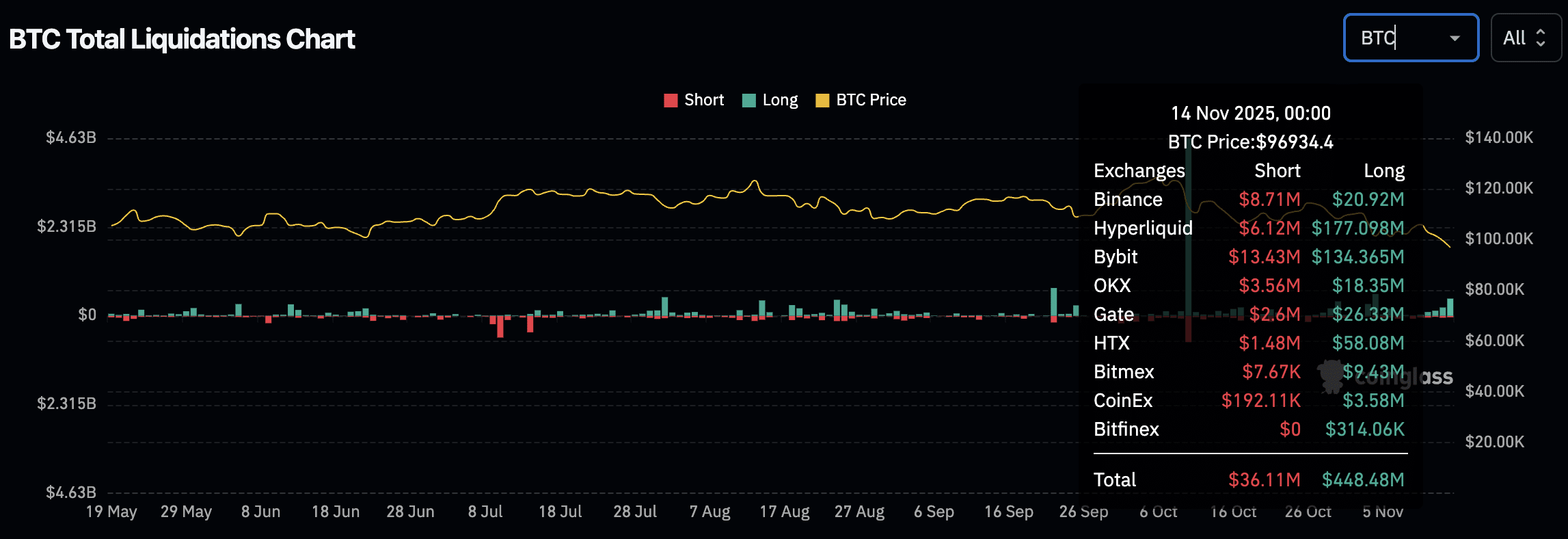

Bitcoin Drops to $97K After Wiping Out Nearly $450M in Longs

Bitcoin plunged to $97,031 after breaking below the $100,000 support level, triggering widespread liquidations that wiped out nearly $450 million in leveraged long positions. The sharp sell-off marks a 23% decline from October’s record high of $126,000, erasing five months of gains in little over a month.

Massive Liquidations Follow the Bitcoin Breakdown

According to Coinglass data, $448.48 million in long positions were liquidated across major exchanges as traders were caught off guard by the rapid drop. Hyperliquid recorded the largest losses, totaling $177 million, followed by Bybit with $134 million and Binance with nearly $21 million in liquidations.

Longs outnumbered shorts by twelve to one, reflecting an overextended market. As key support levels failed, forced liquidations accelerated the sell-off, intensifying the decline. OKX, Gate.io, and HTX also reported significant liquidation activity, signaling widespread overleveraging in the derivatives market.

Technical Breakdown and Key Levels

Bitcoin’s fall below its 20-day moving average near $106,000 confirmed a short-term breakdown. Once the $100,000 threshold gave way, momentum shifted sharply bearish, with price finding little support until the $94,000–$95,000 region.

Trading volume surged during the decline, suggesting genuine selling pressure rather than a temporary liquidity event. The speed of the move points to margin calls and forced unwinding as key drivers of volatility.

Bitcoin Market Context and Outlook

Despite the steep correction, Bitcoin remains up roughly 15% year-to-date after starting 2025 near $102,000. The $94,000–$95,000 area now represents critical support; holding above it could allow the market to stabilize, while a breakdown below may trigger another wave of liquidations toward the high $80,000 range.

Whether this marks a healthy reset or the beginning of a deeper correction will depend on how quickly leverage resets and whether buyers return to defend key levels in the coming sessions.