One of the top gainers today on Crypto.com is UMA, up over 26% in the past 24 hours. At the time of writing UMA price is currently trading at $16.93 after recently hitting an all time high of $21.27. Why are people buying UMA and what is all the hype about? Let’s take a closer look.

What Is UMA?

UMA stands for Universal Market Access, it describes itself as a decentralized financial contracts platform. According to their official website:

“UMA enables anyone to build decentralized financial products.”

In other words, UMA is a platform hosted on the Ethereum blockchain allowing users to mint synthetic assets that can mimic almost any other asset on the market.

One example of a synthetic asset is UMA’s ETHBTC, which mimics the relationship between ETH and BTC on the market. For instance, if ETH is worth $4000 and BTC is worth $60,000 the value of ETHBTC would be $0.06.

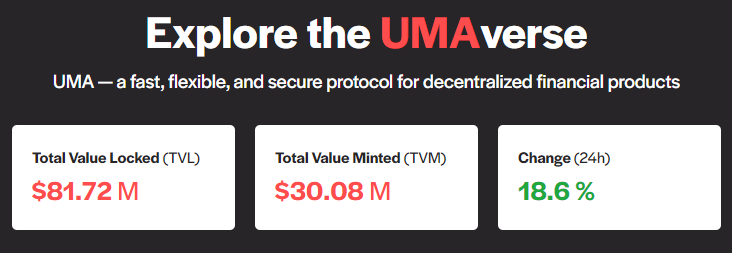

The UMA protocol already has active financial platforms on its UMAverse with a TVL (total value locked) at over $80M and Total value minted at over $30M.

For those confused about TVL:

“Total value locked (TVL), in the context of cryptocurrency, represents the sum of all assets deposited in decentralized finance (DeFi) protocols earning rewards, interest, new coins and tokens, fixed income, etc.” – Nasdaq

Why Is UMA Price Rising?

Such an active DeFi ecosystem with dozens of apps is a big reason for UMA’s recent price hike of over 39% in the past week.

Looking on umaproject.org, we can see an 18% change in the amount of assets locked in the past 24 hours. It seems there is a direct correlation between the amount of assets locked on the platform and UMA’s price.

Moreover, an increase in assets locked means the UMAverse ecosystem is growing, which can only be a good sign to traders and investors.

UMA News

One recent announcement which may attribute to UMA’s recent price hike is the upcoming launch of Across.

1/ @AcrossProtocol is the fastest, cheapest, and most secure L2 to L1 bridge. It will launch live on main net in 4 days.

Across uses UMA's Optimistic Oracle to insure transactions.

— UMA 🥚 (@UMAprotocol) November 5, 2021

According to their announcement on twitter:

“Across Protocol is the fastest, cheapest, and most secure L2 to L1 bridge. It will launch live on main net in 4 days. Across uses UMA’s Optimistic Oracle to insure transaction.

Across goes live tomorrow, November 8th and opens up a new space in DeFi core infrastructure. With the anticipation of the main-net launch, it’s not surprising to see the market rise in price.

UMA Price & Tokenomics

At the time of writing, UMA is trading at $15.94. With the recent price increase UMA’s market cap is at a whopping $1B, placing as the 108th largest cryptocurrency on the market.

The 24 hour trading volume for UMA is $393M, most of which is coming from Binance and Coinbase.

With the growing ecosystem of UMA the long term outlook on this crypto is bullish. However, because the recent price hike has been relatively dramatic and the crypto just hit $1B in market cap, more likely the market will test support before attempting to break through.

As always this is not trading advice, please do your own research before buying any cryptocurrency.

Follow us on twitter @thevrsoldier to stay up to date with the latest cryptocurrency news!