Bitcoin Faces Pressure as ETF Inflows Fail to Offset Outflows

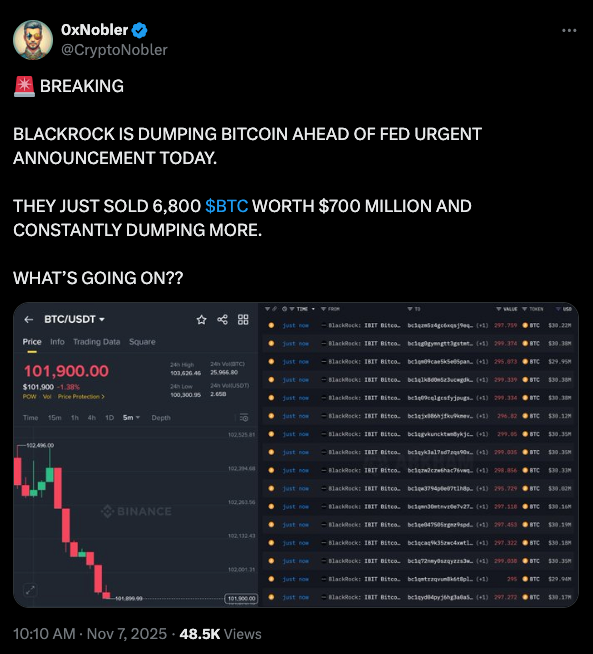

Bitcoin is trading near the $100,000 level after sustained global selling pressure, led by U.S.-based investors. The latest data shows over $700 million worth of BTC sold by major U.S. entities, raising questions about whether the $100K support level can hold in the coming days.

U.S. Selling Drives Market & Bitcoin Weakness

Bitcoin declined 1.5% over the past 24 hours, extending a week-long downtrend. The Coinbase Bitcoin Premium Index — a measure of U.S. trading activity — has remained negative since October 30, confirming persistent sell-side dominance from American investors.

BlackRock was among the largest sellers, reportedly offloading around 6,800 BTC worth over $700 million. The sales occurred in several large transactions averaging roughly $30 million each. Despite recent inflows into Bitcoin ETFs, these efforts were insufficient to offset the broader outflows.

Bitcoin ETF products recorded $240 million in inflows within the past day, according to data shared by Satoshi Staker. However, this rebound came after six straight days of net outflows, reflecting ongoing investor hesitation ahead of key macroeconomic events.

Selling Extends Beyond the U.S.

The sell-off has not been confined to the U.S. — similar trends are visible across Europe and Asia. Over the past week, Bitcoin’s Cumulative Return by Session dropped from +3% to -4%, signaling growing bearish momentum and declining intraday strength.

Prediction market data from Polymarket indicates that traders now see a 48% probability of Bitcoin falling to $95,000 this month, and a 24% chance of a dip to $90,000. Conversely, the odds of a rally toward $115,000 or higher have dropped below 10%.

Broader Market Pressures

Analysts link the recent downturn to a combination of macroeconomic factors: the ongoing U.S. government shutdown, renewed tariff tensions, and broader risk aversion driven by the slowdown in AI-related equities. This backdrop has weighed on crypto sentiment and liquidity.

Watching for Reversal Signals for Bitcoin

Despite the ongoing weakness, cumulative volume delta (CVD) analysis suggests that reversals often occur when short-term selling outpaces buying, followed by renewed bid strength. For now, however, aggressive selling continues to dominate, leaving Bitcoin vulnerable to deeper pullbacks unless demand reappears near the $95K–$100K range.