The cryptocurrency market is gaining traction as Bitcoin trades above $19k, and Ethereum stays above $1,300 after rising in trading volume last night but remaining flat in price. ETHUSD’s trading volume increased by 32% to $20 billion, while BTCUSD’s 24-hour volume increased by 19% to $59 billion. This upward trend in trading volume is continuing. The increase in trading volume suggests that the market is gaining traction for a potential bull run this week, particularly if the market cap of all cryptocurrencies soon crosses the $1 trillion mark.

Contents:

- Following Bitcoin’s 2-week high on Tuesday, cryptocurrency markets are still strong.

- Despite BTC’s inherent immunity to inflation, there is a strong correlation between the cryptocurrency markets and stocks.

- As a result of Ethereum’s merger, ETH’s inflation rate was significantly reduced, which may be a major factor in the coming months’ bullish momentum.

- The increase of Ethereum’s circulating supply following the merger has already decreased dramatically.

- Over $1,300, ETH is still in good shape and is expected to stay here for a while.

Bitcoin News Update

According to a recent CNN report, the cryptocurrency market may be showing signs of thawing after a long winter. Bulls in the cryptocurrency market are optimistic that we will soon experience more bullish momentum after Tuesday’s bull run when Bitcoin’s price surpassed its 2-week high and reached $20.2k.

For investors looking to protect themselves against inflation in the face of the current economic chaos, Bitcoin remains a haven of safety. Bitcoin is inherently resistant to inflation because there is a fixed supply of 21 million coins. Although BTC has a fixed supply, this does not mean that it is unaffected by international markets, particularly stocks.

The S&P 500, the NASDAQ, and cryptocurrencies all exhibit strong correlations. Therefore, Bitcoin typically encounters bearish pressure whenever stocks experience a significant bearish momentum. Fortunately, the S&P 500 and the NASDAQ are both up today, which is most likely the reason why Bitcoin is expected to rise.

Ethereum’s Post-Merge News Update

Regarding the second-largest crypto asset on the market, the focus is still on Ethereum’s merger.

One significant advantage of the network upgrade, as detailed in a Coindesk report, was the elimination of mining rewards, which significantly decreased the net inflation rate of Ethereum.

“In the days since the Merge, the annualized net issuance rate of Ethereum’s native cryptocurrency, ether (ETH), has fallen to a range of 0% to 0.7%, estimates Lucas Outumuro, head of research at crypto data and analysis firm IntoTheBlock. That compares with about 3.5% prior to the Merge.”

This indicates that Ethereum effectively reduced its inflation rate by about 3% by transitioning to a proof-of-stake network. Even though the supply of Ethereum is not fixed like that of Bitcoin, since the merger, there has been a sharp decline in the creation of new coins.

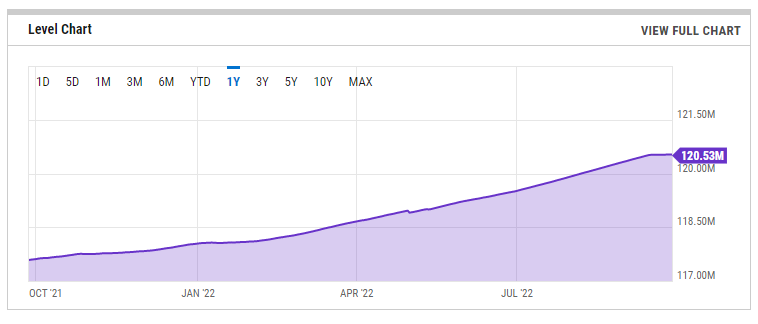

This chart from ycharts.com shows how the level of circulating supply has flattened since the merge on September 13th.

Even though it might take several months for the market to notice the decline in the production of new ETH, the long-term outlook for Ethereum is still very positive.

The price of Ethereum is $1,325, down 3% over the last 24 hours. It has a market cap of $162 billion and a $20.7 billion 24-hour trading volume, up 31% over the previous day.

The $1,300 level appears to be a significant support range for Ethereum, and it’s likely that ETH will stay at its current price throughout this week before attempting a move next.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @thevrsoldier to stay updated with the latest Metaverse, NFT, A.I., Cybersecurity, Supercomputer, and Cryptocurrency news!

Image Source: maximusnd/123RF // Image Effects by Colorcinch