The Avalanche ecosystem has a long history of success, but there’s much to be said about these five high-volume tokens. Each blockchain ecosystem is known for its theme when it comes to dApps. For example, Ethereum and Solana are known for their NFT, Web3, and Metaverse crypto coins, BNB is known for blockchain gaming and ICOs, and Avalanche is known for its DeFi 2.0 capability, Yield Farming, and robust finance ecosystem.

As of Q2 2017, the Avalanche platform continues to see upgrades that make it even more compatible with the Ethereum blockchain. This includes software improvements. In this article, we’ll discuss how these upgrades can benefit the entire Avalanche ecosystem.

Note: The list below is ordered by the market capitalization of each project, lowest to highest.

#5 inSure DeFi (SURE)

- Market Capitalization: $79.2 million

- Unit Price: $0.002958

InSure DeFi, the leading crypto-insurance project by community growth has extended its ecosystem with the Avalanche Network. This decentralized, 100% transparent, and the community-led system is designed to protect crypto portfolios against a wide range of threats. InSure users can hold SURE tokens on Avalanche, representing voting power in the inSure DeFi Ecosystem. The tokens are fully-transferable on CEXs and have no transaction taxes or lockups.

InSure DeFi is built on Chainlink, the blockchain industry’s largest and most popular oracle platform. Chainlink is backed by an extensive network of secure node operators aggregating historical price data from many sources. The decentralized oracle network provides highly available data feeds and can process $10 billion in on-chain value. The resulting outputs are distributed across all DeFi users.

#4 Frax Share (FRX)

- Market Capitalization: $79.3 million

- Unit Price: $4.89

The Avalanche ecosystem is comprised of five high-volume tokens that will work to provide liquidity for the Frax Protocol, the first fractional algorithmic stablecoin system. The Frax Share token is one of them, and it broke out bullish on local exchanges. The project aims to be the first crypto-native consumer price index. It is currently price-pegged to the US dollar but plans to support other currencies. It is also envisioned as a permissionless, worldwide unit of account.

The Avalanche Ecosystem features a diverse range of DeFi protocols, including Frax. In addition to Avalanche, Ethereum, and Binance, the Frax ecosystem is available on several chains. As a result, it continues to drive demand for Frax Share. Much of the supply of FXS has been locked up by staking the veFXS token, a fork based on the Curve veCRV mechanism.

#3 Ren (REN)

- Market Capitalization: $123 million

- Unit Price: $0.1237

REN is an open-source protocol that ensures the confidential transfer of values between public blockchains and provides financial liquidity to different blockchain platforms. Besides being a decentralized, trustless ecosystem, Ren also acts as a platform for building, deploying, and running moving averages applications. REN uses a secure multiparty computation protocol that makes any application run in a safe, fault-tolerant environment while ensuring that all application inputs remain secret to network participants.

The REN ecosystem is based on a scientific algorithm that distributes orders in minute segments to maintain optimal security. Although global jurisdictions are developing regulations for ICOs and token issuances, REN is unregulated and governed by its peer-to-peer community. REN users and their machines operate the network and are responsible for its security. The REN Board has also recognized that expansion means spreading its wings. For this, renowned names have been added to the REN team.

#2 SushiSwap (SUSHI)

- Market Capitalization: $132 million

- Unit Price: $1.04

The decentralized exchange, SushiSwap, is branching out into the Avalanche Ecosystem to allow users to do liquid trading, core token swaps, and liquidity mining. The Avalanche blockchain is an open-source platform that supports various applications, enterprise blockchains, and dApps such as Avalanche. The two projects announced their partnership via crypto Twitter.

On August 26, 2020, SushiSwap launched its project with a copy of Uniswap’s source code and a new SUSHI token for governance. Within a week, their value increased by 700%. The SUSHI token, used for yield farming, received tremendous interest from investors. But in the days following, a new developer took over the project under the name Sam Bankman-Fried.

