After an uncertain beginning of Q3 2022, cryptocurrency markets are showing signs of life this week, with Bitcoin prices climbing past $21k and Ethereum prices trading above the $1.2k level. Bitcoin is up over 11% this week, while Ethereum managed to gain 15% in the past seven days. With the recent bullish momentum, the global cryptocurrency markets are nearing the $1 trillion market capitalization mark, which could be a pivotal point in determining the future market momentum next week.

Stock Markets Show Signs of Recovery This Week

It’s no secret that Bitcoin’s price has followed the stock market trends this year. As such, it is no surprise that significant stocks are also showing bullish momentum this week. Dow Jones is up 2.15% in the past five days, S&P 500 is up over 114 points (3.03%), and NASDAQ is up 2.40% this week, the weakest of the three.

While most stocks opened in the green today, the market is still weak from last week’s selloff. The good news is that the weekend is here, and if the trends continue as they have for the past couple of weeks, cryptocurrency markets will continue to pull ahead until Monday when all eyes will be on the stock market again.

The trend for the past month has been the same on the weekends. Since the stock market is closed, Bitcoin and Ethereum can climb a few percent daily, regaining some of their lost value from the bearish trend during the week. This time, it should be no different.

SEC vs. Bitcoin ETF Battle Isn’t Helping Crypto Markets

The clash between the SEC and Spot ETFs isn’t helping cryptocurrency markets, as the ongoing battle is causing additional strain on the long-term sentiment of Bitcoin and contributes to the uncertainty of retail investors.

While the SEC has approved a Bitcoin ETF already (Teucrium BTC Futures ETF), a renowned Wall Street investor is looking to convert the Grayscale Bitcoin Trust (GBTC) to a spot ETF. If the new Grayscale ETF is approved, it will open up the doors for a significant amount of trading volume for Bitcoin, causing substantial bullish momentum for the cryptocurrency market.

As Martin Collier reported on The Merkle, when it comes to the possible outlook of the SEC’s decision:

“The SEC might be more open to spot ETFs. Moreover, the current conditions may push exchanges to register with the commission to open more doors. All the same, expectance for the better has not been extinguished yet.”

Ethereum Price Up 15% This Week Amid Continued Increase in User Base and Adoption

Ethereum far outperformed Bitcoin this week, up over 15% at the time of writing. As the second-largest cryptocurrency by market cap, Ethereum provides the necessary infrastructure for the cryptocurrency industry, powering the latest trends in blockchain such as DeFi, Metaverse, A.I. & Big Data, and much more.

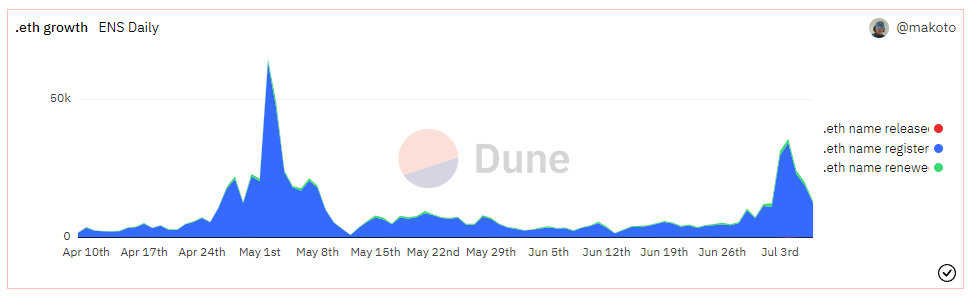

According to data from Dune, Ethereum Name Service (ENS) registrations spiked this week, peaking at 34k domains registered on July 4th.

The only period when more ENS domains were registered was in May when ENS hit a record-high daily domain registration number of over 63k.

Final Thoughts

While this bear market is drawn out and caused substantial losses in the market caps of most cryptocurrency projects, it also provides an opportunity to purchase and utilize services you couldn’t afford during the crypto hype in November and December of 2021.

For example, virtual real estate is at an all-time low, so if you’ve wanted to claim your piece of land on platforms like Decentraland, The Sandbox, ApeCoin’s Otherside, and more, now is the time to purchase plots of land for extremely low prices.

In addition, if you’ve been meaning to register an ENS domain, now is a great time to take advantage of low prices and get yourself a vanity Ethereum address.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, A.I., Cybersecurity, Supercomputer, and Metaverse news!

Image Source: jakarin2521/123RF