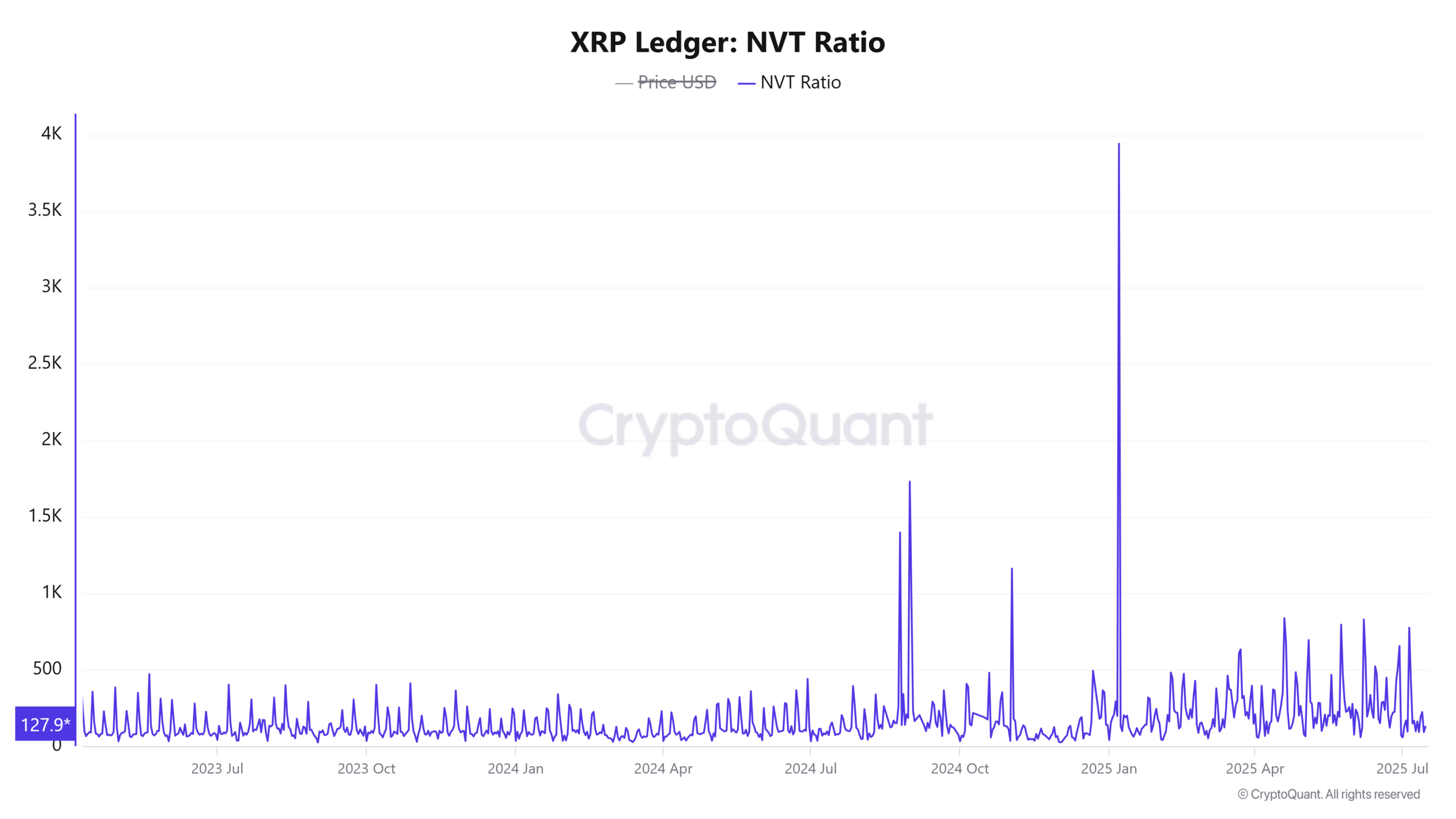

Is XRP Overheating as NVT Ratio Skyrockets?

The Network Value to Transactions (NVT) ratio, a key metric used to evaluate crypto overvaluation, just spiked 40% in a single day, hitting 127.95. This surge suggests that XRP’s price may be running ahead of its network activity, often a sign of speculative behavior rather than organic growth.

Historically, when NVT values hit these levels, it doesn’t end well for prices. Elevated NVT readings have preceded periods of corrections or sideways consolidation. Traders and investors would be wise to monitor this carefully.

Binance Traders Are Going All-In on Longs

Binance data reveals nearly 81% of XRP traders are locked into long positions, pushing the long/short ratio to a sharp 4.22. While this demonstrates strong bullish confidence, it also signals an overheated market vulnerable to sudden corrections.

Overcrowded longs leave the market ripe for liquidations if momentum falters. Though bullish dominance often drives rallies higher, this imbalance shows the potential risks tied to over-leveraged markets.

XRP’s Funding Rate: A Warning Sign Ahead?

Funding rates have climbed to +0.0186%, marking their highest point in months. This indicates that traders are paying hefty premiums just to keep their long positions open. While this underscores current bullish sentiment, it also highlights the potential for swift corrections if optimism fades.

Such funding spikes typically reflect extreme confidence, but they also pave the way for abrupt downturns. If XRP fails to break through its $3.03 resistance level, cascading liquidations could accelerate losses.

Will XRP Break $3.03 or Retreat?

At the time of writing, the coin is trading around $2.95, inching ever closer to the crucial $3.03 resistance level. This price point has proven difficult to crack before, often sparking sharp rejections. Compounding the concern is XRP’s RSI, which now sits deep in overbought territory at 80.67.

Should momentum weaken, ripple may tumble back toward $2.71 or even $2.58. However, if buyers can finally breach the $3.03 threshold, higher highs may be achievable.

Ultimately, it’s short-term fate will depend on whether volume and sentiment can sustain this push. While bullish momentum remains intact, indicators suggest caution. Breakouts and pullbacks are equally possible at this stage.