Introduction

XRP Stuck Below Key Levels

XRP has been unable to move past the $2.73 resistance level for over a month. Consequently, this long period of little movement has frustrated traders and, moreover, lowered confidence in the market. In the past 48 hours, Ripple Futures Open Interest (OI) dropped by over $1 billion. It fell from $2.9 billion as traders pulled back after a failed breakout attempt. This has led to more bearish sentiment, with investors unsure about the near future.

XRP Low Network Activity Causes Concerns

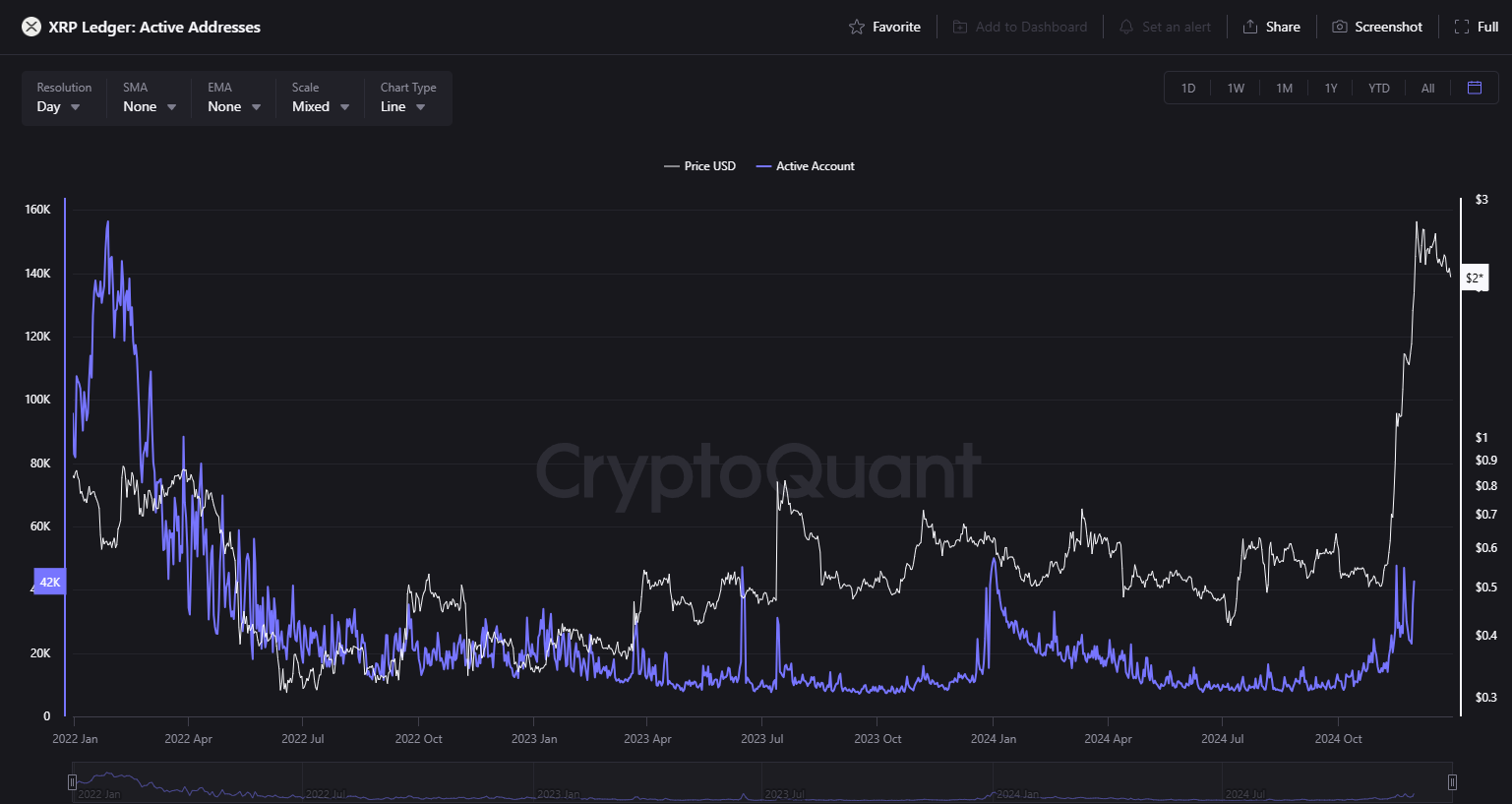

Recent data shows troubling signs for XRP. The Price Daily Active Addresses (DAA) Divergence chart revealed a gap between price movements and network activity. When XRP’s price rose in late November, network activity did not match this rise. This suggests the price increase was driven by trading, not real-world use or adoption. Even now, network engagement remains low. Without more active users, Ripple will find it hard to sustain any recovery or long-term growth.

Key Levels to Watch

XRP’s price is stuck between two important levels:

- Resistance at $2.73: This is the level XRP must break to start a real recovery.

- Support at $2.00: This level has helped prevent further price drops so far.

Breaking above $2.73 could push XRP toward $3.31, its all-time high. But if the $2.00 support fails, the token might face more selling pressure.

Market indicators give mixed signals:

- RSI (Relative Strength Index): At 45.00, it shows the market is undecided.

- Trading Volume: Still low, showing little buying interest.

- OBV (On-Balance Volume): Weak inflows suggest limited momentum for a strong price move.

It will need more buyer interest and better network activity to make any significant progress.

Market Trends and XRP Next Steps

The larger crypto market is also affecting it. Many investors are cautious due to weak market sentiment, which weighs on altcoins. Ripple future depends on stronger network use and real-world adoption. Without these, the token may remain stuck in its current position.

VR Soldier Thoughts

As the VR Soldiers, we see XRP’s next steps as critical. Moreover, breaking the $2.73 resistance is key for recovery, but improving network activity is just as important. Additionally, while the $2.00 support offers some hope, caution is essential. Therefore, traders should watch for clear signs of recovery before making moves. Finally, remember, this is not financial advice—always research thoroughly.

Conclusion

Ripple is in a tough spot, stuck between resistance at $2.73 and support at $2.00. Furthermore, low network activity and weak confidence are holding it back. To recover, it needs to break above $2.73. Consequently, this could lead to a rally toward $3.31. However, without stronger support from buyers and network users, the token risks staying in its current range or even dropping further. Therefore, for now, traders should remain cautious as XRP’s future remains uncertain.