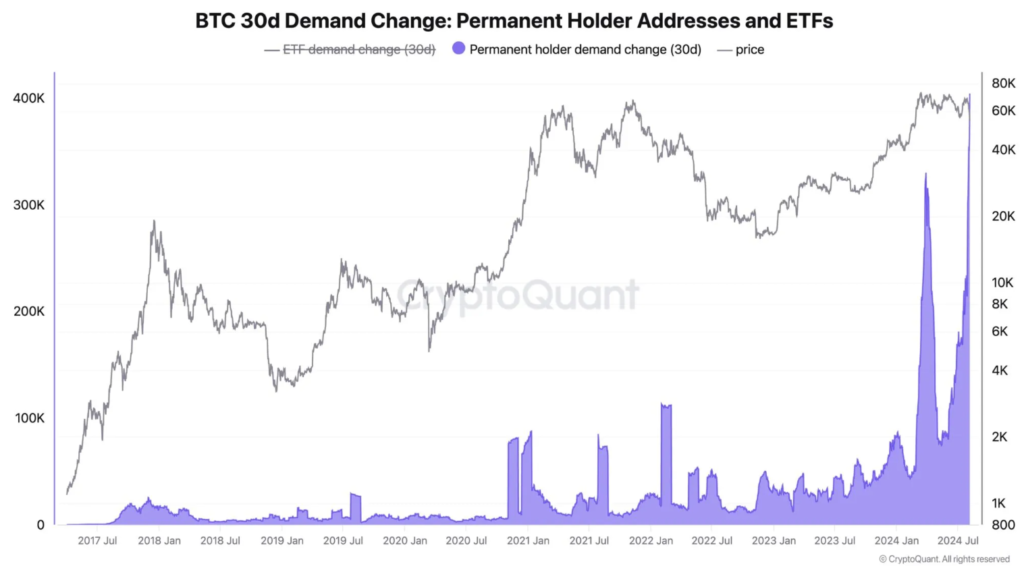

Bitcoin whales have amassed $23 billion worth of BTC in the past month, which could signal a significant shift in the market. The founder of the analytical platform CryptoQuant, Ki Young Yu, pointed out a sharp increase in demand for Bitcoin among regular holders.

The bull market continues

Over the past 30 days, approximately 404,448 BTC, equivalent to $22.8 billion, have been received by regular holders. According to Yu, this indicates accumulation by whales.

“Over the course of the year, some entities — whether TradFi institutions, companies, governments, or others — will announce that they have purchased Bitcoin in Q3 2024,” predicts the CryptoQuant CEO.

Ju notes that retail investors, in turn, will regret not doing the same due to concerns about selling by the German government, Mt. Gox or other macroeconomic factors.

In a separate post on X (formerly Twitter), the expert mentioned several additional factors that support the bullish trend. Miner capitulation is almost over, and the hash rate is approaching record highs, Yu wrote.

Bitcoin Bull Market Outlook

The cost of mining in the US is currently around $43,000 per BTC. If the price of Bitcoin falls below this level, the hash rate will still remain stable. The CryptoQuant founder also noted that there are currently almost no retail investors in the market. This, he said, is reminiscent of mid-2020. Coupled with the fact that the activity of old whales has decreased, there is no selling pressure on Bitcoin at the moment.

Based on this data, Yu concludes that the bull market is still in place. “If the market doesn’t recover in two weeks, I’ll rethink my view. I follow the smart money, so if I’m wrong, the new whales are either wrong or underestimating the macro situation,” he added. According to CoinGecko, at the time of writing, Bitcoin is trading at $57,339. Over the past 24 hours, the price of the cryptocurrency has increased by 4%.