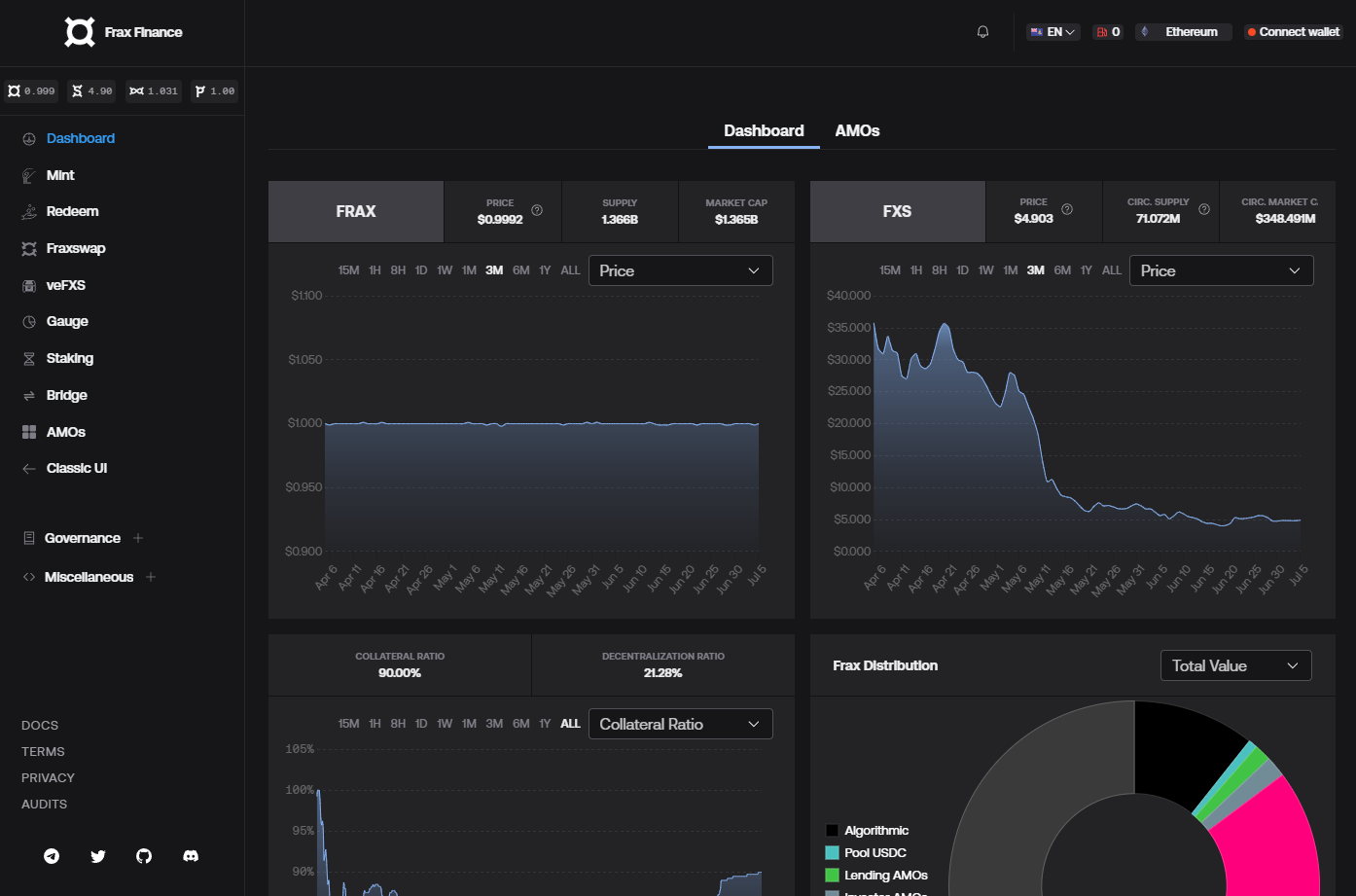

#1 Frax (FRAX)

- Market Capitalization: $1.36 billion

- Unit Price: $0.9969

In the Avalanche Ecosystem, Frax Finance has incorporated a concept of a decentralized central bank into its token. Its Algorithmic Market Operations (AMOs) represent smart contracts that execute different open market operations. They are responsible for protocol security, putting collateral to work, and defining the maximum amount of FXS that can be traded. In total, Frax has four AMOs in its ecosystem.

Frax is currently working on a protocol that will allow decentralized applications to reference its $FPI, a highly algostable peg. The token will also be distributed via airdrop to cvxFXS holders. A recent exchange transaction between OlympusDAO and Frax Finance has revealed that the two have swapped tokens. They’re building a treasury full of DeFi and stablecoins. This is part of the plan to develop a protocol-owned liquidity marketplace.

The above article has been created as a result of the detailed analysis of the projects’ websites.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any Harmony ecosystem crypto coins.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: ximagination/123RF