Following the U.S. SEC’s opposition to Ripple motion to seal remedies-related documents, an XRP Whale has been garnering significant attention in the broader crypto market. This Whale has been offloading massive amounts of XRP coins to a CEX, a move that is potentially driving volatility in the token’s price performance.

On-chain insights from a tracker reveal that this renowned ripple Whale dumped nearly 32 million tokens to an exchange in the past 24 hours. This has ignited a wave of speculation about the future price movements of the Ripple Labs-backed token. Moreover, the crypto landscape is already abuzz with uncertain implications of FIT21’s passing (U.S. House Approves Crypto FIT21 Bill), which is considered as a potential game changer for the XRP lawsuit. Here’s a closer look at these developments that have piqued global attention.

Whale Dumps Ripple Amid SEC’s Opposition & FIT21 Frenzy

According to data by Whale Alert, the Whale Rzn has once again shifted massive amounts of XRP to Bitstamp, a Luxembourg City-based CEX. Notably, 31.8 million XRP, worth $16.87 million, was recorded to be transferred in the past 24 hours.

This transfer has sparked speculation primarily due to the contrasting nature of the transaction amid FIT21’s optimistic buzz. Notably, the passing of the FIT21 crypto bill stages as optimistic news for the Ripple community, giving clarity on what cryptos should be classified as securities.

However, it’s also worth noting that the U.S. SEC has filed to oppose Ripple’s motion to seal key documents in the remedies briefing before Judge Torres. These developments, collectively, have further added a layer of intrigue to the XRP Whale transaction’s motive.

Meanwhile, it’s also worth mentioning that this XRP Whale’s transactions have recently emerged as a recurring phenomenon within the global crypto realm.

XRP Price Falls

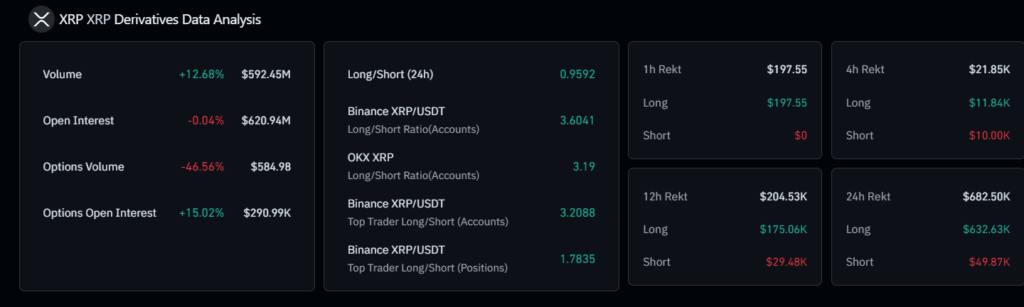

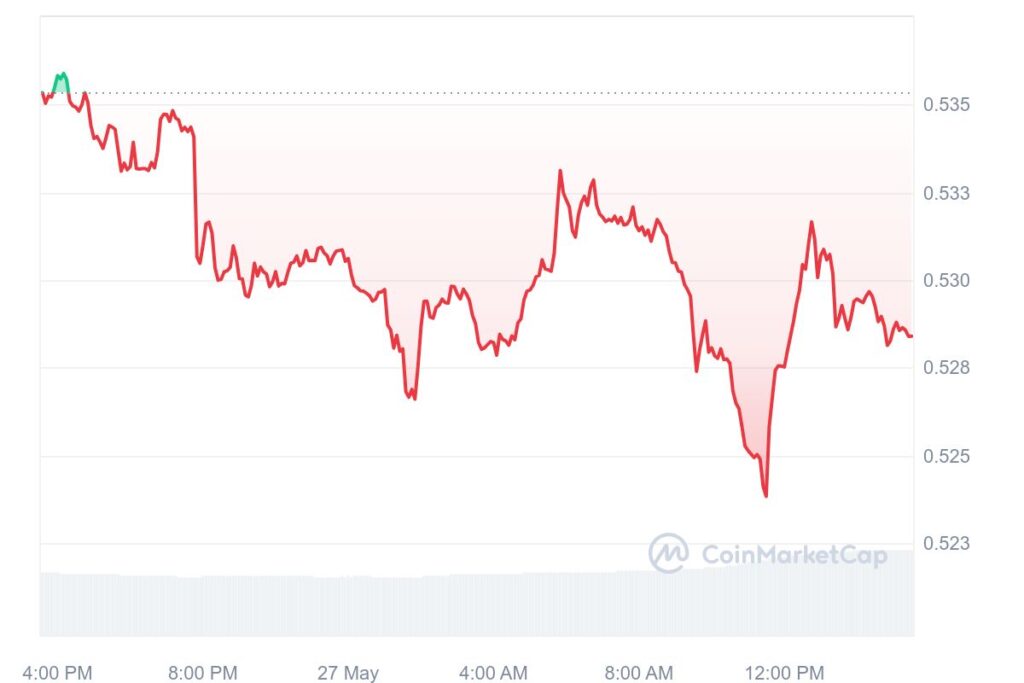

While writing, the XRP token noted a 2.05% dip in its price in the past 24 hours and is currently trading at $0.5274. Derivatives data by Coinglass further illustrated a bearish sentiment among investors for the token.

XRP’s Futures Open Interest slipped 0.26% to $617.99 million, and the derivatives volume plunged 3.79% to $526.51 million. This underscored reduced investor interest in the asset.

Meanwhile, the RSI hovered at around 50, hinting that the asset is neither overbought nor oversold. This data, coupled with the abovementioned developments, has kept crypto traders and investors on their toes, flagging uncertain movements for the token ahead.

Additionally, pro-XRP lawyer Bill Morgan has recently spotlighted further vital market statistics for the Ripple-backed token. In a post shared on X, Morgan rationalized as to why Ripple’s decision to not burn XRP escrow has no significant implications on price.