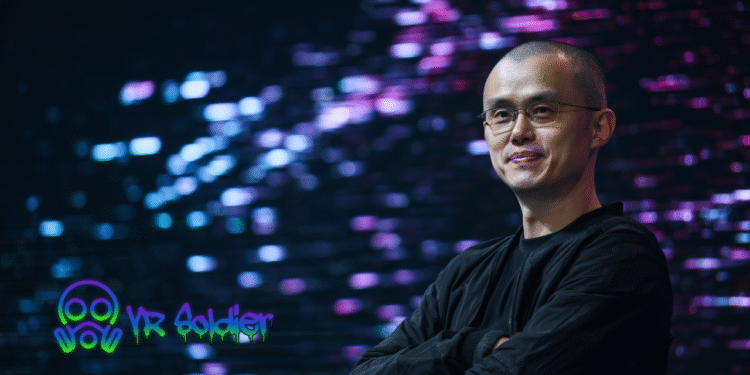

There is a growing debate in the world of decentralized exchanges (DEX), and a prominent trader, James Wynn, is speaking out. Wynn believes that Binance founder Changpeng Zhao’s proposed dark pool perpetuals DEX could challenge HyperLiquid’s current advantage in the market. This warning comes as Zhao’s new project is stirring up discussions on how decentralized trading platforms can evolve.

Wynn, who has previously criticized HyperLiquid for its referral program and compensation structure, argues that Zhao’s extensive resources and past success could significantly affect the competitive landscape. According to Wynn, Zhao’s focus on solving important issues, such as Miner Extractable Value (MEV) and the transparency of on-chain trading, could give Zhao’s project an edge over HyperLiquid.

These comments are especially relevant after Wynn’s criticism of HyperLiquid’s referral program, which, despite generating large trading volumes for the platform, led him to feel undervalued. Wynn shared that he earned only $34,000 through referrals, even though he played a significant role in bringing new users and driving trading activity. Wynn described HyperLiquid’s compensation model as “extremely poor” compared to other platforms in the industry.

I was not paid a single cent by HyperLiquid.

I reached out on two occasions hoping to get some kind of partnership deal for all of the attention I was bringing them, and although they seemed thankful they don’t offer such deals to anyone. Which kinda makes sense considering…

— James Wynn (@JamesWynnReal) June 8, 2025

Wynn’s Disappointment with HyperLiquid

Wynn’s frustration didn’t stop with the referral program. He also revealed that he had reached out to HyperLiquid twice in hopes of forming a partnership, but was declined both times. It seems that HyperLiquid has a policy of avoiding partnerships with individual promoters, according to Wynn. This further deepens his concerns about the platform’s willingness to value its contributors.

Zhao Proposes a New Type of DEX: The Dark Pool

Meanwhile, Changpeng Zhao has been unveiling his vision for a new type of decentralized exchange, called a dark pool perpetuals exchange. This idea could change how decentralized exchanges operate by addressing key problems, especially around transparency. In a recent post on social media, Zhao discussed the major challenges faced by current decentralized exchanges.

Given recent events, I think now might be a good time for someone to launch a dark pool perp DEX.

I have always been puzzled with the fact that everyone can see your orders in real-time on a DEX. The problem is worse on a perp DEX where there are liquidations.

Even with a CEX…

— CZ 🔶 BNB (@cz_binance) June 1, 2025

Zhao pointed out that in traditional DEX structures, order books are visible in real-time, which creates opportunities for front-running and MEV attacks. These issues can raise costs, especially for large traders.

Zhao wrote, “I have always been puzzled with the fact that everyone can see your orders in real-time on a DEX.” He also noted that even centralized exchange order books expose trading intentions that can be exploited by others.

To solve this problem, Zhao proposed a dark pool architecture, where the order books would be hidden or deposits into smart contracts would remain concealed until the trade is completed.

This solution could be achieved using technologies like zero-knowledge proofs, which would allow the system to maintain the benefits of on-chain settlement while avoiding the risks of front-running and MEV.

Wynn’s Concerns for HyperLiquid’s Long-Term Viability

Wynn’s concerns go beyond the referral issues and into the long-term future of HyperLiquid. He emphasized Zhao’s ability to create industry-leading products, pointing to Binance’s dominance in the centralized exchange market as evidence of Zhao’s capability. According to Wynn, Zhao’s success with Binance shows that he has the money, network, and teams needed to build something much more powerful than what HyperLiquid can currently offer.

“CZ has the money, network, teams to build something like no other,” Wynn stated, referring to Zhao’s ability to create large-scale projects. This comment reflects the belief that Zhao’s dark pool DEX could significantly challenge platforms like HyperLiquid, especially if it addresses the key issues that currently affect decentralized exchanges.

HyperLiquid’s Current Setup

Right now, HyperLiquid operates as a decentralized perpetuals exchange. The platform’s strength lies in its full on-chain order books, which make every trading activity transparent. However, this transparency also leaves the platform open to MEV exploitation, a major issue that Zhao’s dark pool concept aims to solve. While HyperLiquid offers openness, it could be vulnerable to the same issues that Zhao is trying to address with his new dark pool architecture.

Looking Ahead: A New Era for DEX?

The competition between HyperLiquid and Zhao’s new DEX could reshape the future of decentralized exchanges. As the market for digital assets grows, the need for secure and transparent trading environments will only increase. With Zhao’s track record and new ideas, the battle between these two platforms could be one of the most important developments in the world of decentralized finance (DeFi).